Envestnet Asset Management Inc. cut its stake in Glaukos Corporation (NYSE:GKOS - Free Report) by 27.8% in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 28,038 shares of the medical instruments supplier's stock after selling 10,817 shares during the quarter. Envestnet Asset Management Inc.'s holdings in Glaukos were worth $2,760,000 as of its most recent SEC filing.

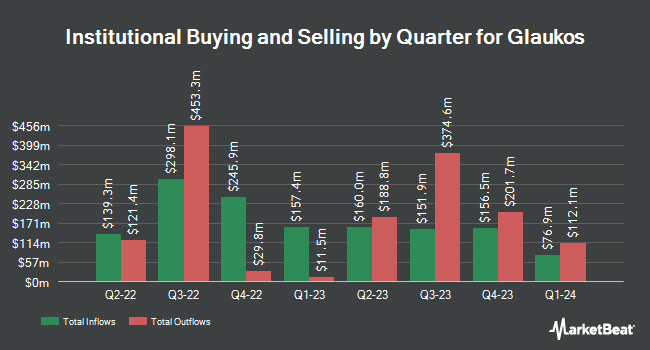

A number of other hedge funds and other institutional investors have also modified their holdings of GKOS. State of Wyoming grew its holdings in shares of Glaukos by 2.3% during the 4th quarter. State of Wyoming now owns 3,245 shares of the medical instruments supplier's stock worth $487,000 after purchasing an additional 72 shares during the period. Quadrant Capital Group LLC grew its holdings in shares of Glaukos by 3.3% during the 4th quarter. Quadrant Capital Group LLC now owns 2,300 shares of the medical instruments supplier's stock worth $345,000 after purchasing an additional 73 shares during the period. HighTower Advisors LLC grew its holdings in shares of Glaukos by 2.8% during the 4th quarter. HighTower Advisors LLC now owns 3,298 shares of the medical instruments supplier's stock worth $495,000 after purchasing an additional 91 shares during the period. Stifel Financial Corp grew its holdings in shares of Glaukos by 2.6% during the 4th quarter. Stifel Financial Corp now owns 4,341 shares of the medical instruments supplier's stock worth $651,000 after purchasing an additional 111 shares during the period. Finally, Lido Advisors LLC boosted its holdings in Glaukos by 0.8% during the 4th quarter. Lido Advisors LLC now owns 16,542 shares of the medical instruments supplier's stock valued at $2,480,000 after acquiring an additional 131 shares during the period. 99.04% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on the company. UBS Group raised their target price on Glaukos from $125.00 to $134.00 and gave the company a "buy" rating in a report on Thursday. Mizuho set a $130.00 target price on Glaukos in a report on Thursday. Stifel Nicolaus lowered their target price on Glaukos from $140.00 to $115.00 and set a "buy" rating for the company in a report on Thursday, May 1st. Truist Financial reaffirmed a "buy" rating and issued a $135.00 price target (down previously from $140.00) on shares of Glaukos in a research report on Thursday, May 1st. Finally, Piper Sandler reduced their price target on Glaukos from $180.00 to $165.00 and set an "overweight" rating on the stock in a research report on Tuesday, April 15th. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating and ten have issued a buy rating to the company. According to data from MarketBeat.com, Glaukos presently has an average rating of "Moderate Buy" and a consensus price target of $126.92.

Get Our Latest Stock Report on Glaukos

Glaukos Stock Performance

GKOS traded down $9.70 during trading on Thursday, hitting $84.35. 1,222,033 shares of the stock were exchanged, compared to its average volume of 928,996. The firm has a market capitalization of $4.82 billion, a P/E ratio of -35.53 and a beta of 0.82. Glaukos Corporation has a 1-year low of $77.10 and a 1-year high of $163.71. The stock has a fifty day moving average price of $98.44 and a two-hundred day moving average price of $109.49. The company has a quick ratio of 5.62, a current ratio of 6.49 and a debt-to-equity ratio of 0.09.

Glaukos (NYSE:GKOS - Get Free Report) last released its quarterly earnings results on Wednesday, July 30th. The medical instruments supplier reported ($0.24) EPS for the quarter, topping the consensus estimate of ($0.26) by $0.02. Glaukos had a negative return on equity of 10.66% and a negative net margin of 31.40%. The company had revenue of $124.12 million for the quarter, compared to analyst estimates of $115.49 million. During the same quarter in the previous year, the company posted ($0.52) earnings per share. The firm's revenue was up 29.7% compared to the same quarter last year. As a group, sell-side analysts predict that Glaukos Corporation will post -1.08 earnings per share for the current year.

Glaukos Profile

(

Free Report)

Glaukos Corporation, an ophthalmic pharmaceutical and medical technology company, focuses on the development of novel therapies for the treatment of glaucoma, corneal disorders, and retinal diseases. It offers iStent and iStent inject W micro-bypass stents that enhance aqueous humor outflow inserted in cataract surgery to treat mild-to-moderate open-angle glaucoma.

Read More

Before you consider Glaukos, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Glaukos wasn't on the list.

While Glaukos currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.