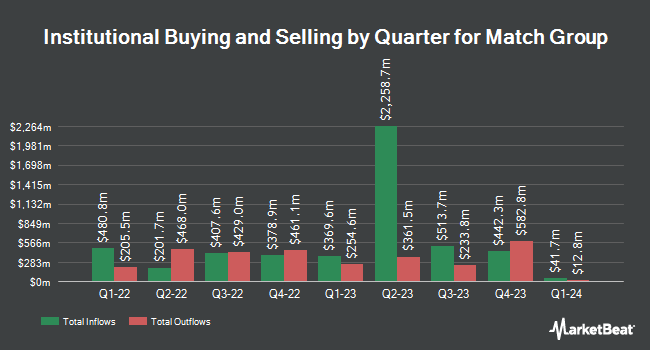

GW Henssler & Associates Ltd. bought a new stake in Match Group Inc. (NASDAQ:MTCH - Free Report) during the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund bought 421,281 shares of the technology company's stock, valued at approximately $13,013,000. GW Henssler & Associates Ltd. owned approximately 0.17% of Match Group at the end of the most recent reporting period.

Other institutional investors and hedge funds have also recently bought and sold shares of the company. MassMutual Private Wealth & Trust FSB grew its stake in Match Group by 56.0% in the second quarter. MassMutual Private Wealth & Trust FSB now owns 1,008 shares of the technology company's stock valued at $31,000 after purchasing an additional 362 shares in the last quarter. NBC Securities Inc. acquired a new stake in shares of Match Group in the first quarter worth about $37,000. SVB Wealth LLC acquired a new stake in shares of Match Group in the first quarter worth about $49,000. Summit Securities Group LLC acquired a new stake in shares of Match Group in the first quarter worth about $54,000. Finally, Parallel Advisors LLC lifted its position in shares of Match Group by 18.5% in the second quarter. Parallel Advisors LLC now owns 2,500 shares of the technology company's stock worth $77,000 after buying an additional 390 shares during the last quarter. Hedge funds and other institutional investors own 94.05% of the company's stock.

Insider Activity at Match Group

In related news, CAO Philip D. Eigenmann sold 6,531 shares of the business's stock in a transaction dated Wednesday, September 3rd. The stock was sold at an average price of $37.52, for a total transaction of $245,043.12. Following the transaction, the chief accounting officer directly owned 23,240 shares in the company, valued at $871,964.80. The trade was a 21.94% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Stephen Bailey sold 12,500 shares of the business's stock in a transaction dated Thursday, August 7th. The shares were sold at an average price of $36.72, for a total value of $459,000.00. Following the transaction, the director owned 8,058 shares in the company, valued at $295,889.76. This represents a 60.80% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 24,454 shares of company stock worth $907,839 over the last three months. Company insiders own 0.64% of the company's stock.

Match Group Stock Performance

NASDAQ MTCH opened at $31.45 on Friday. Match Group Inc. has a twelve month low of $26.39 and a twelve month high of $39.20. The stock has a market capitalization of $7.57 billion, a PE ratio of 15.49, a P/E/G ratio of 0.62 and a beta of 1.38. The stock has a 50-day simple moving average of $36.55 and a 200 day simple moving average of $32.73.

Match Group Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, October 17th. Investors of record on Friday, October 3rd will be paid a dividend of $0.19 per share. This represents a $0.76 annualized dividend and a yield of 2.4%. The ex-dividend date is Friday, October 3rd. Match Group's payout ratio is currently 37.44%.

Analyst Ratings Changes

MTCH has been the subject of a number of analyst reports. UBS Group boosted their price target on Match Group from $31.00 to $35.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 23rd. Weiss Ratings reaffirmed a "hold (c)" rating on shares of Match Group in a research report on Wednesday. Susquehanna boosted their price target on Match Group from $40.00 to $45.00 and gave the stock a "positive" rating in a research report on Thursday, August 7th. JPMorgan Chase & Co. boosted their price target on Match Group from $28.00 to $33.00 and gave the stock a "neutral" rating in a research report on Wednesday, August 6th. Finally, Wells Fargo & Company boosted their price target on Match Group from $31.00 to $32.00 and gave the stock an "equal weight" rating in a research report on Friday, June 27th. Five analysts have rated the stock with a Buy rating and sixteen have assigned a Hold rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $35.44.

Check Out Our Latest Analysis on MTCH

Match Group Profile

(

Free Report)

Match Group, Inc engages in the provision of dating products. Its portfolio of brands includes Tinder, Hinge, Match, Meetic, OkCupid, Pairs, Plenty Of Fish, Azar, BLK, and Hakuna, as well as a various other brands, each built to increase users' likelihood of connecting with others. Its services are available in over 40 languages to users worldwide.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Match Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Match Group wasn't on the list.

While Match Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.