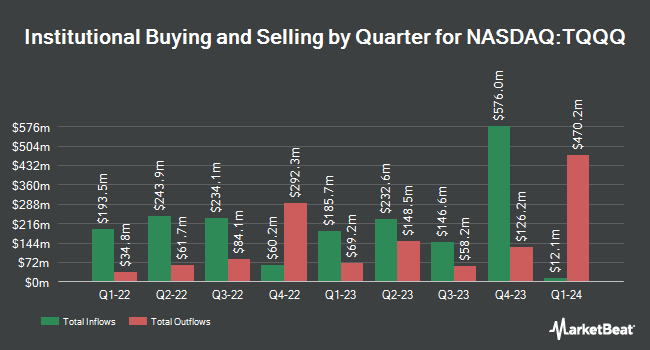

Empirical Financial Services LLC d.b.a. Empirical Wealth Management bought a new stake in shares of ProShares UltraPro QQQ (NASDAQ:TQQQ - Free Report) in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor bought 42,900 shares of the exchange traded fund's stock, valued at approximately $2,458,000.

A number of other hedge funds also recently bought and sold shares of TQQQ. MRP Capital Investments LLC bought a new stake in shares of ProShares UltraPro QQQ in the 1st quarter worth approximately $29,000. Cary Street Partners Financial LLC purchased a new stake in shares of ProShares UltraPro QQQ in the 4th quarter worth $47,000. Columbia River Financial Group LLC purchased a new stake in shares of ProShares UltraPro QQQ in the 1st quarter worth $47,000. Wolff Wiese Magana LLC purchased a new stake in shares of ProShares UltraPro QQQ in the 1st quarter worth $94,000. Finally, Beacon Capital Management LLC increased its stake in shares of ProShares UltraPro QQQ by 32.8% in the 1st quarter. Beacon Capital Management LLC now owns 1,823 shares of the exchange traded fund's stock worth $104,000 after purchasing an additional 450 shares in the last quarter.

ProShares UltraPro QQQ Stock Up 5.1%

TQQQ stock traded up $4.21 during trading on Monday, reaching $87.13. The company's stock had a trading volume of 33,735,969 shares, compared to its average volume of 84,471,578. ProShares UltraPro QQQ has a 1 year low of $35.00 and a 1 year high of $93.79. The company has a market capitalization of $26.85 billion, a P/E ratio of 38.25 and a beta of 3.45. The company's fifty day moving average is $79.82 and its 200-day moving average is $71.25.

ProShares UltraPro QQQ Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Tuesday, July 1st. Investors of record on Wednesday, June 25th were issued a $0.2183 dividend. This represents a $0.87 dividend on an annualized basis and a dividend yield of 1.0%. The ex-dividend date of this dividend was Wednesday, June 25th. This is a positive change from ProShares UltraPro QQQ's previous quarterly dividend of $0.20.

About ProShares UltraPro QQQ

(

Free Report)

Proshares UltraPro QQQ ETF (the Fund) seeks daily investment results, before fees and expenses that correspond to triple (300%) the daily performance of the NASDAQ-100 Index (the Index). The Fund invests in equity securities, derivatives, such as futures contracts, swap agreements, and money market instruments.

Read More

Before you consider ProShares UltraPro QQQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProShares UltraPro QQQ wasn't on the list.

While ProShares UltraPro QQQ currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.