Ramirez Asset Management Inc. trimmed its position in Freeport-McMoRan Inc. (NYSE:FCX - Free Report) by 96.7% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 2,214 shares of the natural resource company's stock after selling 65,152 shares during the period. Ramirez Asset Management Inc.'s holdings in Freeport-McMoRan were worth $84,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

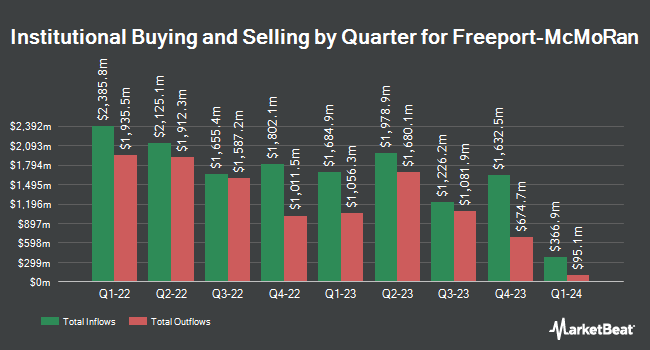

Several other hedge funds have also recently made changes to their positions in FCX. Coppell Advisory Solutions LLC boosted its stake in shares of Freeport-McMoRan by 47.4% during the fourth quarter. Coppell Advisory Solutions LLC now owns 833 shares of the natural resource company's stock worth $32,000 after buying an additional 268 shares during the period. Kestra Private Wealth Services LLC boosted its stake in shares of Freeport-McMoRan by 0.4% during the first quarter. Kestra Private Wealth Services LLC now owns 62,015 shares of the natural resource company's stock worth $2,348,000 after buying an additional 275 shares during the period. Princeton Capital Management LLC boosted its stake in shares of Freeport-McMoRan by 1.1% during the first quarter. Princeton Capital Management LLC now owns 25,980 shares of the natural resource company's stock worth $984,000 after buying an additional 275 shares during the period. Capital Investment Advisory Services LLC boosted its stake in shares of Freeport-McMoRan by 3.2% during the first quarter. Capital Investment Advisory Services LLC now owns 9,102 shares of the natural resource company's stock worth $345,000 after buying an additional 278 shares during the period. Finally, Sargent Investment Group LLC boosted its stake in shares of Freeport-McMoRan by 2.8% during the first quarter. Sargent Investment Group LLC now owns 10,421 shares of the natural resource company's stock worth $395,000 after buying an additional 285 shares during the period. 80.77% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at Freeport-McMoRan

In related news, CAO Ellie L. Mikes sold 8,584 shares of the firm's stock in a transaction that occurred on Monday, June 2nd. The shares were sold at an average price of $40.02, for a total transaction of $343,531.68. Following the sale, the chief accounting officer owned 48,333 shares in the company, valued at approximately $1,934,286.66. This trade represents a 15.08% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Company insiders own 0.75% of the company's stock.

Analyst Ratings Changes

Several equities research analysts have recently weighed in on the stock. Royal Bank Of Canada increased their target price on shares of Freeport-McMoRan from $52.00 to $54.00 and gave the stock a "sector perform" rating in a research note on Wednesday, June 4th. Hsbc Global Res cut shares of Freeport-McMoRan from a "strong-buy" rating to a "hold" rating in a report on Tuesday, July 22nd. Jefferies Financial Group reissued a "buy" rating and set a $50.00 price target (up from $48.00) on shares of Freeport-McMoRan in a report on Friday, April 25th. BMO Capital Markets cut their price target on shares of Freeport-McMoRan from $55.00 to $54.00 and set an "outperform" rating for the company in a report on Thursday, July 24th. Finally, UBS Group cut shares of Freeport-McMoRan from a "buy" rating to a "neutral" rating and increased their price target for the stock from $45.00 to $50.00 in a report on Friday, July 11th. Eight research analysts have rated the stock with a hold rating, nine have issued a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $51.00.

Get Our Latest Stock Analysis on FCX

Freeport-McMoRan Price Performance

Shares of FCX traded up $1.13 during mid-day trading on Thursday, reaching $40.27. 26,253,306 shares of the company's stock were exchanged, compared to its average volume of 19,345,884. The company has a quick ratio of 1.21, a current ratio of 2.47 and a debt-to-equity ratio of 0.30. The company has a 50-day simple moving average of $42.70 and a two-hundred day simple moving average of $39.05. Freeport-McMoRan Inc. has a 52-week low of $27.66 and a 52-week high of $52.61. The company has a market cap of $57.87 billion, a price-to-earnings ratio of 30.51, a PEG ratio of 0.71 and a beta of 1.64.

Freeport-McMoRan (NYSE:FCX - Get Free Report) last issued its quarterly earnings data on Wednesday, July 23rd. The natural resource company reported $0.54 earnings per share for the quarter, topping analysts' consensus estimates of $0.45 by $0.09. Freeport-McMoRan had a net margin of 7.45% and a return on equity of 7.37%. The business had revenue of $7.58 billion during the quarter, compared to analysts' expectations of $6.85 billion. During the same period last year, the company posted $0.46 EPS. The company's revenue was up 14.5% on a year-over-year basis. On average, sell-side analysts predict that Freeport-McMoRan Inc. will post 1.68 EPS for the current fiscal year.

Freeport-McMoRan Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, August 1st. Investors of record on Tuesday, July 15th will be given a dividend of $0.15 per share. This represents a $0.60 dividend on an annualized basis and a yield of 1.5%. Freeport-McMoRan's dividend payout ratio (DPR) is currently 22.73%.

Freeport-McMoRan Profile

(

Free Report)

Freeport-McMoRan Inc engages in the mining of mineral properties in North America, South America, and Indonesia. It primarily explores for copper, gold, molybdenum, silver, and other metals. The company's assets include the Grasberg minerals district in Indonesia; Morenci, Bagdad, Safford, Sierrita, and Miami in Arizona; Chino and Tyrone in New Mexico; and Henderson and Climax in Colorado, North America, as well as Cerro Verde in Peru and El Abra in Chile.

Further Reading

Before you consider Freeport-McMoRan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freeport-McMoRan wasn't on the list.

While Freeport-McMoRan currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.