Great Lakes Advisors LLC trimmed its stake in Medtronic PLC (NYSE:MDT - Free Report) by 87.7% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 3,494 shares of the medical technology company's stock after selling 24,873 shares during the period. Great Lakes Advisors LLC's holdings in Medtronic were worth $314,000 as of its most recent SEC filing.

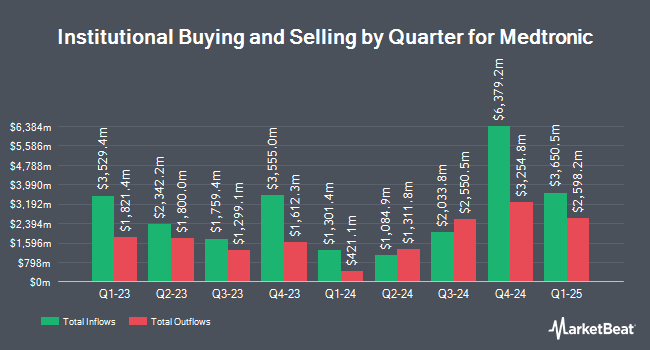

Other large investors have also recently modified their holdings of the company. Vanguard Group Inc. boosted its position in Medtronic by 0.7% during the 1st quarter. Vanguard Group Inc. now owns 125,014,241 shares of the medical technology company's stock valued at $11,233,780,000 after acquiring an additional 810,854 shares in the last quarter. Massachusetts Financial Services Co. MA boosted its position in shares of Medtronic by 7.0% during the first quarter. Massachusetts Financial Services Co. MA now owns 22,278,023 shares of the medical technology company's stock valued at $2,001,903,000 after purchasing an additional 1,461,841 shares in the last quarter. Bank of New York Mellon Corp grew its stake in Medtronic by 3.8% in the first quarter. Bank of New York Mellon Corp now owns 20,680,301 shares of the medical technology company's stock worth $1,858,332,000 after purchasing an additional 756,192 shares during the period. Deutsche Bank AG raised its holdings in Medtronic by 3.1% in the first quarter. Deutsche Bank AG now owns 19,009,795 shares of the medical technology company's stock worth $1,708,220,000 after purchasing an additional 566,155 shares in the last quarter. Finally, Invesco Ltd. raised its holdings in Medtronic by 9.9% in the first quarter. Invesco Ltd. now owns 16,980,592 shares of the medical technology company's stock worth $1,525,876,000 after purchasing an additional 1,535,308 shares in the last quarter. Institutional investors own 82.06% of the company's stock.

Analyst Ratings Changes

A number of brokerages have recently commented on MDT. Wells Fargo & Company boosted their target price on shares of Medtronic from $98.00 to $100.00 and gave the company an "overweight" rating in a report on Wednesday, August 20th. Evercore ISI boosted their price objective on shares of Medtronic from $103.00 to $106.00 and gave the stock an "outperform" rating in a research note on Tuesday, July 8th. UBS Group raised their target price on shares of Medtronic from $94.00 to $95.00 and gave the company a "neutral" rating in a research note on Wednesday, August 20th. Robert W. Baird boosted their price target on Medtronic from $94.00 to $96.00 and gave the stock a "neutral" rating in a research report on Wednesday, August 20th. Finally, BTIG Research restated a "neutral" rating on shares of Medtronic in a research note on Friday, July 11th. One analyst has rated the stock with a Strong Buy rating, ten have assigned a Buy rating and eight have assigned a Hold rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $102.14.

Check Out Our Latest Research Report on Medtronic

Medtronic Stock Down 0.6%

MDT stock traded down $0.56 during midday trading on Monday, hitting $93.48. The company's stock had a trading volume of 5,715,769 shares, compared to its average volume of 6,922,758. The firm's 50-day moving average is $91.61 and its 200-day moving average is $88.26. The company has a current ratio of 2.01, a quick ratio of 1.50 and a debt-to-equity ratio of 0.54. Medtronic PLC has a 12 month low of $79.29 and a 12 month high of $96.25. The company has a market cap of $119.90 billion, a PE ratio of 25.75, a P/E/G ratio of 2.48 and a beta of 0.77.

Medtronic (NYSE:MDT - Get Free Report) last posted its quarterly earnings results on Tuesday, August 19th. The medical technology company reported $1.26 earnings per share for the quarter, topping the consensus estimate of $1.23 by $0.03. Medtronic had a return on equity of 14.61% and a net margin of 13.63%.The firm had revenue of $8.58 billion during the quarter, compared to analysts' expectations of $8.37 billion. During the same quarter in the previous year, the business earned $1.23 earnings per share. The company's revenue was up 7.7% on a year-over-year basis. Medtronic has set its FY 2026 guidance at 5.600-5.660 EPS. On average, equities research analysts forecast that Medtronic PLC will post 5.46 earnings per share for the current fiscal year.

Medtronic Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, October 17th. Investors of record on Friday, September 26th will be issued a $0.71 dividend. This represents a $2.84 dividend on an annualized basis and a yield of 3.0%. The ex-dividend date of this dividend is Friday, September 26th. Medtronic's dividend payout ratio (DPR) is currently 78.24%.

Insider Activity

In other news, Director William R. Jellison purchased 2,500 shares of the company's stock in a transaction on Monday, August 25th. The stock was acquired at an average cost of $92.37 per share, for a total transaction of $230,925.00. Following the completion of the transaction, the director directly owned 5,000 shares in the company, valued at $461,850. This trade represents a 100.00% increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, EVP Harry Skip Kiil sold 8,605 shares of the company's stock in a transaction dated Wednesday, September 3rd. The stock was sold at an average price of $91.58, for a total value of $788,045.90. Following the completion of the transaction, the executive vice president directly owned 35,615 shares of the company's stock, valued at approximately $3,261,621.70. This trade represents a 19.46% decrease in their position. The disclosure for this sale can be found here. 0.26% of the stock is owned by company insiders.

Medtronic Profile

(

Free Report)

Medtronic plc develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. Its Cardiovascular Portfolio segment offers implantable cardiac pacemakers, cardioverter defibrillators, and cardiac resynchronization therapy devices; cardiac ablation products; insertable cardiac monitor systems; TYRX products; and remote monitoring and patient-centered software.

Featured Articles

Before you consider Medtronic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medtronic wasn't on the list.

While Medtronic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report