Goldman Sachs Group Inc. cut its stake in shares of enCore Energy Corp. (NASDAQ:EU - Free Report) by 20.9% in the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 479,971 shares of the company's stock after selling 127,067 shares during the quarter. Goldman Sachs Group Inc. owned 0.26% of enCore Energy worth $658,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

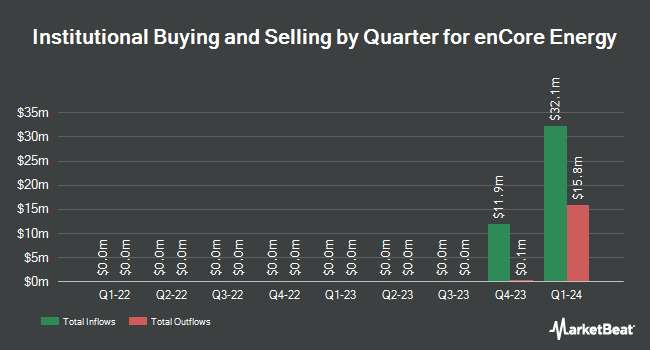

Several other institutional investors also recently bought and sold shares of the stock. Boundary Creek Advisors LP purchased a new stake in enCore Energy during the 1st quarter valued at about $2,898,000. NewEdge Advisors LLC boosted its holdings in enCore Energy by 13.2% during the 1st quarter. NewEdge Advisors LLC now owns 294,405 shares of the company's stock valued at $403,000 after acquiring an additional 34,250 shares during the period. Vident Advisory LLC boosted its holdings in enCore Energy by 21.8% during the 1st quarter. Vident Advisory LLC now owns 2,387,194 shares of the company's stock valued at $3,185,000 after acquiring an additional 427,019 shares during the period. Compound Planning Inc. purchased a new stake in enCore Energy during the 1st quarter valued at about $27,000. Finally, Quantbot Technologies LP purchased a new stake in enCore Energy during the 1st quarter valued at about $102,000. 20.86% of the stock is currently owned by hedge funds and other institutional investors.

enCore Energy Stock Up 1.0%

EU opened at $3.12 on Thursday. The stock has a market cap of $583.75 million, a PE ratio of -8.91 and a beta of 1.84. The business has a 50 day moving average of $2.63 and a 200-day moving average of $2.13. enCore Energy Corp. has a 52 week low of $1.01 and a 52 week high of $4.44.

enCore Energy (NASDAQ:EU - Get Free Report) last posted its quarterly earnings data on Monday, August 11th. The company reported ($0.07) earnings per share for the quarter. enCore Energy had a negative net margin of 143.28% and a negative return on equity of 19.23%. The company had revenue of $3.66 million for the quarter. Equities analysts anticipate that enCore Energy Corp. will post -0.2 EPS for the current year.

Wall Street Analysts Forecast Growth

EU has been the subject of several research analyst reports. HC Wainwright increased their price objective on enCore Energy from $2.75 to $4.00 and gave the stock a "buy" rating in a report on Tuesday, August 12th. Wall Street Zen upgraded enCore Energy from a "sell" rating to a "hold" rating in a report on Monday. Zacks Research upgraded enCore Energy to a "hold" rating in a report on Tuesday, August 12th. Finally, B. Riley initiated coverage on enCore Energy in a report on Wednesday, July 23rd. They issued a "buy" rating and a $4.00 price objective for the company. One research analyst has rated the stock with a Strong Buy rating, one has assigned a Buy rating and one has assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Buy" and an average target price of $4.00.

Get Our Latest Report on EU

About enCore Energy

(

Free Report)

enCore Energy Corp. engages in the acquisition, exploration, and development of uranium resource properties in the United States. It holds a 100% interest in Crownpoint and Hosta Butte uranium project area covers 3,020 acres located in the Grants Uranium Belt, New Mexico. The company also holds interest in the Marquez-Juan Tafoya property comprises 14,582 acres located in McKinley and Sandoval counties of New Mexico; and the Nose Rock project comprising 42 owned unpatented lode mining claims comprising approximately 800 acres located in McKinley County, New Mexico.

Recommended Stories

Want to see what other hedge funds are holding EU? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for enCore Energy Corp. (NASDAQ:EU - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider enCore Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and enCore Energy wasn't on the list.

While enCore Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.