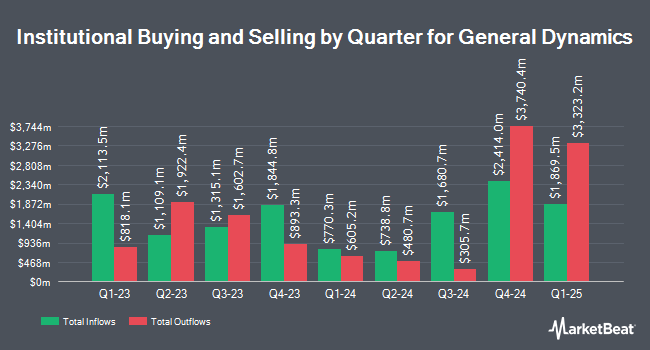

Newport Trust Company LLC cut its holdings in General Dynamics Corporation (NYSE:GD - Free Report) by 1.4% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 14,760,983 shares of the aerospace company's stock after selling 215,457 shares during the period. General Dynamics accounts for 10.3% of Newport Trust Company LLC's investment portfolio, making the stock its 3rd biggest position. Newport Trust Company LLC owned approximately 5.50% of General Dynamics worth $4,023,549,000 as of its most recent SEC filing.

Several other large investors have also recently bought and sold shares of the company. Ameriprise Financial Inc. boosted its holdings in General Dynamics by 34.8% in the 1st quarter. Ameriprise Financial Inc. now owns 2,748,380 shares of the aerospace company's stock valued at $749,252,000 after purchasing an additional 709,782 shares during the period. Norinchukin Bank The raised its position in shares of General Dynamics by 14.2% during the 1st quarter. Norinchukin Bank The now owns 13,373 shares of the aerospace company's stock valued at $3,645,000 after buying an additional 1,659 shares in the last quarter. Integrated Investment Consultants LLC raised its position in shares of General Dynamics by 10.9% during the 1st quarter. Integrated Investment Consultants LLC now owns 845 shares of the aerospace company's stock valued at $230,000 after buying an additional 83 shares in the last quarter. CW Advisors LLC raised its position in shares of General Dynamics by 1.1% during the 1st quarter. CW Advisors LLC now owns 29,194 shares of the aerospace company's stock valued at $7,956,000 after buying an additional 322 shares in the last quarter. Finally, United Asset Strategies Inc. raised its position in shares of General Dynamics by 1.2% during the 1st quarter. United Asset Strategies Inc. now owns 3,140 shares of the aerospace company's stock valued at $856,000 after buying an additional 37 shares in the last quarter. 86.14% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

GD has been the topic of several research reports. Argus set a $295.00 price objective on shares of General Dynamics in a research report on Tuesday, May 6th. Citigroup lifted their target price on shares of General Dynamics from $348.00 to $368.00 and gave the stock a "buy" rating in a research report on Thursday, July 24th. Robert W. Baird lifted their target price on shares of General Dynamics from $283.00 to $350.00 and gave the stock a "neutral" rating in a research report on Thursday, July 24th. Wolfe Research upgraded shares of General Dynamics from a "peer perform" rating to an "outperform" rating and set a $360.00 target price on the stock in a research report on Thursday, July 24th. Finally, JPMorgan Chase & Co. lifted their target price on shares of General Dynamics from $284.00 to $345.00 and gave the stock an "overweight" rating in a research report on Thursday, July 24th. Nine investment analysts have rated the stock with a Buy rating, twelve have assigned a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat, General Dynamics has an average rating of "Hold" and an average target price of $315.78.

Get Our Latest Analysis on General Dynamics

General Dynamics Stock Up 0.6%

General Dynamics stock traded up $1.81 during trading hours on Wednesday, hitting $323.99. The stock had a trading volume of 279,437 shares, compared to its average volume of 1,420,675. The company has a quick ratio of 0.83, a current ratio of 1.36 and a debt-to-equity ratio of 0.32. The stock's 50-day moving average price is $304.19 and its 200-day moving average price is $280.27. General Dynamics Corporation has a 12-month low of $239.20 and a 12-month high of $324.71. The stock has a market capitalization of $87.15 billion, a P/E ratio of 21.75, a price-to-earnings-growth ratio of 1.96 and a beta of 0.48.

General Dynamics (NYSE:GD - Get Free Report) last released its quarterly earnings data on Wednesday, July 23rd. The aerospace company reported $3.74 earnings per share for the quarter, beating the consensus estimate of $3.47 by $0.27. General Dynamics had a net margin of 8.13% and a return on equity of 17.99%. The firm had revenue of $13.04 billion during the quarter, compared to analysts' expectations of $12.13 billion. During the same period in the previous year, the company earned $3.26 earnings per share. The firm's quarterly revenue was up 8.9% on a year-over-year basis. General Dynamics has set its FY 2025 guidance at 15.050-15.150 EPS. Equities research analysts anticipate that General Dynamics Corporation will post 14.83 EPS for the current fiscal year.

General Dynamics Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, November 14th. Shareholders of record on Friday, October 10th will be given a dividend of $1.50 per share. The ex-dividend date is Friday, October 10th. This represents a $6.00 annualized dividend and a yield of 1.9%. General Dynamics's dividend payout ratio (DPR) is 40.27%.

Insiders Place Their Bets

In other news, EVP Marguerite Amy Gilliland sold 33,740 shares of the stock in a transaction on Friday, August 8th. The shares were sold at an average price of $315.20, for a total value of $10,634,848.00. Following the sale, the executive vice president owned 45,192 shares of the company's stock, valued at approximately $14,244,518.40. This represents a 42.75% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Mark Malcolm sold 1,210 shares of the stock in a transaction on Friday, August 22nd. The shares were sold at an average price of $319.04, for a total transaction of $386,038.40. Following the completion of the sale, the director directly owned 10,186 shares in the company, valued at approximately $3,249,741.44. This represents a 10.62% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 450,110 shares of company stock valued at $135,507,928. 1.50% of the stock is currently owned by company insiders.

General Dynamics Company Profile

(

Free Report)

General Dynamics Corporation operates as an aerospace and defense company worldwide. It operates through four segments: Aerospace, Marine Systems, Combat Systems, and Technologies. The Aerospace segment produces and sells business jets; and offers aircraft maintenance and repair, management, aircraft-on-ground support and completion, charter, staffing, and fixed-base operator services.

Featured Stories

Before you consider General Dynamics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Dynamics wasn't on the list.

While General Dynamics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report