Entropy Technologies LP lowered its stake in CNX Resources Corporation. (NYSE:CNX - Free Report) by 75.8% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 22,867 shares of the oil and gas producer's stock after selling 71,790 shares during the period. Entropy Technologies LP's holdings in CNX Resources were worth $720,000 at the end of the most recent quarter.

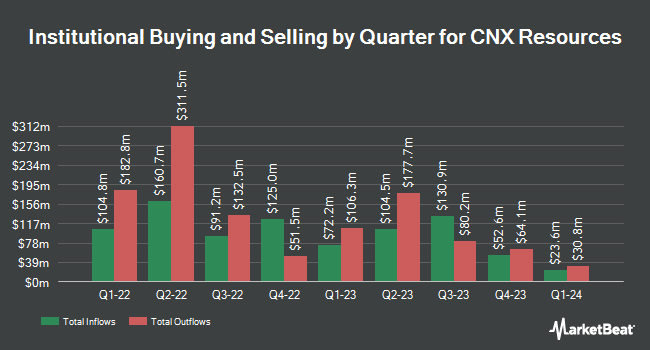

Other hedge funds and other institutional investors have also modified their holdings of the company. Bessemer Group Inc. increased its holdings in shares of CNX Resources by 131.5% in the fourth quarter. Bessemer Group Inc. now owns 926 shares of the oil and gas producer's stock valued at $34,000 after purchasing an additional 526 shares in the last quarter. Harbor Capital Advisors Inc. acquired a new stake in shares of CNX Resources in the first quarter valued at approximately $61,000. Sound Income Strategies LLC acquired a new stake in shares of CNX Resources in the first quarter valued at approximately $63,000. UMB Bank n.a. increased its holdings in shares of CNX Resources by 59.7% in the first quarter. UMB Bank n.a. now owns 2,062 shares of the oil and gas producer's stock valued at $65,000 after purchasing an additional 771 shares in the last quarter. Finally, Ameriflex Group Inc. bought a new position in CNX Resources in the fourth quarter valued at approximately $88,000. Institutional investors and hedge funds own 95.16% of the company's stock.

CNX Resources Stock Up 0.3%

Shares of NYSE:CNX traded up $0.09 during midday trading on Friday, reaching $28.81. 1,625,287 shares of the company were exchanged, compared to its average volume of 2,260,096. CNX Resources Corporation. has a fifty-two week low of $26.43 and a fifty-two week high of $41.93. The company has a quick ratio of 0.30, a current ratio of 0.33 and a debt-to-equity ratio of 0.56. The stock has a fifty day simple moving average of $32.01 and a two-hundred day simple moving average of $31.02. The firm has a market cap of $4.07 billion, a PE ratio of 48.83, a P/E/G ratio of 0.25 and a beta of 0.64.

Wall Street Analysts Forecast Growth

A number of equities analysts have issued reports on CNX shares. Scotiabank reaffirmed a "sector perform" rating and issued a $35.00 price objective (up from $33.00) on shares of CNX Resources in a research note on Friday, July 11th. Cowen reaffirmed a "hold" rating on shares of CNX Resources in a research note on Friday, April 25th. Barclays started coverage on shares of CNX Resources in a research note on Monday, July 7th. They issued an "equal weight" rating and a $33.00 price objective on the stock. TD Cowen raised shares of CNX Resources to a "hold" rating in a research note on Monday, July 7th. Finally, Piper Sandler reduced their price objective on shares of CNX Resources from $26.00 to $24.00 and set an "underweight" rating on the stock in a research note on Thursday. Eight equities research analysts have rated the stock with a sell rating, eight have issued a hold rating and one has issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $31.77.

View Our Latest Research Report on CNX

CNX Resources Company Profile

(

Free Report)

CNX Resources Corporation, an independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin. The company operates in two segments, Shale and Coalbed Methane (CBM). It produces and sells pipeline quality natural gas primarily for gas wholesalers.

Featured Stories

Before you consider CNX Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CNX Resources wasn't on the list.

While CNX Resources currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.