Essex Investment Management Co. LLC boosted its position in Dollar Tree, Inc. (NASDAQ:DLTR - Free Report) by 96.0% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 16,552 shares of the company's stock after acquiring an additional 8,108 shares during the period. Essex Investment Management Co. LLC's holdings in Dollar Tree were worth $1,243,000 at the end of the most recent quarter.

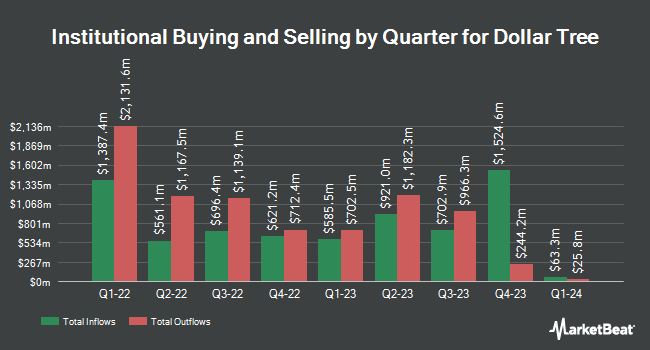

Other hedge funds have also added to or reduced their stakes in the company. Bessemer Group Inc. raised its position in shares of Dollar Tree by 34,600.0% during the fourth quarter. Bessemer Group Inc. now owns 347 shares of the company's stock worth $26,000 after purchasing an additional 346 shares during the period. Hurley Capital LLC acquired a new stake in shares of Dollar Tree during the fourth quarter worth about $33,000. CX Institutional acquired a new stake in shares of Dollar Tree during the first quarter worth about $43,000. Sentry Investment Management LLC acquired a new stake in shares of Dollar Tree during the first quarter worth about $48,000. Finally, GeoWealth Management LLC acquired a new stake in shares of Dollar Tree during the fourth quarter worth about $61,000. Institutional investors own 97.40% of the company's stock.

Dollar Tree Stock Performance

Shares of DLTR stock traded up $1.17 during trading on Friday, reaching $114.72. 3,154,117 shares of the company's stock were exchanged, compared to its average volume of 3,065,441. The company has a quick ratio of 0.72, a current ratio of 1.04 and a debt-to-equity ratio of 0.62. The stock has a market capitalization of $23.94 billion, a PE ratio of -8.28, a PEG ratio of 2.43 and a beta of 0.88. Dollar Tree, Inc. has a twelve month low of $60.49 and a twelve month high of $115.99. The firm's fifty day moving average price is $101.45 and its 200-day moving average price is $84.03.

Dollar Tree (NASDAQ:DLTR - Get Free Report) last released its quarterly earnings results on Wednesday, June 4th. The company reported $1.26 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.21 by $0.05. The business had revenue of $4.64 billion during the quarter, compared to the consensus estimate of $4.52 billion. Dollar Tree had a positive return on equity of 19.36% and a negative net margin of 12.15%. The firm's quarterly revenue was up 11.3% on a year-over-year basis. During the same period in the previous year, the company posted $1.43 EPS. As a group, sell-side analysts anticipate that Dollar Tree, Inc. will post 5.39 EPS for the current year.

Dollar Tree announced that its Board of Directors has authorized a stock repurchase program on Wednesday, July 9th that allows the company to buyback $2.50 billion in shares. This buyback authorization allows the company to purchase up to 11.5% of its stock through open market purchases. Stock buyback programs are often an indication that the company's leadership believes its shares are undervalued.

Insider Buying and Selling at Dollar Tree

In other news, CMO Richard L. Mcneely sold 21,026 shares of the company's stock in a transaction on Friday, June 6th. The stock was sold at an average price of $94.62, for a total transaction of $1,989,480.12. Following the completion of the sale, the chief marketing officer directly owned 50,419 shares in the company, valued at approximately $4,770,645.78. This represents a 29.43% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Insiders own 6.60% of the company's stock.

Wall Street Analyst Weigh In

A number of research firms have recently commented on DLTR. Cfra Research raised Dollar Tree to a "hold" rating in a research report on Wednesday, May 28th. Evercore ISI boosted their target price on Dollar Tree from $92.00 to $94.00 and gave the company an "in-line" rating in a research note on Tuesday, June 24th. Morgan Stanley boosted their target price on Dollar Tree from $80.00 to $96.00 and gave the company an "equal weight" rating in a research note on Thursday, June 5th. Guggenheim restated a "buy" rating and issued a $100.00 target price on shares of Dollar Tree in a research note on Thursday, June 5th. Finally, UBS Group boosted their target price on Dollar Tree from $95.00 to $108.00 and gave the company a "buy" rating in a research note on Thursday, May 29th. Two analysts have rated the stock with a sell rating, thirteen have assigned a hold rating and seven have issued a buy rating to the company. Based on data from MarketBeat.com, Dollar Tree presently has a consensus rating of "Hold" and a consensus price target of $97.74.

Get Our Latest Stock Report on DLTR

Dollar Tree Company Profile

(

Free Report)

Dollar Tree, Inc operates retail discount stores. The company operates in two segments, Dollar Tree and Family Dollar. The Dollar Tree segment offers merchandise at the fixed price of $ 1.25. It provides consumable merchandise, which includes everyday consumables, such as household paper and chemicals, food, candy, health, personal care products, and frozen and refrigerated food; variety merchandise comprising toys, durable housewares, gifts, stationery, party goods, greeting cards, softlines, arts and crafts supplies, and other items; and seasonal goods that include Christmas, Easter, Halloween, and Valentine's Day merchandise.

Read More

Before you consider Dollar Tree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar Tree wasn't on the list.

While Dollar Tree currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.