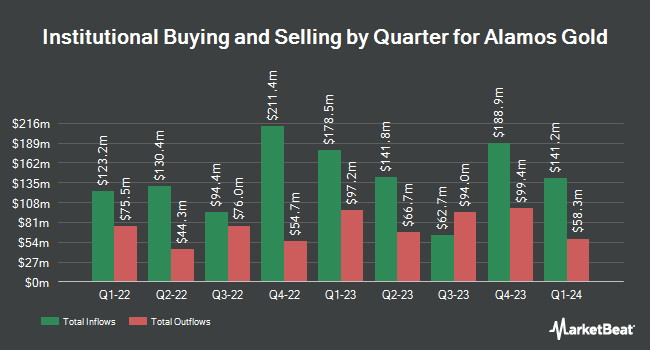

Federation des caisses Desjardins du Quebec boosted its position in shares of Alamos Gold Inc. (NYSE:AGI - Free Report) TSE: AGI by 13.7% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 215,647 shares of the basic materials company's stock after acquiring an additional 25,924 shares during the quarter. Federation des caisses Desjardins du Quebec owned 0.05% of Alamos Gold worth $5,742,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in AGI. Sunbelt Securities Inc. bought a new position in shares of Alamos Gold in the first quarter valued at about $41,000. SBI Securities Co. Ltd. raised its position in shares of Alamos Gold by 67.0% in the first quarter. SBI Securities Co. Ltd. now owns 1,645 shares of the basic materials company's stock valued at $44,000 after purchasing an additional 660 shares during the period. SVB Wealth LLC bought a new position in shares of Alamos Gold in the first quarter valued at about $67,000. Banque Cantonale Vaudoise bought a new position in shares of Alamos Gold in the first quarter valued at about $68,000. Finally, NBT Bank N A NY bought a new position in shares of Alamos Gold in the first quarter valued at about $190,000. 64.33% of the stock is owned by institutional investors.

Alamos Gold Stock Down 1.0%

NYSE AGI traded down $0.34 during mid-day trading on Tuesday, hitting $32.43. The company's stock had a trading volume of 1,259,999 shares, compared to its average volume of 3,449,344. The company's 50 day simple moving average is $27.17 and its 200 day simple moving average is $26.52. Alamos Gold Inc. has a twelve month low of $17.42 and a twelve month high of $33.10. The company has a current ratio of 1.49, a quick ratio of 1.00 and a debt-to-equity ratio of 0.07. The firm has a market capitalization of $13.63 billion, a price-to-earnings ratio of 39.07, a PEG ratio of 0.70 and a beta of 0.55.

Alamos Gold (NYSE:AGI - Get Free Report) TSE: AGI last posted its quarterly earnings results on Wednesday, July 30th. The basic materials company reported $0.34 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.33 by $0.01. The business had revenue of $438.20 million during the quarter, compared to the consensus estimate of $400.61 million. Alamos Gold had a net margin of 22.99% and a return on equity of 10.67%. Alamos Gold's revenue was up 31.7% compared to the same quarter last year. During the same quarter last year, the firm posted $0.24 EPS. Analysts anticipate that Alamos Gold Inc. will post 1.29 earnings per share for the current year.

Alamos Gold Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, September 25th. Shareholders of record on Thursday, September 11th will be issued a dividend of $0.025 per share. This represents a $0.10 dividend on an annualized basis and a yield of 0.3%. The ex-dividend date of this dividend is Thursday, September 11th. Alamos Gold's payout ratio is currently 12.05%.

Wall Street Analyst Weigh In

AGI has been the topic of several research analyst reports. Wall Street Zen lowered shares of Alamos Gold from a "buy" rating to a "hold" rating in a research report on Saturday, August 16th. Stifel Nicolaus initiated coverage on shares of Alamos Gold in a research note on Wednesday, July 9th. They issued a "buy" rating on the stock. Stifel Canada upgraded shares of Alamos Gold to a "strong-buy" rating in a research note on Tuesday, July 8th. National Bankshares reiterated an "outperform" rating on shares of Alamos Gold in a research report on Tuesday, August 5th. Finally, CIBC restated an "outperform" rating on shares of Alamos Gold in a report on Tuesday, July 15th. Two analysts have rated the stock with a Strong Buy rating, six have given a Buy rating and one has given a Hold rating to the company's stock. Based on data from MarketBeat.com, Alamos Gold presently has an average rating of "Buy" and an average price target of $30.38.

Read Our Latest Stock Analysis on Alamos Gold

About Alamos Gold

(

Free Report)

Alamos Gold Inc engages in the acquisition, exploration, development, and extraction of precious metals in Canada and Mexico. The company primarily explores for gold deposits. It holds 100% interest in the Young-Davidson mine and Island Gold mine located in the Ontario, Canada; Mulatos mine located in the Sonora, Mexico; and Lynn Lake project situated in the Manitoba, Canada.

Featured Articles

Before you consider Alamos Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alamos Gold wasn't on the list.

While Alamos Gold currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.