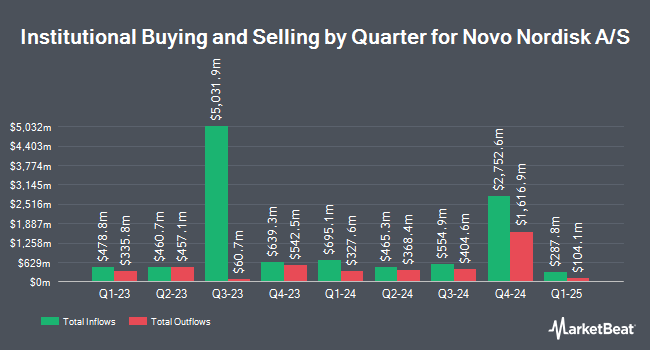

GSA Capital Partners LLP acquired a new stake in Novo Nordisk A/S (NYSE:NVO - Free Report) during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 13,293 shares of the company's stock, valued at approximately $923,000.

Several other institutional investors also recently bought and sold shares of NVO. Nuveen Asset Management LLC boosted its position in shares of Novo Nordisk A/S by 73.2% during the 4th quarter. Nuveen Asset Management LLC now owns 6,244,931 shares of the company's stock worth $537,189,000 after purchasing an additional 2,639,693 shares in the last quarter. Two Sigma Investments LP purchased a new stake in shares of Novo Nordisk A/S during the 4th quarter worth $158,657,000. Bank of America Corp DE boosted its position in shares of Novo Nordisk A/S by 8.1% during the 4th quarter. Bank of America Corp DE now owns 15,492,384 shares of the company's stock worth $1,332,655,000 after purchasing an additional 1,165,955 shares in the last quarter. Northern Trust Corp boosted its position in shares of Novo Nordisk A/S by 26.8% during the 4th quarter. Northern Trust Corp now owns 4,689,098 shares of the company's stock worth $403,356,000 after purchasing an additional 991,022 shares in the last quarter. Finally, Marshall Wace LLP boosted its position in shares of Novo Nordisk A/S by 543.9% in the 4th quarter. Marshall Wace LLP now owns 1,167,498 shares of the company's stock worth $100,428,000 after buying an additional 986,195 shares in the last quarter. 11.54% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts recently commented on the stock. Guggenheim lowered shares of Novo Nordisk A/S from a "strong-buy" rating to a "hold" rating in a research report on Thursday, April 17th. BNP Paribas assumed coverage on shares of Novo Nordisk A/S in a research report on Tuesday, April 15th. They issued an "underperform" rating on the stock. Dbs Bank lowered shares of Novo Nordisk A/S to a "sell" rating in a research report on Friday, April 25th. Hsbc Global Res lowered shares of Novo Nordisk A/S from a "strong-buy" rating to a "hold" rating in a research report on Thursday. Finally, BMO Capital Markets reiterated a "market perform" rating and issued a $64.00 price objective (down from $105.00) on shares of Novo Nordisk A/S in a research report on Thursday, April 17th. Two investment analysts have rated the stock with a sell rating, eight have issued a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat.com, Novo Nordisk A/S presently has a consensus rating of "Hold" and an average target price of $93.67.

Get Our Latest Report on Novo Nordisk A/S

Novo Nordisk A/S Trading Up 2.5%

NYSE:NVO traded up $1.16 on Friday, reaching $48.23. The stock had a trading volume of 34,710,384 shares, compared to its average volume of 17,615,270. Novo Nordisk A/S has a 12-month low of $46.90 and a 12-month high of $139.74. The firm's fifty day moving average is $69.64 and its two-hundred day moving average is $72.95. The company has a debt-to-equity ratio of 0.70, a current ratio of 0.74 and a quick ratio of 0.56. The company has a market cap of $215.35 billion, a price-to-earnings ratio of 14.27, a P/E/G ratio of 1.41 and a beta of 0.63.

Novo Nordisk A/S (NYSE:NVO - Get Free Report) last posted its quarterly earnings data on Wednesday, May 7th. The company reported $0.92 EPS for the quarter, meeting analysts' consensus estimates of $0.92. Novo Nordisk A/S had a net margin of 34.52% and a return on equity of 80.94%. The company had revenue of $11.87 billion during the quarter. Equities analysts expect that Novo Nordisk A/S will post 3.84 EPS for the current fiscal year.

About Novo Nordisk A/S

(

Free Report)

Novo Nordisk A/S, together with its subsidiaries, engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally. It operates in two segments, Diabetes and Obesity Care, and Rare Disease.

See Also

Before you consider Novo Nordisk A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novo Nordisk A/S wasn't on the list.

While Novo Nordisk A/S currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.