Janney Montgomery Scott LLC raised its position in FormFactor, Inc. (NASDAQ:FORM - Free Report) by 52.5% in the second quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 23,250 shares of the semiconductor company's stock after buying an additional 8,005 shares during the period. Janney Montgomery Scott LLC's holdings in FormFactor were worth $800,000 at the end of the most recent quarter.

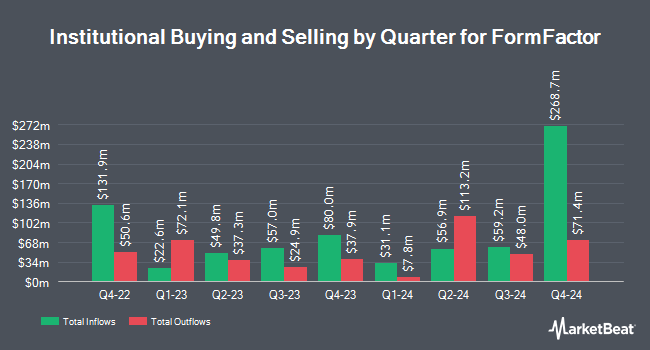

Other institutional investors and hedge funds have also modified their holdings of the company. Westfield Capital Management Co. LP purchased a new stake in FormFactor during the 1st quarter valued at about $25,838,000. Massachusetts Financial Services Co. MA grew its stake in FormFactor by 82.1% during the 1st quarter. Massachusetts Financial Services Co. MA now owns 1,963,727 shares of the semiconductor company's stock valued at $55,554,000 after acquiring an additional 885,617 shares in the last quarter. Reinhart Partners LLC. grew its stake in FormFactor by 64.8% during the 2nd quarter. Reinhart Partners LLC. now owns 1,904,698 shares of the semiconductor company's stock valued at $65,541,000 after acquiring an additional 749,088 shares in the last quarter. Select Equity Group L.P. boosted its holdings in FormFactor by 459.5% in the 1st quarter. Select Equity Group L.P. now owns 345,782 shares of the semiconductor company's stock valued at $9,782,000 after purchasing an additional 283,983 shares during the last quarter. Finally, Paradigm Capital Management Inc. NY boosted its holdings in FormFactor by 679.7% in the 1st quarter. Paradigm Capital Management Inc. NY now owns 295,500 shares of the semiconductor company's stock valued at $8,360,000 after purchasing an additional 257,600 shares during the last quarter. Hedge funds and other institutional investors own 98.76% of the company's stock.

Analysts Set New Price Targets

FORM has been the topic of several recent analyst reports. B. Riley upgraded shares of FormFactor from a "neutral" rating to a "buy" rating and boosted their target price for the company from $34.00 to $47.00 in a report on Friday, October 10th. Stifel Nicolaus boosted their target price on shares of FormFactor from $31.00 to $35.00 and gave the company a "hold" rating in a report on Monday. Wall Street Zen upgraded shares of FormFactor from a "sell" rating to a "hold" rating in a report on Saturday, September 20th. Citigroup reiterated a "neutral" rating and issued a $31.00 target price (down from $36.00) on shares of FormFactor in a report on Thursday, August 21st. Finally, Weiss Ratings reiterated a "hold (c)" rating on shares of FormFactor in a report on Wednesday, October 8th. Two analysts have rated the stock with a Buy rating and six have given a Hold rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $41.00.

View Our Latest Analysis on FORM

Insider Buying and Selling at FormFactor

In other FormFactor news, Director Rebeca Obregon-Jimenez sold 4,000 shares of the firm's stock in a transaction dated Wednesday, August 13th. The shares were sold at an average price of $29.55, for a total transaction of $118,200.00. Following the completion of the transaction, the director directly owned 13,126 shares in the company, valued at approximately $387,873.30. This trade represents a 23.36% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Kelley Steven-Waiss sold 3,600 shares of the firm's stock in a transaction dated Friday, September 12th. The shares were sold at an average price of $30.43, for a total transaction of $109,548.00. Following the transaction, the director owned 35,479 shares of the company's stock, valued at $1,079,625.97. This trade represents a 9.21% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.90% of the stock is currently owned by company insiders.

FormFactor Trading Up 6.1%

Shares of NASDAQ:FORM opened at $42.70 on Thursday. FormFactor, Inc. has a 52 week low of $22.58 and a 52 week high of $50.79. The company's 50 day moving average is $32.88 and its two-hundred day moving average is $31.83. The company has a current ratio of 4.24, a quick ratio of 3.34 and a debt-to-equity ratio of 0.01. The company has a market cap of $3.29 billion, a PE ratio of 76.25 and a beta of 1.28.

FormFactor (NASDAQ:FORM - Get Free Report) last posted its earnings results on Wednesday, July 30th. The semiconductor company reported $0.27 EPS for the quarter, missing analysts' consensus estimates of $0.30 by ($0.03). The company had revenue of $195.80 million during the quarter, compared to analysts' expectations of $190.17 million. FormFactor had a net margin of 5.75% and a return on equity of 5.57%. The company's quarterly revenue was down .8% on a year-over-year basis. During the same period last year, the business earned $0.35 earnings per share. FormFactor has set its Q3 2025 guidance at 0.210-0.290 EPS. Equities analysts predict that FormFactor, Inc. will post 0.9 earnings per share for the current fiscal year.

FormFactor Profile

(

Free Report)

FormFactor, Inc designs, manufactures, and sells probe cards, analytical probes, probe stations, metrology systems, thermal systems, and cryogenic systems to semiconductor companies and scientific institutions in the United States, Taiwan, South Korea, China, Europe, Japan, Malaysia, Singapore, and internationally.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider FormFactor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FormFactor wasn't on the list.

While FormFactor currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.