GSA Capital Partners LLP lifted its stake in shares of Healthcare Realty Trust Incorporated (NYSE:HR - Free Report) by 102.9% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 87,589 shares of the real estate investment trust's stock after acquiring an additional 44,428 shares during the period. GSA Capital Partners LLP's holdings in Healthcare Realty Trust were worth $1,480,000 as of its most recent SEC filing.

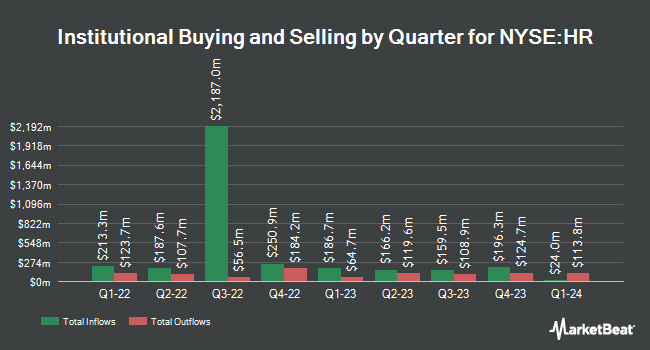

Several other large investors have also modified their holdings of the stock. Starboard Value LP purchased a new position in shares of Healthcare Realty Trust during the 4th quarter worth about $342,110,000. Rush Island Management LP raised its holdings in Healthcare Realty Trust by 21.2% in the fourth quarter. Rush Island Management LP now owns 15,681,440 shares of the real estate investment trust's stock valued at $265,800,000 after buying an additional 2,747,848 shares during the period. Massachusetts Financial Services Co. MA purchased a new position in Healthcare Realty Trust in the first quarter valued at approximately $100,817,000. Norges Bank purchased a new position in Healthcare Realty Trust in the fourth quarter valued at approximately $76,825,000. Finally, Northern Trust Corp raised its holdings in Healthcare Realty Trust by 40.3% in the fourth quarter. Northern Trust Corp now owns 4,040,969 shares of the real estate investment trust's stock valued at $68,494,000 after buying an additional 1,159,763 shares during the period.

Analyst Upgrades and Downgrades

HR has been the topic of several research reports. Wall Street Zen lowered shares of Healthcare Realty Trust from a "hold" rating to a "sell" rating in a report on Saturday, May 31st. Wedbush cut their price target on shares of Healthcare Realty Trust from $18.00 to $16.00 and set a "neutral" rating on the stock in a report on Monday, May 5th. JPMorgan Chase & Co. cut their price target on shares of Healthcare Realty Trust from $18.00 to $17.00 and set a "neutral" rating on the stock in a report on Thursday, June 26th. Finally, Wells Fargo & Company dropped their price objective on shares of Healthcare Realty Trust from $16.00 to $15.00 and set an "underweight" rating on the stock in a research note on Monday, June 2nd. Two equities research analysts have rated the stock with a sell rating and four have issued a hold rating to the stock. According to MarketBeat.com, Healthcare Realty Trust presently has an average rating of "Hold" and a consensus target price of $16.40.

Read Our Latest Stock Analysis on HR

Healthcare Realty Trust Stock Performance

Shares of HR stock traded up $1.14 during mid-day trading on Friday, reaching $16.50. 7,928,085 shares of the company were exchanged, compared to its average volume of 3,644,029. Healthcare Realty Trust Incorporated has a fifty-two week low of $14.09 and a fifty-two week high of $18.90. The company has a market capitalization of $5.80 billion, a P/E ratio of -14.35 and a beta of 0.89. The business's 50 day simple moving average is $15.43 and its 200 day simple moving average is $15.88.

Healthcare Realty Trust (NYSE:HR - Get Free Report) last released its quarterly earnings results on Thursday, July 31st. The real estate investment trust reported $0.41 earnings per share for the quarter, topping analysts' consensus estimates of $0.40 by $0.01. Healthcare Realty Trust had a negative net margin of 32.95% and a negative return on equity of 7.53%. The business had revenue of $287.07 million during the quarter, compared to the consensus estimate of $290.83 million. During the same quarter last year, the company earned $0.38 earnings per share. On average, analysts forecast that Healthcare Realty Trust Incorporated will post 1.59 EPS for the current year.

Healthcare Realty Trust Cuts Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, August 28th. Shareholders of record on Thursday, August 14th will be issued a $0.24 dividend. This represents a $0.96 dividend on an annualized basis and a yield of 5.8%. Healthcare Realty Trust's dividend payout ratio is presently -113.76%.

Insider Buying and Selling

In other Healthcare Realty Trust news, Director Thomas N. Bohjalian acquired 2,500 shares of the firm's stock in a transaction on Tuesday, May 13th. The stock was purchased at an average price of $14.71 per share, with a total value of $36,775.00. Following the completion of the acquisition, the director directly owned 56,502 shares in the company, valued at $831,144.42. This trade represents a 4.63% increase in their position. The purchase was disclosed in a legal filing with the SEC, which is accessible through the SEC website. 0.37% of the stock is currently owned by corporate insiders.

Healthcare Realty Trust Company Profile

(

Free Report)

Healthcare Realty Trust, Inc provides real estate investment services. It owns, leases, manages, acquires, finances, develops, and redevelops income-producing real estate properties associated primarily with the delivery of outpatient healthcare services throughout the United States of America. The company was founded by David R.

Featured Articles

Before you consider Healthcare Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Healthcare Realty Trust wasn't on the list.

While Healthcare Realty Trust currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.