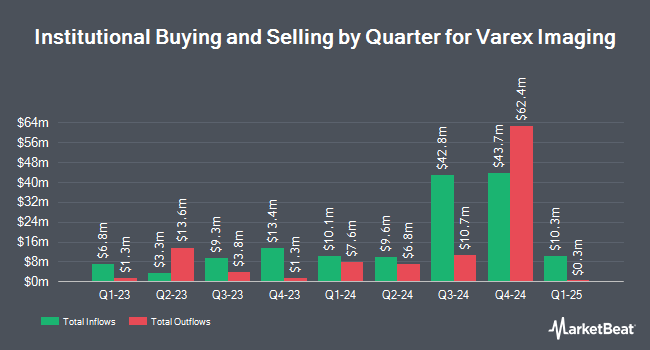

Graham Capital Management L.P. bought a new position in shares of Varex Imaging (NASDAQ:VREX - Free Report) during the 1st quarter, according to its most recent 13F filing with the SEC. The fund bought 91,665 shares of the company's stock, valued at approximately $1,063,000. Graham Capital Management L.P. owned approximately 0.22% of Varex Imaging as of its most recent filing with the SEC.

Several other hedge funds and other institutional investors have also made changes to their positions in the company. Quarry LP acquired a new position in shares of Varex Imaging during the 1st quarter worth $63,000. State of Wyoming raised its stake in Varex Imaging by 42.0% in the 1st quarter. State of Wyoming now owns 16,626 shares of the company's stock valued at $193,000 after purchasing an additional 4,918 shares during the last quarter. JB Capital Partners LP grew its holdings in Varex Imaging by 340.0% in the first quarter. JB Capital Partners LP now owns 110,000 shares of the company's stock valued at $1,276,000 after purchasing an additional 85,000 shares during the period. Jump Financial LLC grew its holdings in Varex Imaging by 144.7% in the first quarter. Jump Financial LLC now owns 53,848 shares of the company's stock valued at $625,000 after purchasing an additional 31,844 shares during the period. Finally, Martingale Asset Management L P purchased a new stake in Varex Imaging in the first quarter valued at approximately $198,000.

Wall Street Analyst Weigh In

A number of equities research analysts recently issued reports on VREX shares. B. Riley restated a "buy" rating and issued a $16.00 target price (up from $12.00) on shares of Varex Imaging in a report on Friday, August 8th. Wall Street Zen downgraded shares of Varex Imaging from a "strong-buy" rating to a "buy" rating in a report on Saturday, August 9th. Two equities research analysts have rated the stock with a Buy rating, According to data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus price target of $19.50.

Check Out Our Latest Report on Varex Imaging

Varex Imaging Stock Down 0.1%

NASDAQ VREX traded down $0.01 on Tuesday, reaching $11.66. The company had a trading volume of 102,287 shares, compared to its average volume of 466,510. The firm has a market capitalization of $483.89 million, a PE ratio of -3.63 and a beta of 0.87. The company has a debt-to-equity ratio of 0.78, a current ratio of 3.51 and a quick ratio of 1.82. The firm has a 50-day moving average of $9.30 and a 200-day moving average of $9.35. Varex Imaging has a 1 year low of $6.76 and a 1 year high of $16.93.

Varex Imaging (NASDAQ:VREX - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported $0.18 EPS for the quarter, beating the consensus estimate of $0.04 by $0.14. The company had revenue of $203.00 million during the quarter, compared to analysts' expectations of $190.32 million. Varex Imaging had a positive return on equity of 5.54% and a negative net margin of 16.13%. Varex Imaging has set its Q4 2025 guidance at 0.100-0.300 EPS. On average, equities research analysts anticipate that Varex Imaging will post 0.53 EPS for the current fiscal year.

About Varex Imaging

(

Free Report)

Varex Imaging Corporation designs, manufactures, and sells X-ray imaging components. The company operates through two segments, Medical and Industrial. The Medical segment designs, manufactures, sells, and services X-ray imaging components, comprising X-ray tubes, digital detectors and accessories, ionization chambers, high voltage connectors, image-processing software and workstations, 3D reconstruction software, computer-aided diagnostic software, collimators, automatic exposure control devices, generators, and heat exchangers.

Further Reading

Before you consider VAREX IMAGING, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VAREX IMAGING wasn't on the list.

While VAREX IMAGING currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.