Alyeska Investment Group L.P. lifted its stake in Flushing Financial Corporation (NASDAQ:FFIC - Free Report) by 54.6% in the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 342,296 shares of the bank's stock after buying an additional 120,926 shares during the period. Alyeska Investment Group L.P. owned about 1.01% of Flushing Financial worth $4,347,000 at the end of the most recent reporting period.

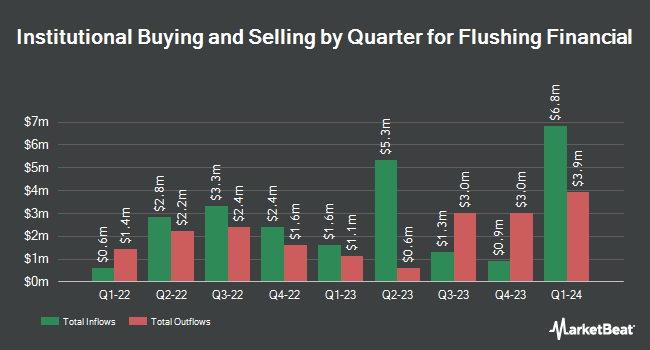

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Vanguard Group Inc. raised its holdings in Flushing Financial by 9.3% in the 1st quarter. Vanguard Group Inc. now owns 1,895,886 shares of the bank's stock valued at $24,078,000 after acquiring an additional 161,133 shares in the last quarter. Hotchkis & Wiley Capital Management LLC increased its position in shares of Flushing Financial by 26.3% during the first quarter. Hotchkis & Wiley Capital Management LLC now owns 839,438 shares of the bank's stock valued at $10,661,000 after purchasing an additional 174,970 shares during the period. Patriot Financial Partners GP LP raised its stake in shares of Flushing Financial by 21.1% in the first quarter. Patriot Financial Partners GP LP now owns 575,000 shares of the bank's stock valued at $7,302,000 after purchasing an additional 100,000 shares in the last quarter. Invesco Ltd. lifted its position in Flushing Financial by 57.7% in the first quarter. Invesco Ltd. now owns 541,904 shares of the bank's stock worth $6,882,000 after purchasing an additional 198,233 shares during the period. Finally, Foundry Partners LLC lifted its holdings in shares of Flushing Financial by 11.8% during the 1st quarter. Foundry Partners LLC now owns 352,110 shares of the bank's stock worth $4,472,000 after acquiring an additional 37,095 shares during the period. 67.10% of the stock is currently owned by institutional investors.

Flushing Financial Price Performance

Shares of NASDAQ FFIC traded up $0.36 during mid-day trading on Thursday, hitting $14.13. 282,930 shares of the stock were exchanged, compared to its average volume of 181,001. The company has a market cap of $477.31 million, a P/E ratio of -11.87 and a beta of 0.83. The company has a debt-to-equity ratio of 0.85, a quick ratio of 0.94 and a current ratio of 0.94. Flushing Financial Corporation has a twelve month low of $10.65 and a twelve month high of $18.59. The stock's fifty day simple moving average is $12.80 and its two-hundred day simple moving average is $12.53.

Flushing Financial (NASDAQ:FFIC - Get Free Report) last released its quarterly earnings results on Thursday, July 24th. The bank reported $0.32 EPS for the quarter, topping analysts' consensus estimates of $0.29 by $0.03. Flushing Financial had a positive return on equity of 4.45% and a negative net margin of 7.13%.The business had revenue of $58.92 million for the quarter, compared to analyst estimates of $60.13 million. As a group, analysts forecast that Flushing Financial Corporation will post 1.2 EPS for the current fiscal year.

Flushing Financial Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, September 26th. Shareholders of record on Friday, September 5th will be given a $0.22 dividend. This represents a $0.88 annualized dividend and a yield of 6.2%. The ex-dividend date is Friday, September 5th. Flushing Financial's dividend payout ratio (DPR) is presently -73.95%.

Wall Street Analyst Weigh In

Separately, Zacks Research raised shares of Flushing Financial from a "strong sell" rating to a "hold" rating in a research report on Monday. One investment analyst has rated the stock with a Hold rating, According to MarketBeat, Flushing Financial presently has a consensus rating of "Hold".

Read Our Latest Stock Analysis on FFIC

Flushing Financial Profile

(

Free Report)

Flushing Financial Corporation operates as the bank holding company for Flushing Bank that provides banking products and services primarily to consumers, businesses, and governmental units. It offers various deposit products, including checking and savings accounts, money market accounts, non-interest bearing demand accounts, NOW accounts, and certificates of deposit.

Read More

Before you consider Flushing Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flushing Financial wasn't on the list.

While Flushing Financial currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.