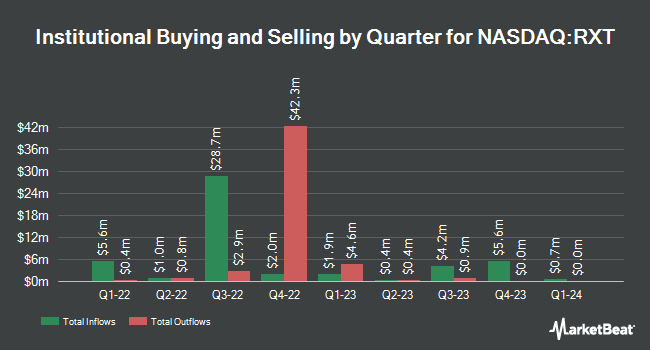

Goldman Sachs Group Inc. cut its holdings in Rackspace Technology, Inc. (NASDAQ:RXT - Free Report) by 28.0% during the 1st quarter, according to the company in its most recent disclosure with the SEC. The firm owned 448,771 shares of the company's stock after selling 174,473 shares during the quarter. Goldman Sachs Group Inc. owned 0.19% of Rackspace Technology worth $758,000 as of its most recent SEC filing.

Other large investors also recently modified their holdings of the company. BNP Paribas Financial Markets bought a new stake in shares of Rackspace Technology in the 4th quarter valued at $319,000. Jacobs Levy Equity Management Inc. boosted its stake in Rackspace Technology by 42.4% during the first quarter. Jacobs Levy Equity Management Inc. now owns 1,255,023 shares of the company's stock worth $2,121,000 after acquiring an additional 373,875 shares in the last quarter. Millennium Management LLC grew its holdings in Rackspace Technology by 38.0% in the fourth quarter. Millennium Management LLC now owns 490,994 shares of the company's stock worth $1,085,000 after purchasing an additional 135,140 shares during the period. Two Sigma Investments LP increased its stake in Rackspace Technology by 1,692.6% in the fourth quarter. Two Sigma Investments LP now owns 406,621 shares of the company's stock valued at $899,000 after purchasing an additional 383,938 shares in the last quarter. Finally, Nuveen LLC acquired a new position in shares of Rackspace Technology during the first quarter valued at about $257,000. Institutional investors and hedge funds own 82.48% of the company's stock.

Rackspace Technology Trading Up 1.4%

RXT stock opened at $1.46 on Wednesday. The stock has a market cap of $349.47 million, a P/E ratio of -0.90 and a beta of 2.06. The stock's fifty day simple moving average is $1.32 and its two-hundred day simple moving average is $1.38. Rackspace Technology, Inc. has a 1-year low of $1.00 and a 1-year high of $3.41.

Rackspace Technology (NASDAQ:RXT - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported ($0.06) EPS for the quarter, missing analysts' consensus estimates of ($0.05) by ($0.01). The firm had revenue of $666.30 million during the quarter, compared to the consensus estimate of $658.86 million. Rackspace Technology's revenue for the quarter was down 2.7% on a year-over-year basis. During the same quarter last year, the firm earned ($0.08) EPS. Rackspace Technology has set its Q3 2025 guidance at -0.060--0.040 EPS.

Insider Activity

In other Rackspace Technology news, Director Anthony Scott sold 40,000 shares of the business's stock in a transaction dated Monday, September 8th. The shares were sold at an average price of $1.43, for a total value of $57,200.00. Following the transaction, the director directly owned 191,045 shares in the company, valued at $273,194.35. The trade was a 17.31% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Amar Maletira sold 1,780,619 shares of the stock in a transaction that occurred on Monday, September 15th. The shares were sold at an average price of $1.35, for a total transaction of $2,403,835.65. Following the transaction, the chief executive officer directly owned 4,608,619 shares of the company's stock, valued at $6,221,635.65. This represents a 27.87% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 2.90% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages have recently commented on RXT. BMO Capital Markets reduced their target price on Rackspace Technology from $1.75 to $1.40 and set a "market perform" rating for the company in a research note on Tuesday, August 12th. Wall Street Zen upgraded Rackspace Technology from a "sell" rating to a "hold" rating in a report on Saturday. Finally, Raymond James Financial restated a "market perform" rating on shares of Rackspace Technology in a report on Monday, June 2nd. Four research analysts have rated the stock with a Hold rating and one has issued a Sell rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Reduce" and a consensus price target of $1.58.

Get Our Latest Research Report on Rackspace Technology

About Rackspace Technology

(

Free Report)

Rackspace Technology, Inc operates as a multi cloud technology services company in the Americas, Europe, the Middle East, Africa, and The Asia-Pacific region. It operates through three segments: Multicloud Services, Apps & Cross Platform, and OpenStack Public Cloud. The company provides public and private cloud managed services, which allow customers to determine, manage, and optimize the right infrastructure, platforms, and services; professional services related to designing and building multi cloud solutions and cloud-native applications; and managed hosting and colocation services.

Featured Articles

Want to see what other hedge funds are holding RXT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Rackspace Technology, Inc. (NASDAQ:RXT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rackspace Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rackspace Technology wasn't on the list.

While Rackspace Technology currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.