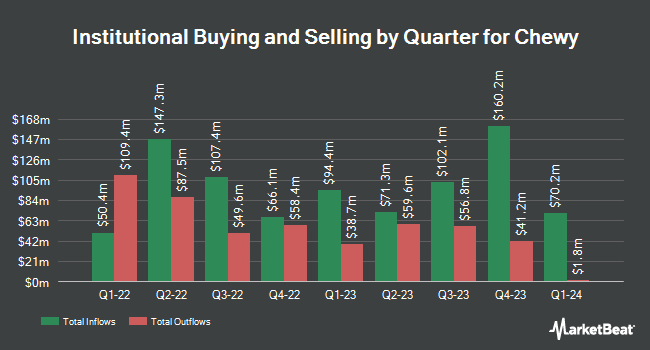

Fox Run Management L.L.C. purchased a new stake in shares of Chewy (NYSE:CHWY - Free Report) during the first quarter, according to its most recent filing with the Securities & Exchange Commission. The firm purchased 26,416 shares of the company's stock, valued at approximately $859,000.

A number of other institutional investors and hedge funds have also bought and sold shares of CHWY. Cerity Partners LLC grew its position in Chewy by 12.4% during the fourth quarter. Cerity Partners LLC now owns 17,230 shares of the company's stock valued at $550,000 after acquiring an additional 1,906 shares during the last quarter. Legal & General Group Plc boosted its stake in shares of Chewy by 49.5% during the fourth quarter. Legal & General Group Plc now owns 231,978 shares of the company's stock valued at $7,769,000 after purchasing an additional 76,836 shares during the period. Rockefeller Capital Management L.P. purchased a new stake in shares of Chewy during the fourth quarter valued at approximately $431,000. Townsquare Capital LLC boosted its stake in shares of Chewy by 17.2% during the fourth quarter. Townsquare Capital LLC now owns 9,451 shares of the company's stock valued at $317,000 after purchasing an additional 1,386 shares during the period. Finally, Summit Investment Advisors Inc. purchased a new stake in shares of Chewy during the fourth quarter valued at approximately $1,106,000. 93.09% of the stock is currently owned by institutional investors.

Chewy Price Performance

NYSE:CHWY traded down $0.4540 during trading hours on Wednesday, hitting $40.4960. The company had a trading volume of 2,837,375 shares, compared to its average volume of 6,339,207. The company has a market capitalization of $16.81 billion, a PE ratio of 45.51, a price-to-earnings-growth ratio of 8.55 and a beta of 1.67. The stock has a 50-day moving average price of $39.21 and a 200 day moving average price of $37.97. Chewy has a 52 week low of $25.19 and a 52 week high of $48.62.

Chewy (NYSE:CHWY - Get Free Report) last released its quarterly earnings results on Wednesday, June 11th. The company reported $0.35 earnings per share for the quarter, beating the consensus estimate of $0.34 by $0.01. The business had revenue of $3.12 billion for the quarter, compared to analysts' expectations of $3.08 billion. Chewy had a net margin of 3.21% and a return on equity of 35.04%. The firm's revenue for the quarter was up 6.3% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.31 earnings per share. Chewy has set its FY 2025 guidance at EPS. Analysts anticipate that Chewy will post 0.24 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of research firms have recently weighed in on CHWY. Barclays increased their price objective on Chewy from $44.00 to $50.00 and gave the company an "overweight" rating in a research note on Wednesday, May 28th. Morgan Stanley reissued an "overweight" rating and set a $50.00 price objective (up previously from $39.00) on shares of Chewy in a research note on Thursday, June 12th. UBS Group reissued a "neutral" rating and set a $44.00 price objective on shares of Chewy in a research note on Tuesday, August 5th. Evercore ISI set a $52.00 price objective on Chewy and gave the company an "outperform" rating in a research note on Thursday, June 12th. Finally, Royal Bank Of Canada reissued an "outperform" rating and set a $44.00 price objective (up previously from $42.00) on shares of Chewy in a research note on Thursday, June 12th. One research analyst has rated the stock with a Strong Buy rating, seventeen have assigned a Buy rating and eight have assigned a Hold rating to the stock. According to data from MarketBeat.com, Chewy has a consensus rating of "Moderate Buy" and a consensus target price of $43.78.

Read Our Latest Analysis on Chewy

Insider Transactions at Chewy

In other Chewy news, CEO Sumit Singh sold 29,557 shares of the firm's stock in a transaction on Monday, August 4th. The stock was sold at an average price of $35.57, for a total transaction of $1,051,342.49. Following the completion of the transaction, the chief executive officer owned 540,406 shares of the company's stock, valued at approximately $19,222,241.42. This trade represents a 5.19% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, CAO William G. Billings sold 20,142 shares of the firm's stock in a transaction on Monday, August 4th. The shares were sold at an average price of $35.57, for a total value of $716,450.94. Following the transaction, the chief accounting officer directly owned 29,464 shares of the company's stock, valued at $1,048,034.48. This represents a 40.60% decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 30,008,777 shares of company stock worth $1,252,444,321. Corporate insiders own 0.43% of the company's stock.

About Chewy

(

Free Report)

Chewy, Inc, together with its subsidiaries, engages in the pure play e-commerce business in the United States. It provides pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services for dogs, cats, fish, birds, small pets, horses, and reptiles through its retail websites and mobile applications.

Read More

Before you consider Chewy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chewy wasn't on the list.

While Chewy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.