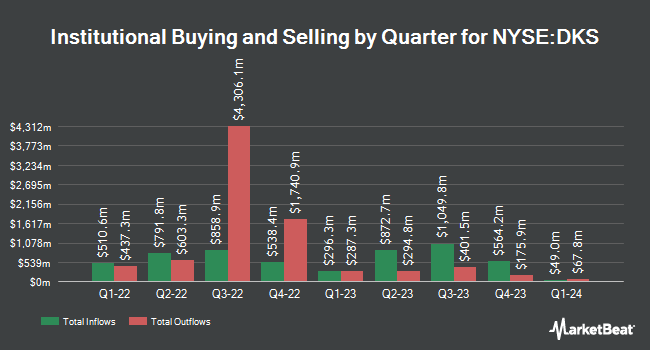

Federated Hermes Inc. boosted its position in DICK'S Sporting Goods, Inc. (NYSE:DKS - Free Report) by 7.7% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 213,021 shares of the sporting goods retailer's stock after purchasing an additional 15,166 shares during the period. Federated Hermes Inc. owned approximately 0.27% of DICK'S Sporting Goods worth $42,937,000 as of its most recent SEC filing.

A number of other institutional investors have also recently added to or reduced their stakes in DKS. EP Wealth Advisors LLC raised its stake in DICK'S Sporting Goods by 5.9% during the 4th quarter. EP Wealth Advisors LLC now owns 1,016 shares of the sporting goods retailer's stock valued at $232,000 after purchasing an additional 57 shares during the period. Pine Haven Investment Counsel Inc raised its stake in DICK'S Sporting Goods by 4.9% during the 1st quarter. Pine Haven Investment Counsel Inc now owns 1,279 shares of the sporting goods retailer's stock valued at $258,000 after purchasing an additional 60 shares during the period. Private Advisor Group LLC raised its stake in DICK'S Sporting Goods by 4.4% during the 1st quarter. Private Advisor Group LLC now owns 1,449 shares of the sporting goods retailer's stock valued at $292,000 after purchasing an additional 61 shares during the period. Private Trust Co. NA raised its stake in DICK'S Sporting Goods by 54.1% during the 1st quarter. Private Trust Co. NA now owns 188 shares of the sporting goods retailer's stock valued at $38,000 after purchasing an additional 66 shares during the period. Finally, Bessemer Group Inc. raised its stake in DICK'S Sporting Goods by 49.3% during the 1st quarter. Bessemer Group Inc. now owns 218 shares of the sporting goods retailer's stock valued at $44,000 after purchasing an additional 72 shares during the period. 89.83% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

DKS has been the topic of several research analyst reports. Loop Capital boosted their price target on shares of DICK'S Sporting Goods from $180.00 to $215.00 and gave the company a "hold" rating in a report on Wednesday. TD Cowen cut shares of DICK'S Sporting Goods from a "buy" rating to a "hold" rating and set a $216.00 price target on the stock. in a report on Thursday, May 15th. Stifel Nicolaus lowered their price target on shares of DICK'S Sporting Goods from $226.00 to $192.00 and set a "hold" rating on the stock in a report on Thursday, April 10th. Gordon Haskett upgraded shares of DICK'S Sporting Goods from a "reduce" rating to a "hold" rating in a report on Friday, July 25th. Finally, Robert W. Baird lowered their price target on shares of DICK'S Sporting Goods from $230.00 to $185.00 and set a "neutral" rating on the stock in a report on Friday, May 16th. Eleven equities research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $221.50.

Check Out Our Latest Research Report on DKS

DICK'S Sporting Goods Trading Down 2.4%

Shares of NYSE DKS traded down $5.05 during midday trading on Friday, reaching $206.46. 1,319,897 shares of the stock were exchanged, compared to its average volume of 1,166,044. The business has a 50-day simple moving average of $194.89 and a two-hundred day simple moving average of $203.33. The company has a market capitalization of $16.53 billion, a price-to-earnings ratio of 14.77, a P/E/G ratio of 2.95 and a beta of 1.07. DICK'S Sporting Goods, Inc. has a 12 month low of $166.37 and a 12 month high of $254.60. The company has a debt-to-equity ratio of 0.49, a current ratio of 1.62 and a quick ratio of 0.47.

DICK'S Sporting Goods (NYSE:DKS - Get Free Report) last issued its quarterly earnings data on Wednesday, May 28th. The sporting goods retailer reported $3.37 EPS for the quarter, hitting analysts' consensus estimates of $3.37. DICK'S Sporting Goods had a net margin of 8.49% and a return on equity of 38.06%. The business had revenue of $3.16 billion for the quarter, compared to analyst estimates of $3.12 billion. As a group, equities research analysts expect that DICK'S Sporting Goods, Inc. will post 13.89 EPS for the current year.

DICK'S Sporting Goods Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, June 27th. Stockholders of record on Friday, June 13th were given a $1.2125 dividend. This represents a $4.85 dividend on an annualized basis and a dividend yield of 2.3%. The ex-dividend date of this dividend was Friday, June 13th. DICK'S Sporting Goods's dividend payout ratio (DPR) is 34.69%.

Insider Buying and Selling

In related news, SVP Elizabeth H. Baran sold 1,830 shares of DICK'S Sporting Goods stock in a transaction dated Wednesday, July 2nd. The shares were sold at an average price of $204.65, for a total transaction of $374,509.50. Following the completion of the sale, the senior vice president owned 12,465 shares of the company's stock, valued at approximately $2,550,962.25. The trade was a 12.80% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, EVP Julie Lodge-Jarrett sold 3,541 shares of DICK'S Sporting Goods stock in a transaction dated Thursday, June 26th. The stock was sold at an average price of $187.00, for a total transaction of $662,167.00. Following the sale, the executive vice president directly owned 19,165 shares of the company's stock, valued at $3,583,855. The trade was a 15.59% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 55,866 shares of company stock worth $11,462,773. Corporate insiders own 32.55% of the company's stock.

DICK'S Sporting Goods Company Profile

(

Free Report)

Dick's Sporting Goods, Inc engages in the retailing of an extensive assortment of authentic sports equipment, apparel, footwear, and accessories. It also offers its products both online and through mobile applications. The company was founded by Richard T. Stack in 1948 and is headquartered in Coraopolis, PA.

Further Reading

Before you consider DICK'S Sporting Goods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DICK'S Sporting Goods wasn't on the list.

While DICK'S Sporting Goods currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.