Graham Capital Management L.P. grew its position in CoreCivic, Inc. (NYSE:CXW - Free Report) by 126.4% in the 1st quarter, according to its most recent disclosure with the SEC. The fund owned 87,195 shares of the real estate investment trust's stock after buying an additional 48,688 shares during the period. Graham Capital Management L.P. owned approximately 0.08% of CoreCivic worth $1,769,000 as of its most recent SEC filing.

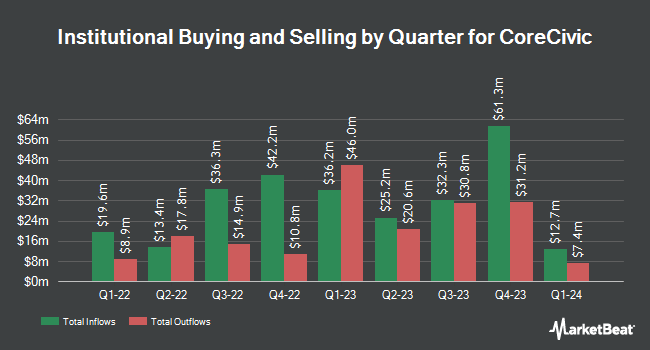

Other large investors have also bought and sold shares of the company. Copia Wealth Management purchased a new position in CoreCivic in the fourth quarter worth about $82,000. GAMMA Investing LLC grew its stake in shares of CoreCivic by 10.0% in the first quarter. GAMMA Investing LLC now owns 5,156 shares of the real estate investment trust's stock worth $105,000 after acquiring an additional 470 shares during the period. Harbour Investments Inc. lifted its position in CoreCivic by 215.6% during the first quarter. Harbour Investments Inc. now owns 5,337 shares of the real estate investment trust's stock valued at $108,000 after purchasing an additional 3,646 shares during the period. Harvest Fund Management Co. Ltd lifted its position in CoreCivic by 29.6% during the first quarter. Harvest Fund Management Co. Ltd now owns 9,250 shares of the real estate investment trust's stock valued at $187,000 after purchasing an additional 2,113 shares during the period. Finally, Bayesian Capital Management LP bought a new position in CoreCivic during the fourth quarter valued at approximately $211,000. 85.13% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of research analysts recently weighed in on CXW shares. Wedbush restated an "outperform" rating and set a $38.00 price objective on shares of CoreCivic in a research report on Wednesday, June 11th. Jones Trading restated a "buy" rating and set a $30.00 price objective on shares of CoreCivic in a research report on Thursday, August 7th. Finally, Wall Street Zen upgraded shares of CoreCivic from a "hold" rating to a "strong-buy" rating in a research report on Saturday, August 9th. Four equities research analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, the company currently has an average rating of "Buy" and an average target price of $33.33.

Read Our Latest Analysis on CoreCivic

CoreCivic Stock Performance

NYSE CXW traded down $0.22 during trading hours on Friday, hitting $19.65. 685,150 shares of the company's stock traded hands, compared to its average volume of 945,654. The business's fifty day moving average price is $20.64 and its two-hundred day moving average price is $20.80. The company has a current ratio of 1.60, a quick ratio of 1.60 and a debt-to-equity ratio of 0.68. The firm has a market capitalization of $2.10 billion, a P/E ratio of 20.90 and a beta of 0.81. CoreCivic, Inc. has a 52 week low of $12.13 and a 52 week high of $24.99.

CoreCivic (NYSE:CXW - Get Free Report) last announced its earnings results on Wednesday, August 6th. The real estate investment trust reported $0.59 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.43 by $0.16. The company had revenue of $538.17 million during the quarter, compared to analyst estimates of $499.02 million. CoreCivic had a net margin of 5.21% and a return on equity of 7.12%. The firm's quarterly revenue was up 9.8% compared to the same quarter last year. During the same period in the previous year, the business posted $0.42 earnings per share. Equities research analysts predict that CoreCivic, Inc. will post 1.5 EPS for the current year.

CoreCivic Profile

(

Free Report)

CoreCivic, Inc owns and operates partnership correctional, detention, and residential reentry facilities in the United States. It operates through three segments: CoreCivic Safety, CoreCivic Community, and CoreCivic Properties. The company provides a range of solutions to government partners that serve the public good through corrections and detention management, a network of residential reentry centers to help address America's recidivism crisis, and government real estate solutions.

Further Reading

Before you consider CoreCivic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CoreCivic wasn't on the list.

While CoreCivic currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.