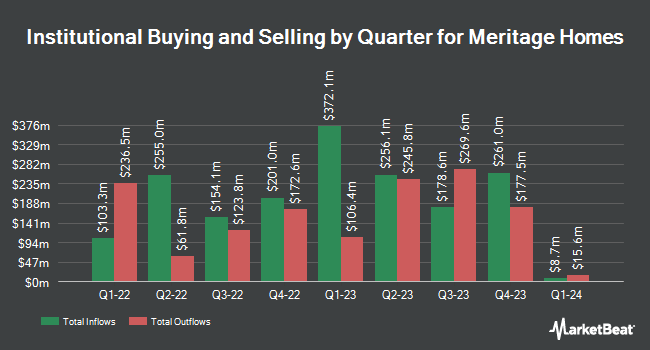

EMG Holdings L.P. acquired a new position in Meritage Homes Corporation (NYSE:MTH - Free Report) during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor acquired 141,977 shares of the construction company's stock, valued at approximately $10,063,000. Meritage Homes accounts for approximately 4.8% of EMG Holdings L.P.'s investment portfolio, making the stock its 3rd biggest position. EMG Holdings L.P. owned 0.20% of Meritage Homes as of its most recent SEC filing.

A number of other institutional investors have also modified their holdings of the stock. Long Pond Capital LP increased its position in shares of Meritage Homes by 592.7% during the first quarter. Long Pond Capital LP now owns 1,125,995 shares of the construction company's stock worth $79,811,000 after acquiring an additional 963,438 shares during the period. Corebridge Financial Inc. boosted its stake in Meritage Homes by 96.1% in the first quarter. Corebridge Financial Inc. now owns 37,536 shares of the construction company's stock valued at $2,661,000 after acquiring an additional 18,399 shares in the last quarter. MetLife Investment Management LLC boosted its stake in Meritage Homes by 705.0% in the first quarter. MetLife Investment Management LLC now owns 173,682 shares of the construction company's stock valued at $12,311,000 after acquiring an additional 152,106 shares in the last quarter. Jump Financial LLC purchased a new stake in shares of Meritage Homes during the first quarter valued at $686,000. Finally, SVB Wealth LLC acquired a new stake in Meritage Homes during the 1st quarter valued at approximately $48,000. 98.44% of the stock is owned by hedge funds and other institutional investors.

Meritage Homes Price Performance

Shares of MTH opened at $80.1230 on Monday. Meritage Homes Corporation has a fifty-two week low of $59.27 and a fifty-two week high of $106.99. The firm's 50 day moving average price is $70.95 and its 200 day moving average price is $69.66. The company has a market cap of $5.70 billion, a P/E ratio of 7.21 and a beta of 1.29. The company has a quick ratio of 2.16, a current ratio of 2.16 and a debt-to-equity ratio of 0.35.

Meritage Homes (NYSE:MTH - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The construction company reported $2.04 earnings per share for the quarter, topping the consensus estimate of $1.99 by $0.05. Meritage Homes had a net margin of 10.27% and a return on equity of 12.37%. The firm had revenue of $1.62 billion for the quarter, compared to the consensus estimate of $1.60 billion. During the same period in the prior year, the firm earned $3.15 EPS. The firm's revenue for the quarter was down 4.6% on a year-over-year basis. On average, research analysts forecast that Meritage Homes Corporation will post 9.44 earnings per share for the current fiscal year.

Meritage Homes Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Tuesday, September 16th will be given a $0.43 dividend. The ex-dividend date of this dividend is Tuesday, September 16th. This represents a $1.72 dividend on an annualized basis and a dividend yield of 2.1%. Meritage Homes's dividend payout ratio is currently 15.47%.

Wall Street Analyst Weigh In

MTH has been the subject of a number of research reports. Bank of America assumed coverage on shares of Meritage Homes in a research report on Monday, May 5th. They set a "buy" rating and a $82.00 target price for the company. Evercore ISI boosted their price target on shares of Meritage Homes from $97.00 to $100.00 and gave the stock an "outperform" rating in a research report on Friday, July 25th. Keefe, Bruyette & Woods decreased their target price on shares of Meritage Homes from $77.00 to $75.00 and set a "market perform" rating on the stock in a report on Monday, July 28th. Wedbush decreased their target price on shares of Meritage Homes from $103.00 to $90.00 and set a "neutral" rating on the stock in a report on Friday, July 25th. Finally, JPMorgan Chase & Co. decreased their target price on shares of Meritage Homes from $70.00 to $60.00 and set a "neutral" rating on the stock in a report on Monday, July 28th. One investment analyst has rated the stock with a Strong Buy rating, four have given a Buy rating and five have issued a Hold rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $87.71.

View Our Latest Analysis on Meritage Homes

Insider Buying and Selling at Meritage Homes

In related news, Director Joseph Keough bought 4,000 shares of the company's stock in a transaction that occurred on Thursday, June 12th. The shares were purchased at an average cost of $66.16 per share, with a total value of $264,640.00. Following the transaction, the director directly owned 41,700 shares of the company's stock, valued at approximately $2,758,872. This represents a 10.61% increase in their position. The purchase was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CEO Phillippe Lord sold 6,950 shares of the stock in a transaction on Friday, August 22nd. The shares were sold at an average price of $80.01, for a total transaction of $556,069.50. Following the completion of the transaction, the chief executive officer directly owned 221,320 shares in the company, valued at $17,707,813.20. This trade represents a 3.04% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 2.20% of the company's stock.

Meritage Homes Company Profile

(

Free Report)

Meritage Homes Corporation, together with its subsidiaries, designs and builds single-family attached and detached homes in the United States. The company operates through two segments, Homebuilding and Financial Services. It acquires and develops land; and constructs, markets, and sells homes for entry-level and first move-up buyers in Arizona, California, Colorado, Utah, Texas, Florida, Georgia, North Carolina, South Carolina, and Tennessee.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Meritage Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meritage Homes wasn't on the list.

While Meritage Homes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report