Financial Counselors Inc. grew its holdings in shares of TE Connectivity Ltd. (NYSE:TEL - Free Report) by 4.3% during the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 165,572 shares of the electronics maker's stock after acquiring an additional 6,780 shares during the quarter. Financial Counselors Inc. owned 0.06% of TE Connectivity worth $23,399,000 at the end of the most recent quarter.

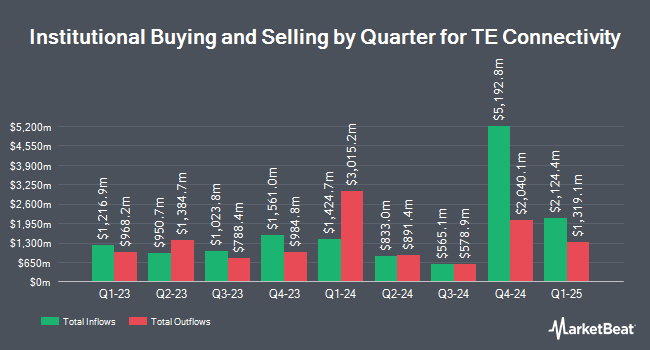

Other large investors have also recently made changes to their positions in the company. Fairway Wealth LLC bought a new position in shares of TE Connectivity in the fourth quarter worth approximately $43,000. North Capital Inc. bought a new stake in TE Connectivity in the first quarter valued at $46,000. Global X Japan Co. Ltd. bought a new stake in TE Connectivity in the first quarter valued at $47,000. Bartlett & CO. Wealth Management LLC boosted its holdings in TE Connectivity by 650.8% in the first quarter. Bartlett & CO. Wealth Management LLC now owns 488 shares of the electronics maker's stock valued at $69,000 after acquiring an additional 423 shares in the last quarter. Finally, Loomis Sayles & Co. L P boosted its holdings in TE Connectivity by 32.6% in the fourth quarter. Loomis Sayles & Co. L P now owns 500 shares of the electronics maker's stock valued at $71,000 after acquiring an additional 123 shares in the last quarter. 91.43% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several analysts recently weighed in on TEL shares. Robert W. Baird lifted their price target on shares of TE Connectivity from $147.00 to $153.00 and gave the company an "outperform" rating in a report on Thursday, April 24th. Bank of America raised their price objective on TE Connectivity from $168.00 to $190.00 and gave the company a "buy" rating in a research report on Thursday. Wall Street Zen lowered TE Connectivity from a "buy" rating to a "hold" rating in a research report on Saturday, May 24th. Vertical Research raised TE Connectivity from a "hold" rating to a "buy" rating and set a $170.00 price objective for the company in a research report on Friday, April 25th. Finally, HSBC raised TE Connectivity from a "hold" rating to a "buy" rating and set a $175.00 price objective for the company in a research report on Thursday, April 24th. Five equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $165.90.

Check Out Our Latest Analysis on TEL

TE Connectivity Stock Up 1.3%

Shares of TEL traded up $2.27 during trading hours on Thursday, hitting $174.92. The company had a trading volume of 1,723,100 shares, compared to its average volume of 1,711,639. The firm has a fifty day moving average price of $162.72 and a 200-day moving average price of $150.40. The company has a debt-to-equity ratio of 0.27, a quick ratio of 1.08 and a current ratio of 1.51. The stock has a market capitalization of $51.87 billion, a price-to-earnings ratio of 38.44, a P/E/G ratio of 2.25 and a beta of 1.23. TE Connectivity Ltd. has a 52-week low of $116.30 and a 52-week high of $175.66.

TE Connectivity (NYSE:TEL - Get Free Report) last posted its quarterly earnings results on Wednesday, April 23rd. The electronics maker reported $2.10 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.96 by $0.14. TE Connectivity had a return on equity of 19.40% and a net margin of 8.67%. The firm had revenue of $4.14 billion during the quarter, compared to analyst estimates of $3.97 billion. During the same quarter in the previous year, the firm earned $1.86 EPS. TE Connectivity's quarterly revenue was up 4.4% compared to the same quarter last year. On average, equities research analysts forecast that TE Connectivity Ltd. will post 8.05 EPS for the current fiscal year.

TE Connectivity Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, September 12th. Shareholders of record on Friday, August 22nd will be given a $0.71 dividend. This represents a $2.84 dividend on an annualized basis and a yield of 1.62%. The ex-dividend date of this dividend is Friday, August 22nd. TE Connectivity's dividend payout ratio (DPR) is 62.42%.

Insiders Place Their Bets

In other TE Connectivity news, insider Aaron Kyle Stucki sold 13,100 shares of the business's stock in a transaction dated Thursday, June 26th. The stock was sold at an average price of $170.00, for a total transaction of $2,227,000.00. Following the completion of the sale, the insider directly owned 23,657 shares in the company, valued at $4,021,690. The trade was a 35.64% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, SVP Malavika Sagar sold 3,125 shares of the business's stock in a transaction dated Monday, May 12th. The shares were sold at an average price of $160.00, for a total value of $500,000.00. Following the sale, the senior vice president owned 5,927 shares of the company's stock, valued at approximately $948,320. This represents a 34.52% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 187,775 shares of company stock worth $29,596,059 in the last quarter. Insiders own 0.90% of the company's stock.

TE Connectivity Company Profile

(

Free Report)

TE Connectivity Ltd., together with its subsidiaries, manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the AsiaPacific, and the Americas. The company operates through three segments: Transportation Solutions, Industrial Solutions, and Communications Solutions.

Recommended Stories

Before you consider TE Connectivity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TE Connectivity wasn't on the list.

While TE Connectivity currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.