GAMMA Investing LLC lifted its position in shares of KKR & Co. Inc. (NYSE:KKR - Free Report) by 29.1% during the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 12,908 shares of the asset manager's stock after purchasing an additional 2,911 shares during the period. GAMMA Investing LLC's holdings in KKR & Co. Inc. were worth $1,717,000 as of its most recent filing with the Securities and Exchange Commission.

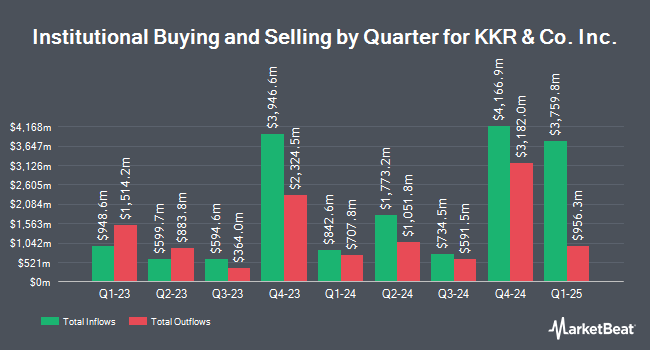

Several other institutional investors have also added to or reduced their stakes in KKR. Brighton Jones LLC boosted its holdings in KKR & Co. Inc. by 109.6% in the fourth quarter. Brighton Jones LLC now owns 4,661 shares of the asset manager's stock valued at $689,000 after acquiring an additional 2,437 shares during the last quarter. Bison Wealth LLC bought a new stake in KKR & Co. Inc. in the fourth quarter valued at approximately $218,000. Two Sigma Investments LP boosted its holdings in KKR & Co. Inc. by 0.8% in the fourth quarter. Two Sigma Investments LP now owns 29,558 shares of the asset manager's stock valued at $4,372,000 after acquiring an additional 234 shares during the last quarter. Toronto Dominion Bank boosted its holdings in KKR & Co. Inc. by 0.6% in the fourth quarter. Toronto Dominion Bank now owns 220,987 shares of the asset manager's stock valued at $32,686,000 after acquiring an additional 1,310 shares during the last quarter. Finally, Ameriflex Group Inc. bought a new stake in KKR & Co. Inc. in the fourth quarter valued at approximately $46,000. 76.26% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

Several brokerages recently commented on KKR. Wells Fargo & Company upped their target price on KKR & Co. Inc. from $140.00 to $156.00 and gave the company an "overweight" rating in a report on Friday, July 11th. Keefe, Bruyette & Woods upped their target price on KKR & Co. Inc. from $155.00 to $162.00 and gave the company an "outperform" rating in a report on Monday, August 4th. Evercore ISI boosted their price target on KKR & Co. Inc. from $130.00 to $150.00 and gave the company an "outperform" rating in a research note on Thursday, July 10th. Oppenheimer boosted their price target on KKR & Co. Inc. from $149.00 to $162.00 and gave the company an "outperform" rating in a research note on Monday, July 14th. Finally, Citigroup boosted their price target on KKR & Co. Inc. from $160.00 to $170.00 and gave the company a "buy" rating in a research note on Friday, August 1st. Twelve research analysts have rated the stock with a Buy rating and four have issued a Hold rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $158.07.

View Our Latest Report on KKR & Co. Inc.

KKR & Co. Inc. Trading Down 1.4%

NYSE KKR opened at $146.81 on Tuesday. The firm has a market capitalization of $130.80 billion, a P/E ratio of 68.28, a PEG ratio of 1.64 and a beta of 1.93. The business has a fifty day simple moving average of $143.27 and a 200 day simple moving average of $127.26. KKR & Co. Inc. has a 12 month low of $86.15 and a 12 month high of $170.40. The company has a current ratio of 0.08, a quick ratio of 0.08 and a debt-to-equity ratio of 0.77.

KKR & Co. Inc. (NYSE:KKR - Get Free Report) last released its quarterly earnings results on Thursday, July 31st. The asset manager reported $1.18 EPS for the quarter, beating analysts' consensus estimates of $1.14 by $0.04. The business had revenue of $1.86 billion during the quarter, compared to analyst estimates of $1.81 billion. KKR & Co. Inc. had a return on equity of 6.30% and a net margin of 12.95%.During the same period in the prior year, the firm posted $1.09 EPS. On average, analysts predict that KKR & Co. Inc. will post 5.19 EPS for the current fiscal year.

KKR & Co. Inc. Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, August 26th. Shareholders of record on Monday, August 11th were paid a $0.185 dividend. This is a boost from KKR & Co. Inc.'s previous quarterly dividend of $0.18. The ex-dividend date was Monday, August 11th. This represents a $0.74 dividend on an annualized basis and a yield of 0.5%. KKR & Co. Inc.'s dividend payout ratio is currently 34.42%.

Insider Activity at KKR & Co. Inc.

In other news, Chairman George R. Roberts sold 809,906 shares of KKR & Co. Inc. stock in a transaction on Thursday, August 7th. The stock was sold at an average price of $144.25, for a total transaction of $116,828,940.50. Following the sale, the chairman directly owned 81,361,978 shares in the company, valued at $11,736,465,326.50. The trade was a 0.99% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. 39.34% of the stock is owned by insiders.

About KKR & Co. Inc.

(

Free Report)

KKR & Co, Inc operates as an investment firm. It offers alternative asset management as well as capital markets and insurance solutions. The firm's business segments include Asset Management and Insurance Business. The Asset Management segment engages in providing private equity, real assets, credit and liquid strategies, capital markets, and principal activities.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider KKR & Co. Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KKR & Co. Inc. wasn't on the list.

While KKR & Co. Inc. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.