GSA Capital Partners LLP bought a new position in shares of Alpha Metallurgical Resources, Inc. (NYSE:AMR - Free Report) in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 6,917 shares of the energy company's stock, valued at approximately $866,000. GSA Capital Partners LLP owned about 0.05% of Alpha Metallurgical Resources as of its most recent filing with the Securities and Exchange Commission (SEC).

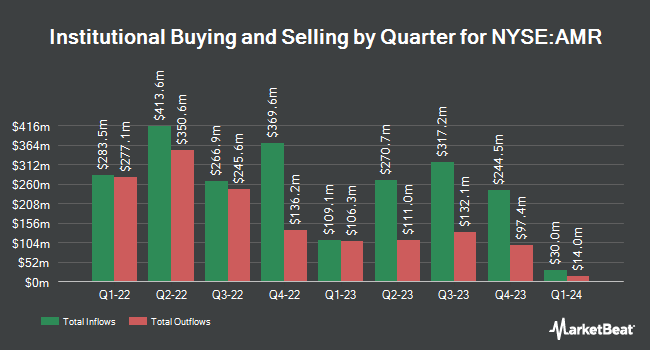

A number of other hedge funds also recently bought and sold shares of AMR. Federated Hermes Inc. grew its holdings in Alpha Metallurgical Resources by 59,520.9% during the 1st quarter. Federated Hermes Inc. now owns 25,637 shares of the energy company's stock worth $3,211,000 after acquiring an additional 25,594 shares in the last quarter. LPL Financial LLC acquired a new stake in Alpha Metallurgical Resources in the 1st quarter valued at $1,618,000. Cetera Investment Advisers acquired a new stake in Alpha Metallurgical Resources during the 1st quarter worth $222,000. Royce & Associates LP lifted its position in Alpha Metallurgical Resources by 154.5% in the first quarter. Royce & Associates LP now owns 6,335 shares of the energy company's stock valued at $793,000 after buying an additional 3,846 shares during the last quarter. Finally, Readystate Asset Management LP acquired a new position in Alpha Metallurgical Resources in the first quarter valued at about $394,000. Hedge funds and other institutional investors own 84.29% of the company's stock.

Analyst Ratings Changes

A number of analysts recently weighed in on the stock. Jefferies Financial Group initiated coverage on shares of Alpha Metallurgical Resources in a research note on Tuesday, July 1st. They set a "hold" rating and a $110.00 target price on the stock. Wall Street Zen downgraded shares of Alpha Metallurgical Resources from a "hold" rating to a "sell" rating in a research note on Thursday, May 22nd. Finally, B. Riley lowered their price target on Alpha Metallurgical Resources from $173.00 to $171.00 and set a "buy" rating for the company in a report on Tuesday.

Check Out Our Latest Stock Report on AMR

Alpha Metallurgical Resources Stock Up 6.3%

Shares of AMR traded up $7.50 during trading on Tuesday, reaching $126.12. The company's stock had a trading volume of 155,046 shares, compared to its average volume of 319,877. The company has a fifty day moving average of $115.75 and a two-hundred day moving average of $132.51. Alpha Metallurgical Resources, Inc. has a twelve month low of $97.41 and a twelve month high of $259.20. The company has a market cap of $1.65 billion, a price-to-earnings ratio of 62.41 and a beta of 0.59.

Alpha Metallurgical Resources (NYSE:AMR - Get Free Report) last issued its quarterly earnings data on Friday, May 9th. The energy company reported ($2.60) EPS for the quarter, missing analysts' consensus estimates of ($1.06) by ($1.54). Alpha Metallurgical Resources had a return on equity of 1.62% and a net margin of 1.01%. The company had revenue of $531.96 million for the quarter, compared to the consensus estimate of $586.15 million. During the same quarter in the previous year, the company earned $9.59 earnings per share. Alpha Metallurgical Resources's quarterly revenue was down 38.4% compared to the same quarter last year. As a group, equities analysts forecast that Alpha Metallurgical Resources, Inc. will post 14.31 EPS for the current fiscal year.

About Alpha Metallurgical Resources

(

Free Report)

Alpha Metallurgical Resources, Inc, a mining company, produces, processes, and sells met and thermal coal in Virginia and West Virginia. The company offers metallurgical coal products. It operates twenty-two active mines and nine coal preparation and load-out facilities. The company was formerly known as Contura Energy, Inc and changed its name to Alpha Metallurgical Resources, Inc in February 2021.

Further Reading

Before you consider Alpha Metallurgical Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alpha Metallurgical Resources wasn't on the list.

While Alpha Metallurgical Resources currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.