Foster & Motley Inc. lowered its position in Diamondback Energy, Inc. (NASDAQ:FANG - Free Report) by 41.3% in the 2nd quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 3,067 shares of the oil and natural gas company's stock after selling 2,161 shares during the period. Foster & Motley Inc.'s holdings in Diamondback Energy were worth $421,000 as of its most recent SEC filing.

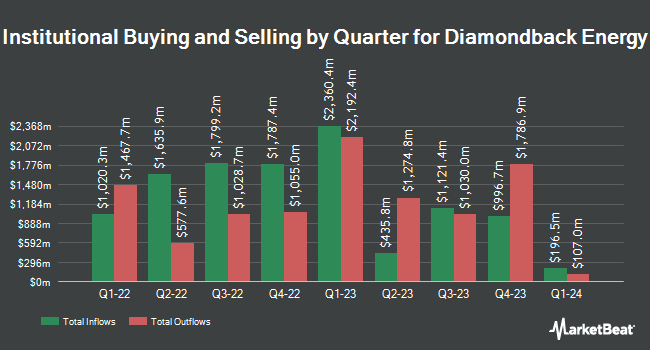

Several other institutional investors have also recently made changes to their positions in the company. Chevy Chase Trust Holdings LLC raised its position in shares of Diamondback Energy by 0.8% in the 2nd quarter. Chevy Chase Trust Holdings LLC now owns 98,905 shares of the oil and natural gas company's stock worth $13,590,000 after acquiring an additional 760 shares in the last quarter. Arista Wealth Management LLC bought a new position in shares of Diamondback Energy in the 2nd quarter worth approximately $358,000. Stratos Wealth Partners LTD. increased its position in Diamondback Energy by 0.7% during the 2nd quarter. Stratos Wealth Partners LTD. now owns 23,034 shares of the oil and natural gas company's stock valued at $3,165,000 after buying an additional 162 shares in the last quarter. Private Trust Co. NA increased its position in Diamondback Energy by 13.5% during the 2nd quarter. Private Trust Co. NA now owns 1,796 shares of the oil and natural gas company's stock valued at $247,000 after buying an additional 214 shares in the last quarter. Finally, Praxis Investment Management Inc. increased its position in Diamondback Energy by 39.0% during the 2nd quarter. Praxis Investment Management Inc. now owns 7,020 shares of the oil and natural gas company's stock valued at $965,000 after buying an additional 1,970 shares in the last quarter. Institutional investors own 90.01% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms recently weighed in on FANG. KeyCorp reduced their price objective on Diamondback Energy from $180.00 to $176.00 and set an "overweight" rating for the company in a research report on Wednesday, September 3rd. Melius Research began coverage on Diamondback Energy in a research report on Wednesday, August 20th. They set a "buy" rating and a $213.00 price objective for the company. Raymond James Financial reduced their price objective on Diamondback Energy from $221.00 to $212.00 and set a "strong-buy" rating for the company in a research report on Wednesday, August 20th. Evercore ISI raised their price objective on Diamondback Energy from $165.00 to $175.00 and gave the company an "outperform" rating in a research report on Monday, October 6th. Finally, Mizuho reduced their price objective on Diamondback Energy from $183.00 to $176.00 and set an "outperform" rating for the company in a research report on Monday, September 15th. Two research analysts have rated the stock with a Strong Buy rating, twenty have issued a Buy rating and one has given a Hold rating to the stock. According to MarketBeat.com, Diamondback Energy currently has an average rating of "Buy" and an average price target of $189.91.

Read Our Latest Report on FANG

Insider Activity at Diamondback Energy

In other news, Chairman Travis D. Stice sold 20,400 shares of the firm's stock in a transaction on Thursday, August 7th. The stock was sold at an average price of $142.80, for a total value of $2,913,120.00. Following the transaction, the chairman directly owned 102,145 shares in the company, valued at $14,586,306. This trade represents a 16.65% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this link. Insiders own 0.48% of the company's stock.

Diamondback Energy Stock Down 0.3%

Diamondback Energy stock opened at $139.09 on Monday. The firm has a market cap of $40.27 billion, a price-to-earnings ratio of 9.89 and a beta of 1.04. The stock has a fifty day simple moving average of $142.18 and a two-hundred day simple moving average of $140.36. Diamondback Energy, Inc. has a 12 month low of $114.00 and a 12 month high of $186.74. The company has a current ratio of 0.55, a quick ratio of 0.52 and a debt-to-equity ratio of 0.35.

Diamondback Energy (NASDAQ:FANG - Get Free Report) last posted its earnings results on Monday, August 4th. The oil and natural gas company reported $2.67 EPS for the quarter, missing analysts' consensus estimates of $2.72 by ($0.05). The business had revenue of $3.68 billion during the quarter, compared to the consensus estimate of $3.35 billion. Diamondback Energy had a return on equity of 9.48% and a net margin of 27.25%.The firm's revenue for the quarter was up 48.1% on a year-over-year basis. During the same period in the previous year, the business posted $4.52 EPS. Equities analysts predict that Diamondback Energy, Inc. will post 15.49 EPS for the current fiscal year.

Diamondback Energy Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, August 21st. Shareholders of record on Thursday, August 14th were issued a $1.00 dividend. The ex-dividend date of this dividend was Thursday, August 14th. This represents a $4.00 dividend on an annualized basis and a dividend yield of 2.9%. Diamondback Energy's dividend payout ratio (DPR) is presently 28.43%.

Diamondback Energy Profile

(

Free Report)

Diamondback Energy, Inc, an independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas. It focuses on the development of the Spraberry and Wolfcamp formations of the Midland basin; and the Wolfcamp and Bone Spring formations of the Delaware basin, which are part of the Permian Basin in West Texas and New Mexico.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Diamondback Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diamondback Energy wasn't on the list.

While Diamondback Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.