Fox Run Management L.L.C. lifted its stake in Super Group (SGHC) Limited (NYSE:SGHC - Free Report) by 401.0% in the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 60,436 shares of the company's stock after purchasing an additional 48,372 shares during the quarter. Fox Run Management L.L.C.'s holdings in Super Group (SGHC) were worth $389,000 at the end of the most recent reporting period.

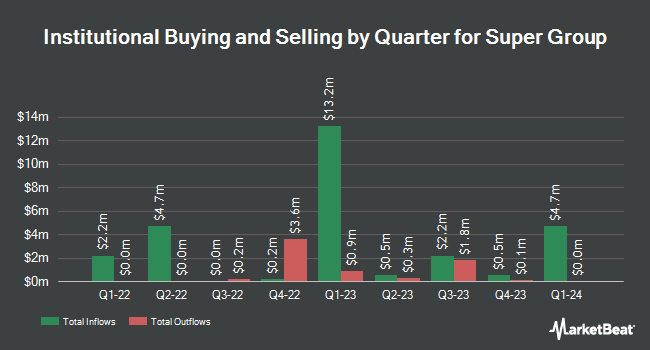

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. GAMMA Investing LLC increased its holdings in shares of Super Group (SGHC) by 4,606.6% in the first quarter. GAMMA Investing LLC now owns 4,283 shares of the company's stock valued at $28,000 after purchasing an additional 4,192 shares during the last quarter. Pacer Advisors Inc. increased its stake in Super Group (SGHC) by 56.6% during the first quarter. Pacer Advisors Inc. now owns 4,600 shares of the company's stock worth $30,000 after acquiring an additional 1,662 shares during the last quarter. Aquatic Capital Management LLC acquired a new stake in Super Group (SGHC) during the fourth quarter worth $30,000. Signaturefd LLC increased its stake in Super Group (SGHC) by 95.9% during the first quarter. Signaturefd LLC now owns 5,439 shares of the company's stock worth $35,000 after acquiring an additional 2,662 shares during the last quarter. Finally, Harvest Fund Management Co. Ltd acquired a new stake in Super Group (SGHC) during the first quarter worth $37,000. Institutional investors and hedge funds own 5.09% of the company's stock.

Analyst Ratings Changes

Several equities research analysts have issued reports on SGHC shares. Benchmark raised their target price on Super Group (SGHC) from $14.00 to $15.00 and gave the stock a "buy" rating in a research note on Thursday, August 7th. JMP Securities started coverage on Super Group (SGHC) in a research note on Monday, July 14th. They set a "market outperform" rating and a $15.00 target price for the company. Canaccord Genuity Group raised their target price on Super Group (SGHC) from $15.00 to $17.00 and gave the stock a "buy" rating in a research note on Thursday, August 7th. Craig Hallum set a $12.00 target price on Super Group (SGHC) in a research note on Monday, May 19th. Finally, Citizens Jmp started coverage on Super Group (SGHC) in a research note on Monday, July 14th. They set a "strong-buy" rating and a $15.00 target price for the company. Two equities research analysts have rated the stock with a Strong Buy rating and seven have assigned a Buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Buy" and an average target price of $13.88.

Get Our Latest Research Report on SGHC

Super Group (SGHC) Stock Performance

Shares of SGHC traded up $0.4950 during midday trading on Friday, hitting $12.1350. 3,581,143 shares of the stock were exchanged, compared to its average volume of 1,733,968. Super Group has a 52-week low of $3.26 and a 52-week high of $12.25. The stock has a fifty day simple moving average of $11.00 and a 200 day simple moving average of $8.92. The firm has a market cap of $6.11 billion, a P/E ratio of 44.94 and a beta of 1.08.

Super Group (SGHC) Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Monday, June 30th. Stockholders of record on Monday, June 23rd were given a dividend of $0.04 per share. This represents a $0.16 annualized dividend and a dividend yield of 1.3%. The ex-dividend date was Monday, June 23rd. Super Group (SGHC)'s dividend payout ratio (DPR) is currently 59.26%.

Super Group (SGHC) Company Profile

(

Free Report)

Super Group (SGHC) Limited operates as an online sports betting and gaming operator. It offers Betway, an online sports betting brand; and Spin, a multi-brand online casino offering. Super Group (SGHC) Limited is based in Saint Peter Port, Guernsey.

Featured Articles

Before you consider Super Group (SGHC), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Group (SGHC) wasn't on the list.

While Super Group (SGHC) currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.