GW Henssler & Associates Ltd. grew its holdings in shares of Southern Company (The) (NYSE:SO - Free Report) by 2.1% during the 2nd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 353,005 shares of the utilities provider's stock after acquiring an additional 7,274 shares during the quarter. Southern accounts for approximately 1.7% of GW Henssler & Associates Ltd.'s holdings, making the stock its 11th biggest holding. GW Henssler & Associates Ltd.'s holdings in Southern were worth $32,416,000 at the end of the most recent quarter.

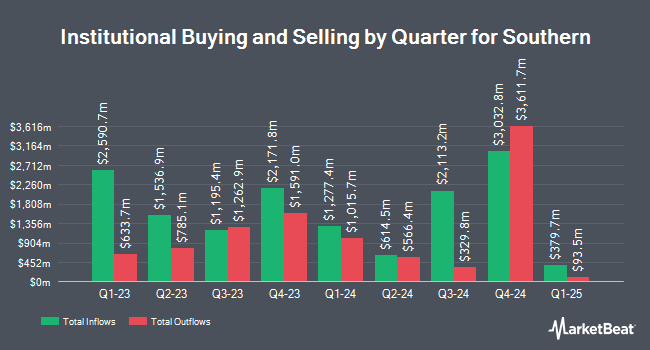

Several other large investors have also recently made changes to their positions in the business. Klein Pavlis & Peasley Financial Inc. purchased a new position in shares of Southern in the second quarter worth $2,352,000. Intech Investment Management LLC boosted its holdings in Southern by 35.8% in the first quarter. Intech Investment Management LLC now owns 116,059 shares of the utilities provider's stock valued at $10,672,000 after acquiring an additional 30,618 shares in the last quarter. Investors Research Corp boosted its holdings in Southern by 1,982.6% in the second quarter. Investors Research Corp now owns 5,623 shares of the utilities provider's stock valued at $516,000 after acquiring an additional 5,353 shares in the last quarter. Czech National Bank boosted its holdings in shares of Southern by 6.8% during the 2nd quarter. Czech National Bank now owns 268,648 shares of the utilities provider's stock valued at $24,670,000 after buying an additional 17,111 shares in the last quarter. Finally, GAMMA Investing LLC boosted its holdings in shares of Southern by 23.2% during the 1st quarter. GAMMA Investing LLC now owns 21,253 shares of the utilities provider's stock valued at $1,954,000 after buying an additional 4,005 shares in the last quarter. 64.10% of the stock is owned by hedge funds and other institutional investors.

Southern Price Performance

NYSE SO opened at $98.23 on Friday. The company has a 50-day moving average price of $93.62 and a 200-day moving average price of $91.73. Southern Company has a 52 week low of $80.46 and a 52 week high of $98.36. The company has a quick ratio of 0.54, a current ratio of 0.74 and a debt-to-equity ratio of 1.69. The firm has a market capitalization of $108.06 billion, a P/E ratio of 25.25, a PEG ratio of 3.40 and a beta of 0.43.

Southern (NYSE:SO - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The utilities provider reported $0.91 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.99 by ($0.08). The business had revenue of $6.97 billion during the quarter, compared to analysts' expectations of $6.70 billion. Southern had a return on equity of 12.09% and a net margin of 15.10%.The business's quarterly revenue was up 7.9% compared to the same quarter last year. During the same period in the previous year, the business posted $1.10 EPS. Southern has set its Q3 2025 guidance at 1.500-1.500 EPS. FY 2025 guidance at 4.200-4.300 EPS. Equities research analysts anticipate that Southern Company will post 4.29 earnings per share for the current year.

Southern Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Monday, September 8th. Investors of record on Monday, August 18th were issued a $0.74 dividend. The ex-dividend date of this dividend was Monday, August 18th. This represents a $2.96 dividend on an annualized basis and a dividend yield of 3.0%. Southern's dividend payout ratio (DPR) is presently 76.09%.

Analyst Ratings Changes

Several research firms have recently issued reports on SO. Scotiabank reaffirmed a "sector perform" rating and issued a $99.00 price target on shares of Southern in a research report on Friday, October 3rd. UBS Group lifted their price target on Southern from $100.00 to $104.00 and gave the stock a "neutral" rating in a research report on Friday. Weiss Ratings reaffirmed a "buy (b)" rating on shares of Southern in a research report on Wednesday. JPMorgan Chase & Co. lifted their price target on Southern from $97.00 to $98.00 and gave the stock a "neutral" rating in a research report on Thursday, August 21st. Finally, Morgan Stanley decreased their target price on Southern from $94.00 to $92.00 and set an "equal weight" rating for the company in a research report on Thursday, September 25th. Four research analysts have rated the stock with a Buy rating, nine have assigned a Hold rating and one has assigned a Sell rating to the stock. Based on data from MarketBeat, Southern currently has a consensus rating of "Hold" and an average price target of $96.31.

View Our Latest Research Report on SO

Insider Activity

In related news, CEO Kimberly S. Greene sold 13,158 shares of the firm's stock in a transaction that occurred on Monday, July 21st. The shares were sold at an average price of $95.00, for a total value of $1,250,010.00. Following the transaction, the chief executive officer owned 93,661 shares of the company's stock, valued at approximately $8,897,795. This trade represents a 12.32% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Insiders own 0.16% of the company's stock.

Southern Profile

(

Free Report)

The Southern Company, through its subsidiaries, engages in the generation, transmission, and distribution of electricity. The company also develops, constructs, acquires, owns, and manages power generation assets, including renewable energy projects and sells electricity in the wholesale market; and distributes natural gas in Illinois, Georgia, Virginia, and Tennessee, as well as provides gas marketing services, gas distribution operations, and gas pipeline investments operations.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Southern, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern wasn't on the list.

While Southern currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.