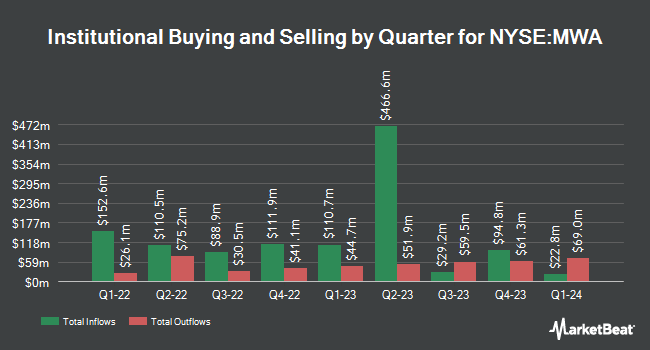

Fuller & Thaler Asset Management Inc. raised its position in shares of Mueller Water Products (NYSE:MWA - Free Report) by 66.2% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 5,401,086 shares of the industrial products company's stock after purchasing an additional 2,152,096 shares during the quarter. Fuller & Thaler Asset Management Inc. owned 3.45% of Mueller Water Products worth $137,296,000 as of its most recent SEC filing.

Other large investors have also made changes to their positions in the company. Wealth Enhancement Advisory Services LLC bought a new stake in shares of Mueller Water Products during the 1st quarter valued at about $502,000. Envestnet Asset Management Inc. grew its stake in shares of Mueller Water Products by 354.3% during the 1st quarter. Envestnet Asset Management Inc. now owns 318,939 shares of the industrial products company's stock valued at $8,107,000 after acquiring an additional 248,733 shares during the period. Handelsbanken Fonder AB grew its stake in shares of Mueller Water Products by 45.6% during the 1st quarter. Handelsbanken Fonder AB now owns 52,336 shares of the industrial products company's stock valued at $1,330,000 after acquiring an additional 16,400 shares during the period. Envestnet Portfolio Solutions Inc. bought a new position in shares of Mueller Water Products during the 1st quarter valued at approximately $287,000. Finally, Cambridge Investment Research Advisors Inc. bought a new position in shares of Mueller Water Products during the 1st quarter valued at approximately $217,000. 91.68% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

Separately, Wall Street Zen upgraded Mueller Water Products from a "hold" rating to a "buy" rating in a research note on Saturday, July 12th. One analyst has rated the stock with a Buy rating and two have given a Hold rating to the stock. According to MarketBeat, the company presently has an average rating of "Hold" and an average target price of $28.33.

Get Our Latest Research Report on Mueller Water Products

Insider Activity

In other news, Director Thomas J. Hansen sold 24,005 shares of the stock in a transaction that occurred on Monday, August 18th. The stock was sold at an average price of $26.15, for a total transaction of $627,730.75. Following the completion of the transaction, the director directly owned 86,163 shares in the company, valued at approximately $2,253,162.45. This represents a 21.79% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CAO Suzanne G. Smith sold 8,621 shares of the stock in a transaction that occurred on Friday, August 15th. The shares were sold at an average price of $26.37, for a total value of $227,335.77. Following the transaction, the chief accounting officer owned 761 shares of the company's stock, valued at $20,067.57. This represents a 91.89% decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 1.10% of the company's stock.

Mueller Water Products Price Performance

MWA stock traded up $1.2120 during midday trading on Friday, hitting $27.1820. The company's stock had a trading volume of 1,039,777 shares, compared to its average volume of 1,792,760. Mueller Water Products has a 12 month low of $19.23 and a 12 month high of $28.58. The company has a quick ratio of 2.56, a current ratio of 3.86 and a debt-to-equity ratio of 0.48. The firm has a market capitalization of $4.25 billion, a price-to-earnings ratio of 28.92, a price-to-earnings-growth ratio of 1.39 and a beta of 1.18. The company has a 50 day moving average of $24.86 and a two-hundred day moving average of $25.30.

Mueller Water Products (NYSE:MWA - Get Free Report) last posted its quarterly earnings results on Monday, August 4th. The industrial products company reported $0.34 earnings per share for the quarter, missing the consensus estimate of $0.35 by ($0.01). The business had revenue of $380.30 million during the quarter, compared to the consensus estimate of $366.82 million. Mueller Water Products had a return on equity of 20.89% and a net margin of 10.67%.The company's revenue for the quarter was up 6.6% compared to the same quarter last year. During the same quarter in the previous year, the company earned $0.32 earnings per share. Mueller Water Products has set its FY 2025 guidance at EPS. On average, analysts expect that Mueller Water Products will post 1.24 EPS for the current year.

Mueller Water Products Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, August 21st. Stockholders of record on Tuesday, August 12th were given a dividend of $0.067 per share. This represents a $0.27 dividend on an annualized basis and a dividend yield of 1.0%. The ex-dividend date was Tuesday, August 12th. Mueller Water Products's dividend payout ratio is currently 28.72%.

Mueller Water Products Company Profile

(

Free Report)

Mueller Water Products, Inc manufactures and markets products and services for the transmission, distribution, and measurement of water used by municipalities, and the residential and non-residential construction industries in the United States, Israel, and internationally. It operates in two segments, Water Flow Solutions and Water Management Solutions.

Featured Articles

Before you consider Mueller Water Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Water Products wasn't on the list.

While Mueller Water Products currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.