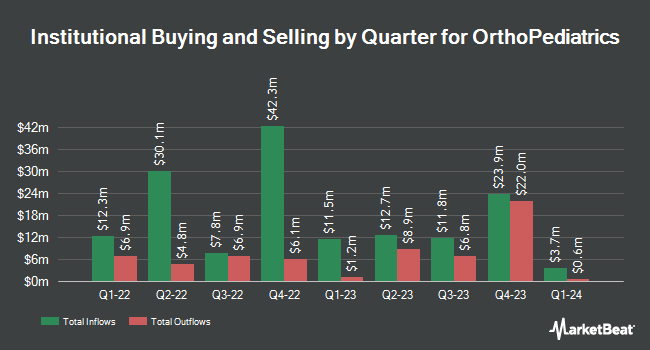

Goldman Sachs Group Inc. raised its stake in OrthoPediatrics Corp. (NASDAQ:KIDS - Free Report) by 112.3% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 200,439 shares of the company's stock after purchasing an additional 106,041 shares during the period. Goldman Sachs Group Inc. owned about 0.83% of OrthoPediatrics worth $4,937,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds also recently bought and sold shares of the stock. Northern Trust Corp raised its position in OrthoPediatrics by 0.3% in the 4th quarter. Northern Trust Corp now owns 193,798 shares of the company's stock valued at $4,492,000 after purchasing an additional 644 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in OrthoPediatrics by 6.9% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 9,995 shares of the company's stock valued at $246,000 after purchasing an additional 645 shares in the last quarter. Invesco Ltd. increased its holdings in shares of OrthoPediatrics by 12.1% in the 1st quarter. Invesco Ltd. now owns 18,349 shares of the company's stock valued at $452,000 after acquiring an additional 1,986 shares during the last quarter. American Century Companies Inc. increased its holdings in shares of OrthoPediatrics by 16.1% in the 1st quarter. American Century Companies Inc. now owns 30,658 shares of the company's stock valued at $755,000 after acquiring an additional 4,248 shares during the last quarter. Finally, Connor Clark & Lunn Investment Management Ltd. increased its holdings in shares of OrthoPediatrics by 46.8% in the 1st quarter. Connor Clark & Lunn Investment Management Ltd. now owns 14,148 shares of the company's stock valued at $348,000 after acquiring an additional 4,508 shares during the last quarter. Institutional investors and hedge funds own 69.05% of the company's stock.

OrthoPediatrics Price Performance

KIDS stock traded down $0.93 during midday trading on Friday, hitting $19.18. 223,650 shares of the stock were exchanged, compared to its average volume of 136,948. The stock's 50-day moving average price is $20.66 and its 200-day moving average price is $21.76. The stock has a market cap of $480.84 million, a price-to-earnings ratio of -10.72 and a beta of 1.06. OrthoPediatrics Corp. has a fifty-two week low of $16.59 and a fifty-two week high of $32.00. The company has a debt-to-equity ratio of 0.27, a quick ratio of 3.43 and a current ratio of 6.66.

OrthoPediatrics (NASDAQ:KIDS - Get Free Report) last issued its quarterly earnings data on Tuesday, August 5th. The company reported ($0.11) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.17) by $0.06. The firm had revenue of $61.08 million during the quarter, compared to analysts' expectations of $61.40 million. OrthoPediatrics had a negative return on equity of 6.36% and a negative net margin of 18.92%. OrthoPediatrics has set its FY 2025 guidance at EPS. Research analysts predict that OrthoPediatrics Corp. will post -0.93 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of research analysts have recently commented on KIDS shares. BTIG Research dropped their price objective on OrthoPediatrics from $40.00 to $39.00 and set a "buy" rating on the stock in a report on Wednesday, August 6th. Wall Street Zen upgraded OrthoPediatrics from a "sell" rating to a "hold" rating in a report on Saturday, August 9th. Citigroup reiterated a "market outperform" rating on shares of OrthoPediatrics in a report on Friday, August 8th. Finally, JMP Securities set a $35.00 price target on OrthoPediatrics and gave the stock a "market outperform" rating in a research note on Friday, August 8th. Seven investment analysts have rated the stock with a Buy rating and one has given a Hold rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $34.14.

Check Out Our Latest Research Report on OrthoPediatrics

Insiders Place Their Bets

In related news, CFO Fred Hite purchased 5,076 shares of the company's stock in a transaction on Thursday, August 21st. The stock was bought at an average price of $19.41 per share, with a total value of $98,525.16. Following the completion of the transaction, the chief financial officer owned 213,065 shares of the company's stock, valued at approximately $4,135,591.65. This represents a 2.44% increase in their position. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Insiders own 32.70% of the company's stock.

OrthoPediatrics Profile

(

Free Report)

OrthoPediatrics Corp., a medical device company, engages in designing, developing, and marketing anatomically appropriate implants, instruments, and specialized braces for children with orthopedic conditions in the United States and internationally. The company offers pediatric trauma and deformity correction products; scoliosis procedures for the treatment of spinal deformity; and sports medicine and other products.

Read More

Before you consider OrthoPediatrics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OrthoPediatrics wasn't on the list.

While OrthoPediatrics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.