HB Wealth Management LLC increased its stake in shares of Gilead Sciences, Inc. (NASDAQ:GILD - Free Report) by 28.6% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 33,958 shares of the biopharmaceutical company's stock after buying an additional 7,547 shares during the quarter. HB Wealth Management LLC's holdings in Gilead Sciences were worth $3,805,000 at the end of the most recent quarter.

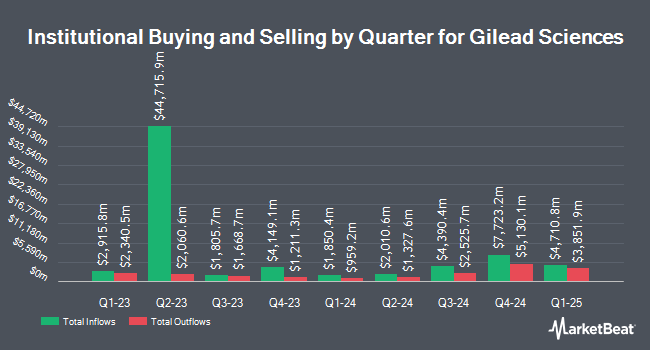

Several other institutional investors have also bought and sold shares of the stock. Redwood Financial Network Corp grew its holdings in Gilead Sciences by 4.0% during the fourth quarter. Redwood Financial Network Corp now owns 2,530 shares of the biopharmaceutical company's stock worth $234,000 after buying an additional 98 shares in the last quarter. Argentarii LLC grew its stake in Gilead Sciences by 3.0% in the 1st quarter. Argentarii LLC now owns 3,392 shares of the biopharmaceutical company's stock valued at $380,000 after purchasing an additional 99 shares during the period. Nicolet Advisory Services LLC grew its stake in Gilead Sciences by 2.9% in the 4th quarter. Nicolet Advisory Services LLC now owns 3,580 shares of the biopharmaceutical company's stock valued at $322,000 after purchasing an additional 100 shares during the period. Peak Financial Advisors LLC grew its stake in Gilead Sciences by 1.7% in the 1st quarter. Peak Financial Advisors LLC now owns 6,040 shares of the biopharmaceutical company's stock valued at $677,000 after purchasing an additional 100 shares during the period. Finally, Perkins Coie Trust Co grew its stake in Gilead Sciences by 2.6% in the 1st quarter. Perkins Coie Trust Co now owns 3,880 shares of the biopharmaceutical company's stock valued at $435,000 after purchasing an additional 100 shares during the period. Institutional investors own 83.67% of the company's stock.

Insider Buying and Selling

In related news, Director Jeffrey Bluestone sold 5,000 shares of the stock in a transaction dated Monday, July 14th. The stock was sold at an average price of $109.74, for a total transaction of $548,700.00. Following the sale, the director owned 8,920 shares of the company's stock, valued at approximately $978,880.80. This represents a 35.92% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Johanna Mercier sold 3,000 shares of the firm's stock in a transaction dated Tuesday, July 15th. The shares were sold at an average price of $111.03, for a total value of $333,090.00. Following the completion of the sale, the insider directly owned 117,168 shares in the company, valued at approximately $13,009,163.04. The trade was a 2.50% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 82,000 shares of company stock worth $8,984,175. Company insiders own 0.27% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have issued reports on the company. Needham & Company LLC upgraded Gilead Sciences from a "hold" rating to a "buy" rating and set a $133.00 price objective for the company in a research note on Friday, July 25th. Cantor Fitzgerald assumed coverage on Gilead Sciences in a research note on Tuesday, April 22nd. They issued an "overweight" rating and a $125.00 price objective for the company. Morgan Stanley upped their price objective on Gilead Sciences from $130.00 to $135.00 and gave the company an "overweight" rating in a research note on Friday, April 25th. Finally, Oppenheimer reduced their price objective on Gilead Sciences from $132.00 to $125.00 and set an "outperform" rating for the company in a research note on Friday, April 25th. Eight investment analysts have rated the stock with a hold rating, fifteen have given a buy rating and three have issued a strong buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $112.36.

Read Our Latest Stock Report on Gilead Sciences

Gilead Sciences Price Performance

GILD traded up $0.68 during trading on Thursday, reaching $115.44. 1,841,840 shares of the company were exchanged, compared to its average volume of 8,409,563. The company's 50-day moving average is $110.29 and its two-hundred day moving average is $106.39. The company has a market cap of $143.60 billion, a price-to-earnings ratio of 24.27, a P/E/G ratio of 0.72 and a beta of 0.29. The company has a quick ratio of 1.23, a current ratio of 1.37 and a debt-to-equity ratio of 1.16. Gilead Sciences, Inc. has a 12-month low of $72.43 and a 12-month high of $119.96.

Gilead Sciences Company Profile

(

Free Report)

Gilead Sciences, Inc, a biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally. The company provides Biktarvy, Genvoya, Descovy, Odefsey, Truvada, Complera/ Eviplera, Stribild, Sunlencs, and Atripla products for the treatment of HIV/AIDS; Veklury, an injection for intravenous use, for the treatment of COVID-19; and Epclusa, Harvoni, Vemlidy, and Viread for the treatment of viral hepatitis.

Further Reading

Before you consider Gilead Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gilead Sciences wasn't on the list.

While Gilead Sciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.