Griffin Asset Management Inc. lessened its stake in shares of British American Tobacco p.l.c. (NYSE:BTI - Free Report) by 26.5% during the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 13,709 shares of the company's stock after selling 4,932 shares during the quarter. Griffin Asset Management Inc.'s holdings in British American Tobacco were worth $649,000 at the end of the most recent reporting period.

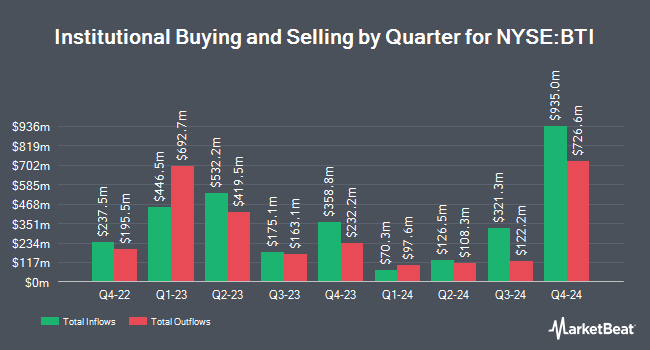

Several other hedge funds and other institutional investors have also bought and sold shares of the stock. MGO One Seven LLC boosted its position in British American Tobacco by 55.1% during the 2nd quarter. MGO One Seven LLC now owns 7,636 shares of the company's stock valued at $361,000 after acquiring an additional 2,712 shares in the last quarter. Allspring Global Investments Holdings LLC boosted its position in shares of British American Tobacco by 1.3% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 23,188 shares of the company's stock worth $1,083,000 after purchasing an additional 297 shares in the last quarter. GW Henssler & Associates Ltd. boosted its position in shares of British American Tobacco by 0.8% in the 2nd quarter. GW Henssler & Associates Ltd. now owns 395,955 shares of the company's stock worth $18,741,000 after purchasing an additional 3,066 shares in the last quarter. Vanguard Personalized Indexing Management LLC boosted its position in shares of British American Tobacco by 17.2% in the 2nd quarter. Vanguard Personalized Indexing Management LLC now owns 68,051 shares of the company's stock worth $3,221,000 after purchasing an additional 10,000 shares in the last quarter. Finally, Concurrent Investment Advisors LLC boosted its position in shares of British American Tobacco by 19.2% in the 2nd quarter. Concurrent Investment Advisors LLC now owns 8,715 shares of the company's stock worth $413,000 after purchasing an additional 1,403 shares in the last quarter. Institutional investors own 16.16% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms have recently weighed in on BTI. Royal Bank Of Canada cut British American Tobacco from a "sector perform" rating to an "underperform" rating in a research report on Tuesday, September 2nd. Argus upgraded British American Tobacco from a "hold" rating to a "buy" rating and set a $62.00 target price for the company in a research note on Monday, September 8th. Jefferies Financial Group started coverage on British American Tobacco in a research note on Wednesday, July 9th. They issued a "buy" rating for the company. Morgan Stanley restated an "underweight" rating and issued a $40.00 target price on shares of British American Tobacco in a research note on Friday, August 15th. Finally, Wall Street Zen lowered British American Tobacco from a "buy" rating to a "hold" rating in a research note on Saturday, July 26th. Five investment analysts have rated the stock with a Buy rating, one has assigned a Hold rating and two have assigned a Sell rating to the company. According to data from MarketBeat.com, British American Tobacco currently has a consensus rating of "Hold" and a consensus price target of $51.00.

Check Out Our Latest Stock Report on BTI

British American Tobacco Stock Performance

NYSE BTI opened at $51.50 on Monday. The stock has a 50-day simple moving average of $55.39 and a two-hundred day simple moving average of $49.21. The firm has a market capitalization of $105.82 billion, a P/E ratio of 10.57, a PEG ratio of 3.57 and a beta of 0.42. British American Tobacco p.l.c. has a fifty-two week low of $34.17 and a fifty-two week high of $59.29. The company has a debt-to-equity ratio of 0.68, a quick ratio of 0.55 and a current ratio of 0.87.

About British American Tobacco

(

Free Report)

British American Tobacco p.l.c. engages in the provision of tobacco and nicotine products to consumers worldwide. It also offers vapour, heated, and modern oral nicotine products; combustible cigarettes; and traditional oral products, such as snus and moist snuff. The company offers its products under the Vuse, glo, Velo, Grizzly, Kodiak, Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans, Camel, Natural American Spirit, Newport, Vogue, Viceroy, Kool, Peter Stuyvesant, Craven A, State Express 555 and Shuang Xi brands.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider British American Tobacco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and British American Tobacco wasn't on the list.

While British American Tobacco currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.