Generali Investments Towarzystwo Funduszy Inwestycyjnych cut its stake in shares of Danaher Corporation (NYSE:DHR - Free Report) by 24.3% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 4,000 shares of the conglomerate's stock after selling 1,282 shares during the quarter. Generali Investments Towarzystwo Funduszy Inwestycyjnych's holdings in Danaher were worth $820,000 as of its most recent SEC filing.

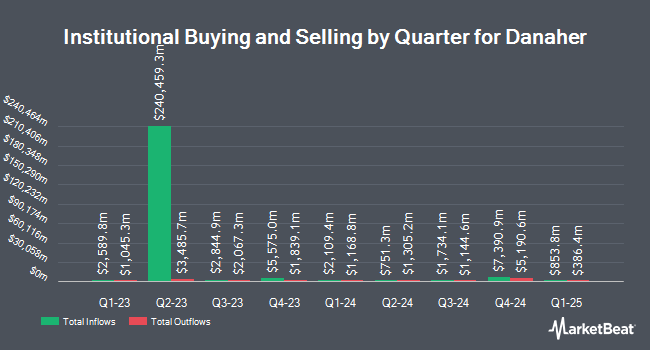

Several other institutional investors also recently made changes to their positions in DHR. GHP Investment Advisors Inc. lifted its position in Danaher by 396.0% in the first quarter. GHP Investment Advisors Inc. now owns 124 shares of the conglomerate's stock worth $25,000 after purchasing an additional 99 shares during the period. Heck Capital Advisors LLC acquired a new stake in Danaher in the fourth quarter worth approximately $27,000. Sierra Ocean LLC lifted its position in Danaher by 116.9% in the first quarter. Sierra Ocean LLC now owns 141 shares of the conglomerate's stock worth $29,000 after purchasing an additional 76 shares during the period. Smallwood Wealth Investment Management LLC acquired a new stake in Danaher in the first quarter worth approximately $31,000. Finally, Hurley Capital LLC acquired a new stake in Danaher in the fourth quarter worth approximately $34,000. 79.05% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Several research firms have recently weighed in on DHR. Citigroup reissued a "buy" rating on shares of Danaher in a research note on Monday, April 7th. Wells Fargo & Company reduced their price objective on Danaher from $210.00 to $205.00 and set an "equal weight" rating for the company in a research note on Wednesday, July 23rd. Leerink Partners raised their price objective on Danaher from $225.00 to $230.00 and gave the stock an "outperform" rating in a research note on Wednesday, April 23rd. Jefferies Financial Group reduced their price objective on Danaher from $260.00 to $230.00 and set a "buy" rating for the company in a research note on Tuesday, April 22nd. Finally, Scotiabank raised Danaher from a "sector perform" rating to a "sector outperform" rating and set a $275.00 price objective for the company in a research note on Friday, July 11th. Three investment analysts have rated the stock with a hold rating and eighteen have issued a buy rating to the company. Based on data from MarketBeat, Danaher currently has a consensus rating of "Moderate Buy" and a consensus target price of $247.61.

View Our Latest Stock Analysis on Danaher

Danaher Stock Performance

DHR stock traded up $2.05 during mid-day trading on Tuesday, reaching $199.51. 756,758 shares of the stock traded hands, compared to its average volume of 4,283,080. The company has a quick ratio of 1.22, a current ratio of 1.62 and a debt-to-equity ratio of 0.32. Danaher Corporation has a 52 week low of $171.00 and a 52 week high of $279.90. The business has a 50-day moving average of $197.75 and a two-hundred day moving average of $201.87. The firm has a market capitalization of $142.86 billion, a PE ratio of 42.43, a P/E/G ratio of 2.74 and a beta of 0.73.

Danaher (NYSE:DHR - Get Free Report) last released its earnings results on Tuesday, July 22nd. The conglomerate reported $1.80 earnings per share for the quarter, beating the consensus estimate of $1.64 by $0.16. Danaher had a net margin of 14.21% and a return on equity of 10.70%. The business had revenue of $5.94 billion during the quarter, compared to analysts' expectations of $5.83 billion. During the same quarter last year, the company earned $1.72 earnings per share. The firm's revenue was up 3.4% on a year-over-year basis. As a group, equities analysts predict that Danaher Corporation will post 7.63 EPS for the current fiscal year.

Insider Buying and Selling at Danaher

In related news, Chairman Steven M. Rales sold 1,250,000 shares of the firm's stock in a transaction that occurred on Monday, May 12th. The shares were sold at an average price of $196.74, for a total value of $245,925,000.00. Following the completion of the sale, the chairman owned 3,105,808 shares of the company's stock, valued at $611,036,665.92. This trade represents a 28.70% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Insiders own 11.20% of the company's stock.

Danaher Profile

(

Free Report)

Danaher Corporation designs, manufactures, and markets professional, medical, industrial, and commercial products and services worldwide. The Biotechnology segments offers bioprocess technologies, consumables, and services that advance, accelerate, and integrate the development and manufacture of therapeutics; cell line and cell culture media development services; cell culture media, process liquids and buffers for manufacturing, chromatography resins, filtration technologies, aseptic fill finish; single-use hardware and consumables and services, such as the design and installation of full manufacturing suites; lab filtration, separation, and purification; lab-scale protein purification and analytical tools; reagents, membranes, and services; and healthcare filtration solutions.

See Also

Before you consider Danaher, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Danaher wasn't on the list.

While Danaher currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.