Ferguson Wellman Capital Management Inc. reduced its holdings in Alphabet Inc. (NASDAQ:GOOG - Free Report) by 5.9% in the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 76,650 shares of the information services provider's stock after selling 4,808 shares during the period. Ferguson Wellman Capital Management Inc.'s holdings in Alphabet were worth $13,597,000 at the end of the most recent reporting period.

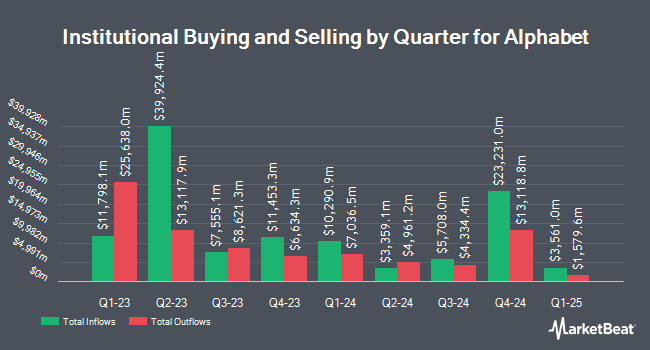

A number of other institutional investors and hedge funds have also recently bought and sold shares of GOOG. Principia Wealth Advisory LLC grew its position in shares of Alphabet by 111.8% in the first quarter. Principia Wealth Advisory LLC now owns 161 shares of the information services provider's stock valued at $26,000 after purchasing an additional 85 shares during the last quarter. MorganRosel Wealth Management LLC acquired a new stake in Alphabet in the 1st quarter valued at about $26,000. Goodman Advisory Group LLC acquired a new stake in shares of Alphabet in the first quarter valued at approximately $32,000. Greykasell Wealth Strategies Inc. acquired a new position in Alphabet during the 1st quarter valued at about $32,000. Finally, Elevate Wealth Advisory Inc. bought a new position in Alphabet during the 1st quarter worth approximately $34,000. Hedge funds and other institutional investors own 27.26% of the company's stock.

Alphabet Stock Performance

Shares of NASDAQ GOOG traded up $2.91 during trading on Friday, reaching $255.24. 41,503,403 shares of the company traded hands, compared to its average volume of 24,489,492. The company has a current ratio of 1.90, a quick ratio of 1.90 and a debt-to-equity ratio of 0.07. The stock has a market cap of $3.09 trillion, a P/E ratio of 27.18, a PEG ratio of 1.72 and a beta of 1.01. Alphabet Inc. has a 12-month low of $142.66 and a 12-month high of $256.70. The firm's fifty day simple moving average is $210.08 and its 200 day simple moving average is $181.61.

Alphabet (NASDAQ:GOOG - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The information services provider reported $2.31 earnings per share for the quarter, topping the consensus estimate of $2.12 by $0.19. The company had revenue of $96.43 billion during the quarter, compared to analyst estimates of $93.67 billion. Alphabet had a net margin of 31.12% and a return on equity of 34.31%. Alphabet's revenue was up 13.8% compared to the same quarter last year. During the same quarter last year, the firm posted $1.89 earnings per share. As a group, research analysts anticipate that Alphabet Inc. will post 8.89 earnings per share for the current fiscal year.

Alphabet Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, September 15th. Investors of record on Monday, September 8th were given a dividend of $0.21 per share. The ex-dividend date was Monday, September 8th. This represents a $0.84 dividend on an annualized basis and a yield of 0.3%. Alphabet's dividend payout ratio (DPR) is 8.95%.

Wall Street Analyst Weigh In

Several brokerages recently issued reports on GOOG. The Goldman Sachs Group reiterated a "buy" rating and issued a $220.00 target price on shares of Alphabet in a research note on Monday, June 2nd. JPMorgan Chase & Co. increased their price target on Alphabet from $232.00 to $260.00 and gave the stock an "overweight" rating in a report on Wednesday, September 3rd. KeyCorp set a $265.00 price target on Alphabet in a research report on Wednesday, September 3rd. UBS Group lifted their price target on Alphabet from $186.00 to $192.00 and gave the company a "neutral" rating in a research report on Wednesday, July 16th. Finally, Pivotal Research boosted their price target on shares of Alphabet from $245.00 to $300.00 and gave the stock a "buy" rating in a research note on Wednesday, September 3rd. Four analysts have rated the stock with a Strong Buy rating, eighteen have assigned a Buy rating, five have assigned a Hold rating and three have assigned a Sell rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $227.56.

Check Out Our Latest Stock Report on GOOG

Insider Activity at Alphabet

In related news, CAO Amie Thuener O'toole sold 2,778 shares of Alphabet stock in a transaction on Monday, September 15th. The stock was sold at an average price of $245.00, for a total value of $680,610.00. Following the transaction, the chief accounting officer directly owned 17,293 shares in the company, valued at $4,236,785. The trade was a 13.84% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Kavitark Ram Shriram sold 18,566 shares of the stock in a transaction on Friday, July 18th. The stock was sold at an average price of $185.76, for a total value of $3,448,820.16. Following the sale, the director owned 243,400 shares of the company's stock, valued at approximately $45,213,984. This represents a 7.09% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 258,088 shares of company stock worth $52,405,304 in the last 90 days. Company insiders own 12.99% of the company's stock.

Alphabet Company Profile

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Read More

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report