First Financial Bank Trust Division raised its position in Fastenal Company (NASDAQ:FAST - Free Report) by 77.5% during the second quarter, according to its most recent 13F filing with the SEC. The fund owned 36,190 shares of the company's stock after buying an additional 15,804 shares during the period. First Financial Bank Trust Division's holdings in Fastenal were worth $1,520,000 as of its most recent filing with the SEC.

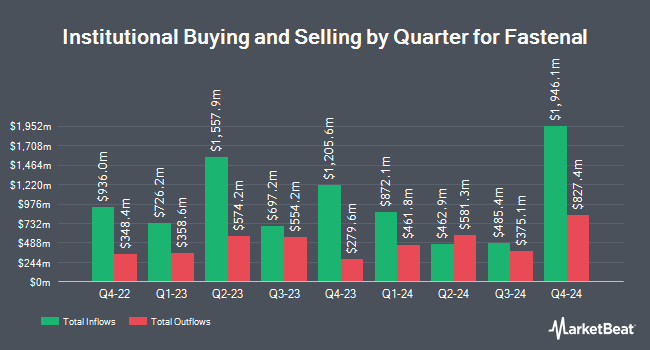

Other hedge funds have also recently bought and sold shares of the company. 1248 Management LLC bought a new position in Fastenal in the 1st quarter valued at $36,000. Horizon Financial Services LLC boosted its position in Fastenal by 5,330.0% in the 1st quarter. Horizon Financial Services LLC now owns 543 shares of the company's stock valued at $42,000 after buying an additional 533 shares during the last quarter. Zions Bancorporation National Association UT bought a new position in Fastenal in the 1st quarter valued at $49,000. TruNorth Capital Management LLC bought a new position in Fastenal in the 1st quarter valued at $57,000. Finally, Golden State Wealth Management LLC boosted its position in Fastenal by 5,661.5% in the 1st quarter. Golden State Wealth Management LLC now owns 749 shares of the company's stock valued at $58,000 after buying an additional 736 shares during the last quarter. 81.38% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In related news, EVP William Joseph Drazkowski sold 6,842 shares of the firm's stock in a transaction on Friday, August 15th. The stock was sold at an average price of $48.67, for a total transaction of $333,000.14. Following the sale, the executive vice president owned 11,994 shares of the company's stock, valued at approximately $583,747.98. This trade represents a 36.32% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, CFO Sheryl Ann Lisowski sold 21,052 shares of the firm's stock in a transaction on Thursday, July 17th. The stock was sold at an average price of $45.21, for a total value of $951,760.92. Following the sale, the chief financial officer directly owned 10,192 shares in the company, valued at $460,780.32. The trade was a 67.38% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 111,230 shares of company stock worth $5,288,364. 0.37% of the stock is owned by corporate insiders.

Analyst Ratings Changes

A number of research analysts have commented on FAST shares. Loop Capital reiterated a "hold" rating on shares of Fastenal in a research report on Tuesday, July 15th. Robert W. Baird upgraded Fastenal from a "neutral" rating to an "outperform" rating and raised their price target for the stock from $47.00 to $55.00 in a research report on Thursday, August 7th. Wolfe Research restated a "positive" rating on shares of Fastenal in a research report on Monday, July 14th. Morgan Stanley set a $40.00 price target on Fastenal and gave the stock an "equal weight" rating in a research report on Thursday, July 3rd. Finally, Stifel Nicolaus set a $82.00 price target on Fastenal in a research report on Thursday, July 3rd. One equities research analyst has rated the stock with a Strong Buy rating, four have assigned a Buy rating, eight have issued a Hold rating and one has assigned a Sell rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $46.82.

Read Our Latest Stock Analysis on Fastenal

Fastenal Stock Performance

Shares of Fastenal stock opened at $47.45 on Friday. The company has a market capitalization of $54.46 billion, a PE ratio of 45.63, a PEG ratio of 4.30 and a beta of 0.97. Fastenal Company has a 12 month low of $34.67 and a 12 month high of $50.63. The company has a current ratio of 4.22, a quick ratio of 2.12 and a debt-to-equity ratio of 0.03. The stock's fifty day simple moving average is $47.42 and its 200 day simple moving average is $42.54.

Fastenal (NASDAQ:FAST - Get Free Report) last issued its quarterly earnings data on Monday, July 14th. The company reported $0.29 EPS for the quarter, topping the consensus estimate of $0.28 by $0.01. The business had revenue of $2.08 billion for the quarter, compared to the consensus estimate of $2.07 billion. Fastenal had a return on equity of 32.33% and a net margin of 15.30%.The firm's revenue was up 8.6% compared to the same quarter last year. During the same quarter last year, the business posted $0.25 EPS. On average, research analysts predict that Fastenal Company will post 2.15 EPS for the current year.

Fastenal Cuts Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, August 26th. Investors of record on Tuesday, July 29th were paid a dividend of $0.22 per share. This represents a $0.88 annualized dividend and a yield of 1.9%. The ex-dividend date of this dividend was Tuesday, July 29th. Fastenal's dividend payout ratio (DPR) is presently 84.62%.

Fastenal Profile

(

Free Report)

Fastenal Company, together with its subsidiaries, engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, North America, and internationally. It offers fasteners, and related industrial and construction supplies under the Fastenal name. The company's fastener products include threaded fasteners, bolts, nuts, screws, studs, and related washers that are used in manufactured products and construction projects, as well as in the maintenance and repair of machines.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fastenal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fastenal wasn't on the list.

While Fastenal currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.