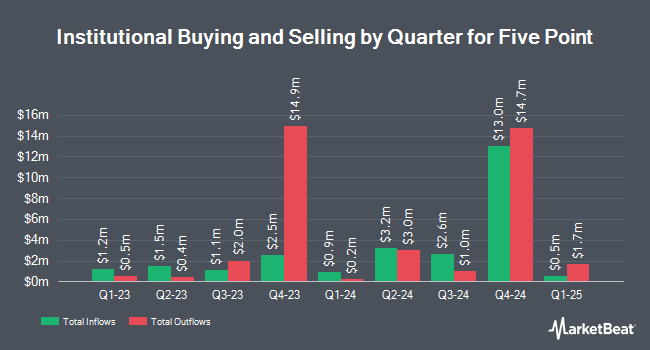

Glendon Capital Management LP lessened its holdings in shares of Five Point Holdings, LLC (NYSE:FPH - Free Report) by 2.9% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 1,658,375 shares of the company's stock after selling 50,000 shares during the period. Five Point accounts for approximately 0.5% of Glendon Capital Management LP's holdings, making the stock its 14th biggest position. Glendon Capital Management LP owned 1.12% of Five Point worth $8,856,000 as of its most recent SEC filing.

A number of other institutional investors also recently made changes to their positions in the stock. Lazard Asset Management LLC acquired a new position in Five Point in the 4th quarter valued at approximately $45,000. Virtu Financial LLC acquired a new stake in Five Point in the 1st quarter valued at about $65,000. Kapitalo Investimentos Ltda bought a new position in shares of Five Point in the 1st quarter valued at about $79,000. Envestnet Asset Management Inc. boosted its stake in Five Point by 21.3% during the 4th quarter. Envestnet Asset Management Inc. now owns 17,364 shares of the company's stock worth $66,000 after acquiring an additional 3,052 shares during the last quarter. Finally, Jump Financial LLC bought a new position in Five Point in the fourth quarter valued at approximately $70,000. 38.09% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Separately, Wall Street Zen cut shares of Five Point from a "strong-buy" rating to a "hold" rating in a report on Saturday, July 26th. One analyst has rated the stock with a Buy rating, According to MarketBeat, the stock presently has a consensus rating of "Buy".

View Our Latest Stock Report on FPH

Five Point Stock Up 0.6%

Shares of NYSE FPH traded up $0.04 during trading on Wednesday, reaching $5.62. The company had a trading volume of 34,769 shares, compared to its average volume of 257,784. Five Point Holdings, LLC has a 12-month low of $3.10 and a 12-month high of $6.71. The stock has a market cap of $837.20 million, a PE ratio of 5.15 and a beta of 1.53. The business's 50-day moving average is $5.68 and its 200 day moving average is $5.50.

Five Point (NYSE:FPH - Get Free Report) last issued its earnings results on Thursday, July 24th. The company reported $0.05 earnings per share (EPS) for the quarter. Five Point had a return on equity of 3.61% and a net margin of 39.43%.The company had revenue of $7.47 million for the quarter.

Five Point Company Profile

(

Free Report)

Five Point Holdings, LLC, through its subsidiary, Five Point Operating Company, LP, owns and develops mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County. The company operates in four segments: Valencia, San Francisco, Great Park, and Commercial. It sells residential and commercial land sites to homebuilders, commercial developers, and commercial buyers; operates and owns a commercial office, research and development, medical campus, and other properties; and provides development and property management services.

See Also

Before you consider Five Point, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five Point wasn't on the list.

While Five Point currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.