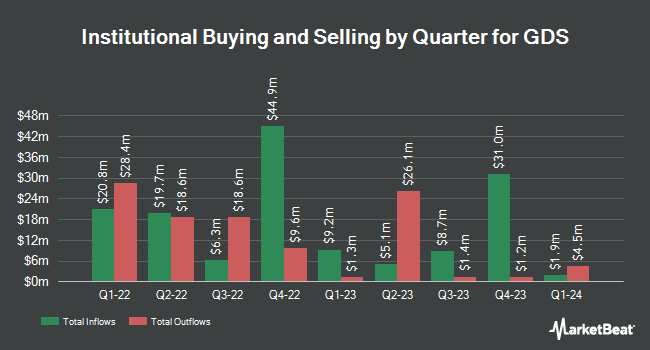

Hsbc Holdings PLC cut its holdings in GDS Holdings (NASDAQ:GDS - Free Report) by 25.4% during the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 181,153 shares of the company's stock after selling 61,795 shares during the quarter. Hsbc Holdings PLC owned approximately 0.10% of GDS worth $4,544,000 at the end of the most recent reporting period.

Other large investors have also bought and sold shares of the company. Brooklyn Investment Group boosted its stake in GDS by 2,390.0% in the first quarter. Brooklyn Investment Group now owns 996 shares of the company's stock valued at $25,000 after buying an additional 956 shares in the last quarter. Summit Securities Group LLC acquired a new stake in shares of GDS in the 1st quarter valued at approximately $26,000. Wells Fargo & Company MN boosted its position in GDS by 1,904.2% in the fourth quarter. Wells Fargo & Company MN now owns 3,788 shares of the company's stock valued at $90,000 after buying an additional 3,599 shares in the last quarter. Caitong International Asset Management Co. Ltd acquired a new stake in GDS in the first quarter valued at approximately $125,000. Finally, Harvest Fund Management Co. Ltd acquired a new stake in GDS in the first quarter valued at approximately $176,000. 33.71% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several research firms recently weighed in on GDS. Zacks Research downgraded GDS from a "strong-buy" rating to a "hold" rating in a report on Tuesday, August 26th. BMO Capital Markets raised GDS to a "market perform" rating in a research note on Wednesday, July 16th. Bank of America lifted their target price on shares of GDS from $47.60 to $50.60 and gave the stock a "buy" rating in a research report on Friday, August 22nd. Daiwa Capital Markets reiterated a "buy" rating on shares of GDS in a research report on Wednesday, May 28th. Finally, JPMorgan Chase & Co. upgraded shares of GDS from a "neutral" rating to an "overweight" rating and lifted their target price for the stock from $34.00 to $46.00 in a research report on Wednesday, July 16th. Two investment analysts have rated the stock with a Strong Buy rating, six have assigned a Buy rating and three have issued a Hold rating to the company's stock. According to MarketBeat.com, GDS presently has a consensus rating of "Moderate Buy" and an average target price of $46.93.

Check Out Our Latest Research Report on GDS

GDS Trading Down 1.5%

GDS stock traded down $0.52 during midday trading on Friday, hitting $34.56. The stock had a trading volume of 3,930,620 shares, compared to its average volume of 2,370,391. The firm has a market cap of $6.59 billion, a P/E ratio of 10.22 and a beta of 0.34. The company has a current ratio of 2.00, a quick ratio of 2.00 and a debt-to-equity ratio of 1.71. GDS Holdings has a 1-year low of $15.91 and a 1-year high of $52.50. The business has a fifty day moving average price of $33.91 and a two-hundred day moving average price of $30.31.

GDS Profile

(

Free Report)

GDS Holdings Limited, together with its subsidiaries, develops and operates data centers in the People's Republic of China. The company provides colocation services comprising critical facilities space, customer-available power, racks, and cooling; managed hosting services, including business continuity and disaster recovery, network management, data storage, system security, operating system, database, and server middleware services; managed cloud services; and consulting services.

Featured Articles

Before you consider GDS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GDS wasn't on the list.

While GDS currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.