Great Lakes Advisors LLC decreased its position in shares of Broadridge Financial Solutions, Inc. (NYSE:BR - Free Report) by 83.4% during the 1st quarter, according to the company in its most recent disclosure with the SEC. The fund owned 4,752 shares of the business services provider's stock after selling 23,882 shares during the quarter. Great Lakes Advisors LLC's holdings in Broadridge Financial Solutions were worth $1,152,000 as of its most recent filing with the SEC.

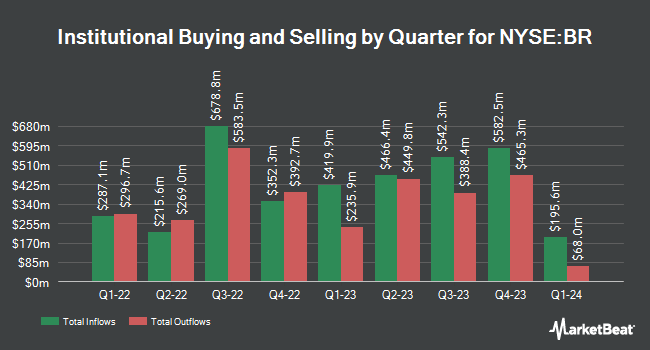

Other hedge funds also recently made changes to their positions in the company. Golden State Wealth Management LLC purchased a new position in shares of Broadridge Financial Solutions during the first quarter worth about $29,000. Whipplewood Advisors LLC boosted its holdings in shares of Broadridge Financial Solutions by 2,620.0% in the first quarter. Whipplewood Advisors LLC now owns 136 shares of the business services provider's stock valued at $33,000 after acquiring an additional 131 shares in the last quarter. Continuum Advisory LLC boosted its holdings in shares of Broadridge Financial Solutions by 48.4% in the first quarter. Continuum Advisory LLC now owns 141 shares of the business services provider's stock valued at $34,000 after acquiring an additional 46 shares in the last quarter. Clal Insurance Enterprises Holdings Ltd boosted its holdings in shares of Broadridge Financial Solutions by 450.0% in the first quarter. Clal Insurance Enterprises Holdings Ltd now owns 143 shares of the business services provider's stock valued at $35,000 after acquiring an additional 117 shares in the last quarter. Finally, Olde Wealth Management LLC purchased a new stake in shares of Broadridge Financial Solutions in the first quarter valued at about $36,000. Hedge funds and other institutional investors own 90.03% of the company's stock.

Wall Street Analyst Weigh In

BR has been the topic of a number of research analyst reports. Morgan Stanley boosted their price objective on shares of Broadridge Financial Solutions from $222.00 to $261.00 and gave the stock an "equal weight" rating in a report on Wednesday, August 6th. Royal Bank Of Canada reaffirmed an "outperform" rating and issued a $259.00 price target on shares of Broadridge Financial Solutions in a report on Monday, May 19th. UBS Group upped their price target on shares of Broadridge Financial Solutions from $250.00 to $280.00 and gave the company a "neutral" rating in a report on Friday, August 8th. Finally, Needham & Company LLC upped their price target on shares of Broadridge Financial Solutions from $300.00 to $305.00 and gave the company a "buy" rating in a report on Wednesday, August 6th. Two analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the company. According to data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $261.50.

Check Out Our Latest Research Report on BR

Broadridge Financial Solutions Stock Performance

Shares of BR traded down $3.92 during midday trading on Tuesday, hitting $245.87. 181,820 shares of the stock traded hands, compared to its average volume of 591,357. The business's 50 day moving average price is $251.84 and its two-hundred day moving average price is $242.19. The firm has a market capitalization of $28.80 billion, a PE ratio of 34.69 and a beta of 0.96. The company has a debt-to-equity ratio of 1.04, a quick ratio of 0.98 and a current ratio of 0.98. Broadridge Financial Solutions, Inc. has a 1-year low of $207.21 and a 1-year high of $271.91.

Broadridge Financial Solutions (NYSE:BR - Get Free Report) last announced its quarterly earnings results on Tuesday, August 5th. The business services provider reported $3.55 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.51 by $0.04. Broadridge Financial Solutions had a return on equity of 42.72% and a net margin of 12.19%.The company had revenue of $2.07 billion during the quarter, compared to analyst estimates of $2.06 billion. During the same quarter in the previous year, the firm posted $3.50 EPS. The firm's quarterly revenue was up 6.2% on a year-over-year basis. Broadridge Financial Solutions has set its FY 2026 guidance at 9.230-9.580 EPS. Equities research analysts predict that Broadridge Financial Solutions, Inc. will post 8.53 EPS for the current fiscal year.

Broadridge Financial Solutions Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, October 2nd. Shareholders of record on Thursday, September 11th will be given a $0.975 dividend. This represents a $3.90 dividend on an annualized basis and a yield of 1.6%. This is a positive change from Broadridge Financial Solutions's previous quarterly dividend of $0.88. The ex-dividend date is Thursday, September 11th. Broadridge Financial Solutions's payout ratio is currently 55.01%.

Insider Activity at Broadridge Financial Solutions

In related news, CEO Timothy C. Gokey sold 5,674 shares of the stock in a transaction that occurred on Monday, August 25th. The shares were sold at an average price of $258.37, for a total transaction of $1,465,991.38. Following the completion of the sale, the chief executive officer directly owned 143,285 shares of the company's stock, valued at $37,020,545.45. This represents a 3.81% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, President Christopher John Perry sold 7,036 shares of the stock in a transaction that occurred on Tuesday, August 12th. The shares were sold at an average price of $262.72, for a total transaction of $1,848,497.92. Following the sale, the president directly owned 48,813 shares of the company's stock, valued at approximately $12,824,151.36. This represents a 12.60% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 147,532 shares of company stock valued at $38,417,208. Company insiders own 1.30% of the company's stock.

Broadridge Financial Solutions Company Profile

(

Free Report)

Broadridge Financial Solutions, Inc provides investor communications and technology-driven solutions for the financial services industry. The company's Investor Communication Solutions segment processes and distributes proxy materials to investors in equity securities and mutual funds, as well as facilitates related vote processing services; and distributes regulatory reports, class action, and corporate action/reorganization event information, as well as tax reporting solutions.

Read More

Before you consider Broadridge Financial Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadridge Financial Solutions wasn't on the list.

While Broadridge Financial Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.