Mackenzie Financial Corp lowered its stake in shares of Essential Properties Realty Trust, Inc. (NYSE:EPRT - Free Report) by 73.7% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 11,638 shares of the company's stock after selling 32,632 shares during the period. Mackenzie Financial Corp's holdings in Essential Properties Realty Trust were worth $380,000 at the end of the most recent reporting period.

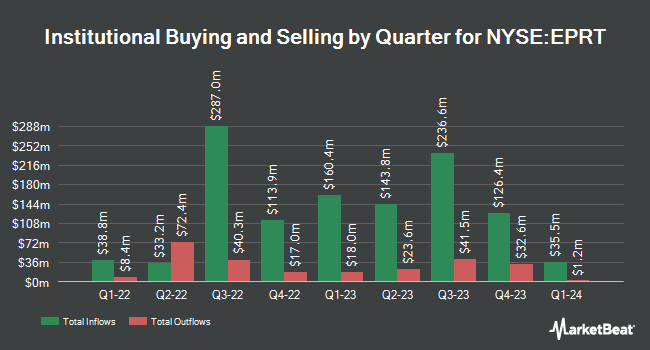

A number of other large investors have also recently made changes to their positions in the stock. Franchise Capital Ltd purchased a new stake in shares of Essential Properties Realty Trust in the first quarter worth $42,000. Quarry LP raised its position in shares of Essential Properties Realty Trust by 439.4% in the fourth quarter. Quarry LP now owns 1,451 shares of the company's stock worth $45,000 after buying an additional 1,182 shares in the last quarter. GF Fund Management CO. LTD. purchased a new stake in shares of Essential Properties Realty Trust in the fourth quarter worth $100,000. Morse Asset Management Inc raised its position in shares of Essential Properties Realty Trust by 44.6% in the fourth quarter. Morse Asset Management Inc now owns 3,325 shares of the company's stock worth $104,000 after buying an additional 1,025 shares in the last quarter. Finally, Archer Investment Corp purchased a new stake in shares of Essential Properties Realty Trust in the first quarter worth $119,000. 96.98% of the stock is owned by institutional investors.

Essential Properties Realty Trust Trading Down 0.9%

Shares of NYSE EPRT traded down $0.27 during trading hours on Monday, hitting $29.95. The company's stock had a trading volume of 1,130,874 shares, compared to its average volume of 1,706,602. The company has a debt-to-equity ratio of 0.60, a quick ratio of 5.67 and a current ratio of 5.67. The stock has a market cap of $5.93 billion, a price-to-earnings ratio of 25.38, a P/E/G ratio of 2.27 and a beta of 1.07. Essential Properties Realty Trust, Inc. has a 12 month low of $27.44 and a 12 month high of $34.88. The business has a 50-day simple moving average of $31.60 and a 200-day simple moving average of $31.69.

Essential Properties Realty Trust (NYSE:EPRT - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The company reported $0.46 earnings per share for the quarter, missing the consensus estimate of $0.47 by ($0.01). The firm had revenue of $129.11 million for the quarter, compared to the consensus estimate of $131.72 million. Essential Properties Realty Trust had a net margin of 44.48% and a return on equity of 6.20%. The business's revenue was up 25.4% compared to the same quarter last year. During the same period in the previous year, the firm posted $0.47 earnings per share. On average, analysts anticipate that Essential Properties Realty Trust, Inc. will post 1.83 earnings per share for the current fiscal year.

Essential Properties Realty Trust Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, July 14th. Shareholders of record on Monday, June 30th were given a dividend of $0.30 per share. This represents a $1.20 annualized dividend and a yield of 4.0%. The ex-dividend date of this dividend was Monday, June 30th. This is a positive change from Essential Properties Realty Trust's previous quarterly dividend of $0.30. Essential Properties Realty Trust's payout ratio is presently 101.69%.

Insiders Place Their Bets

In other news, VP A Joseph Peil sold 13,227 shares of the business's stock in a transaction that occurred on Tuesday, June 10th. The stock was sold at an average price of $32.96, for a total value of $435,961.92. Following the sale, the vice president directly owned 76,590 shares of the company's stock, valued at $2,524,406.40. The trade was a 14.73% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Insiders own 0.81% of the company's stock.

Wall Street Analyst Weigh In

EPRT has been the topic of a number of recent analyst reports. Barclays lowered their price objective on Essential Properties Realty Trust from $37.00 to $36.00 and set an "overweight" rating on the stock in a research report on Monday, July 21st. UBS Group lowered their price target on Essential Properties Realty Trust from $37.00 to $36.00 and set a "buy" rating on the stock in a research report on Wednesday, July 16th. Truist Financial raised their price target on Essential Properties Realty Trust from $35.00 to $36.00 and gave the company a "buy" rating in a research report on Monday, May 5th. Finally, Scotiabank raised their price target on Essential Properties Realty Trust from $32.00 to $33.00 and gave the company a "sector perform" rating in a research report on Monday, May 12th. Three analysts have rated the stock with a hold rating and ten have given a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $34.90.

Read Our Latest Analysis on EPRT

Essential Properties Realty Trust Profile

(

Free Report)

Essential Properties Realty Trust, Inc, a real estate company, acquires, owns, and manages single-tenant properties in the United States. The company leases its properties to middle-market companies, such as restaurants, car washes, automotive services, medical and dental services, convenience stores, equipment rental, entertainment, early childhood education, grocery, and health and fitness on a long-term basis.

Further Reading

Before you consider Essential Properties Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Essential Properties Realty Trust wasn't on the list.

While Essential Properties Realty Trust currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.