Donald Smith & CO. Inc. boosted its stake in shares of Genworth Financial, Inc. (NYSE:GNW - Free Report) by 4.5% in the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 27,114,581 shares of the financial services provider's stock after purchasing an additional 1,165,112 shares during the quarter. Genworth Financial comprises 4.7% of Donald Smith & CO. Inc.'s portfolio, making the stock its 3rd largest holding. Donald Smith & CO. Inc. owned approximately 6.54% of Genworth Financial worth $192,242,000 as of its most recent filing with the Securities & Exchange Commission.

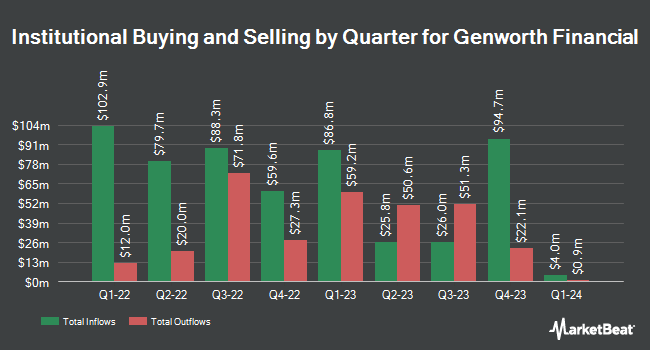

A number of other large investors have also recently added to or reduced their stakes in GNW. Byrne Asset Management LLC boosted its position in shares of Genworth Financial by 69.5% in the first quarter. Byrne Asset Management LLC now owns 7,595 shares of the financial services provider's stock valued at $54,000 after acquiring an additional 3,115 shares during the period. Abel Hall LLC bought a new stake in shares of Genworth Financial in the first quarter valued at approximately $71,000. Blueshift Asset Management LLC bought a new stake in shares of Genworth Financial in the first quarter valued at approximately $71,000. Pennington Partners & CO. LLC bought a new stake in shares of Genworth Financial in the fourth quarter valued at approximately $84,000. Finally, Mercer Global Advisors Inc. ADV bought a new stake in shares of Genworth Financial in the fourth quarter valued at approximately $86,000. Institutional investors own 81.85% of the company's stock.

Genworth Financial Price Performance

Genworth Financial stock traded down $0.04 during mid-day trading on Thursday, hitting $8.55. 2,587,785 shares of the company were exchanged, compared to its average volume of 6,288,629. The company has a quick ratio of 0.29, a current ratio of 0.29 and a debt-to-equity ratio of 0.16. The business has a fifty day moving average of $7.64 and a 200 day moving average of $7.16. Genworth Financial, Inc. has a 1-year low of $5.99 and a 1-year high of $8.60. The company has a market capitalization of $3.51 billion, a PE ratio of 18.99 and a beta of 1.12.

Genworth Financial (NYSE:GNW - Get Free Report) last released its quarterly earnings data on Wednesday, July 30th. The financial services provider reported $0.16 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.05 by $0.11. Genworth Financial had a return on equity of 1.91% and a net margin of 2.61%. The firm had revenue of $1.80 billion during the quarter.

Analyst Ratings Changes

Several equities research analysts have recently weighed in on the company. Wall Street Zen cut Genworth Financial from a "hold" rating to a "sell" rating in a research report on Thursday, May 22nd. Keefe, Bruyette & Woods raised their target price on Genworth Financial from $9.00 to $9.50 and gave the stock an "outperform" rating in a research report on Wednesday, July 9th.

Get Our Latest Stock Analysis on Genworth Financial

About Genworth Financial

(

Free Report)

Genworth Financial, Inc, together with its subsidiaries, provides mortgage and long-term care insurance products in the United States and internationally. It operates in three segments: Enact, Long-Term Care Insurance, and Life and Annuities. The Enact segment offers private mortgage insurance products primarily insuring prime-based, individually underwritten residential mortgage loans; and pool mortgage insurance products.

Further Reading

Before you consider Genworth Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genworth Financial wasn't on the list.

While Genworth Financial currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.