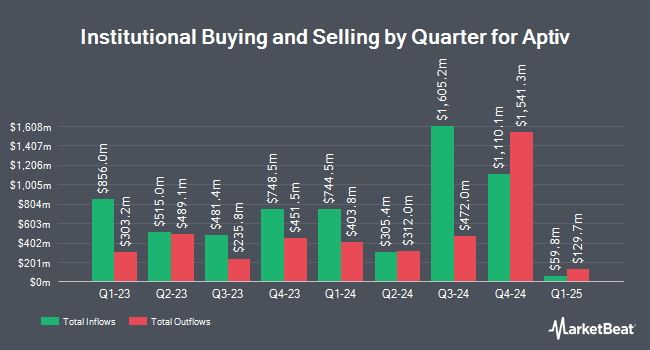

Fox Run Management L.L.C. acquired a new position in Aptiv PLC (NYSE:APTV - Free Report) during the first quarter, according to its most recent filing with the SEC. The firm acquired 17,607 shares of the auto parts company's stock, valued at approximately $1,048,000.

Other large investors have also recently made changes to their positions in the company. Stephens Inc. AR boosted its position in shares of Aptiv by 5.4% during the first quarter. Stephens Inc. AR now owns 3,941 shares of the auto parts company's stock valued at $234,000 after purchasing an additional 201 shares in the last quarter. Tokio Marine Asset Management Co. Ltd. boosted its holdings in Aptiv by 2.9% in the first quarter. Tokio Marine Asset Management Co. Ltd. now owns 8,443 shares of the auto parts company's stock worth $502,000 after acquiring an additional 235 shares in the last quarter. OLD Second National Bank of Aurora boosted its holdings in Aptiv by 1.0% in the first quarter. OLD Second National Bank of Aurora now owns 24,547 shares of the auto parts company's stock worth $1,461,000 after acquiring an additional 239 shares in the last quarter. ProShare Advisors LLC raised its stake in shares of Aptiv by 0.5% in the fourth quarter. ProShare Advisors LLC now owns 51,722 shares of the auto parts company's stock worth $3,128,000 after purchasing an additional 248 shares during the last quarter. Finally, Rafferty Asset Management LLC raised its stake in shares of Aptiv by 1.3% in the fourth quarter. Rafferty Asset Management LLC now owns 25,669 shares of the auto parts company's stock worth $1,552,000 after purchasing an additional 341 shares during the last quarter. 94.21% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

APTV has been the subject of several recent analyst reports. Robert W. Baird set a $82.00 price target on Aptiv and gave the stock an "outperform" rating in a research note on Friday, July 11th. Oppenheimer reissued an "outperform" rating and set a $88.00 price target (up previously from $84.00) on shares of Aptiv in a report on Monday, August 4th. Piper Sandler set a $70.00 price target on Aptiv and gave the company a "neutral" rating in a report on Thursday, May 22nd. Barclays boosted their price target on Aptiv from $65.00 to $85.00 and gave the company an "equal weight" rating in a report on Wednesday, July 16th. Finally, Royal Bank Of Canada upped their price objective on Aptiv from $85.00 to $92.00 and gave the stock an "outperform" rating in a research note on Tuesday, August 5th. Three analysts have rated the stock with a Strong Buy rating, ten have given a Buy rating, seven have issued a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $81.81.

Read Our Latest Analysis on APTV

Aptiv Stock Up 0.4%

Shares of Aptiv stock traded up $0.3120 during trading hours on Tuesday, reaching $76.0220. 887,167 shares of the company were exchanged, compared to its average volume of 3,020,524. Aptiv PLC has a 1 year low of $47.19 and a 1 year high of $77.09. The stock's fifty day moving average is $69.41 and its 200 day moving average is $64.40. The company has a debt-to-equity ratio of 0.79, a quick ratio of 1.24 and a current ratio of 1.76. The firm has a market cap of $16.55 billion, a PE ratio of 17.40, a PEG ratio of 0.83 and a beta of 1.48.

Aptiv (NYSE:APTV - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The auto parts company reported $2.12 earnings per share for the quarter, topping analysts' consensus estimates of $1.83 by $0.29. The business had revenue of $5.21 billion for the quarter, compared to analyst estimates of $5.02 billion. Aptiv had a return on equity of 18.46% and a net margin of 5.12%.The company's revenue was up 3.1% on a year-over-year basis. During the same quarter in the prior year, the company earned $1.58 earnings per share. Aptiv has set its FY 2025 guidance at 7.300-7.600 EPS. Q3 2025 guidance at 1.600-1.800 EPS. As a group, equities research analysts forecast that Aptiv PLC will post 7.2 earnings per share for the current year.

Aptiv Profile

(

Free Report)

Aptiv PLC engages in design, manufacture, and sale of vehicle components in North America, Europe, Middle East, Africa, the Asia Pacific, South America, and internationally. The company provides electrical, electronic, and safety technology solutions to the automotive and commercial vehicle markets. It operates through two segments, Signal and Power Solutions, and Advanced Safety and User Experience.

Recommended Stories

Before you consider Aptiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aptiv wasn't on the list.

While Aptiv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.