Mitsubishi UFJ Trust & Banking Corp lifted its stake in shares of H World Group Limited Sponsored ADR (NASDAQ:HTHT - Free Report) by 2,301.4% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 3,926,818 shares of the company's stock after acquiring an additional 3,763,295 shares during the quarter. Mitsubishi UFJ Trust & Banking Corp owned approximately 1.28% of H World Group worth $145,332,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

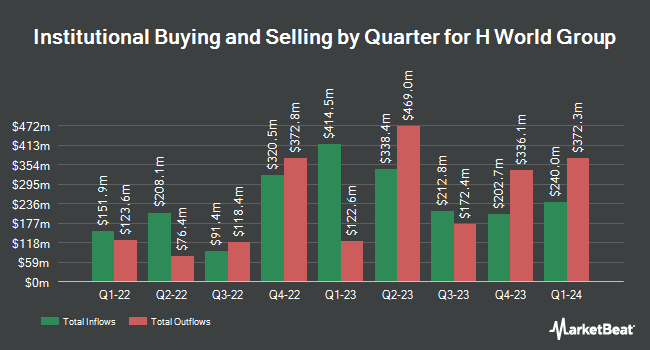

Other hedge funds have also added to or reduced their stakes in the company. Confluence Investment Management LLC acquired a new stake in H World Group in the first quarter valued at approximately $209,000. Greenleaf Trust purchased a new position in shares of H World Group during the first quarter valued at approximately $226,000. US Bancorp DE boosted its position in shares of H World Group by 36.4% during the first quarter. US Bancorp DE now owns 6,600 shares of the company's stock valued at $244,000 after buying an additional 1,761 shares during the last quarter. Mariner LLC boosted its position in H World Group by 33.8% in the fourth quarter. Mariner LLC now owns 8,120 shares of the company's stock worth $268,000 after purchasing an additional 2,050 shares during the last quarter. Finally, Envestnet Asset Management Inc. boosted its position in H World Group by 41.6% in the fourth quarter. Envestnet Asset Management Inc. now owns 9,446 shares of the company's stock worth $312,000 after purchasing an additional 2,774 shares during the last quarter. 46.41% of the stock is currently owned by institutional investors.

H World Group Stock Performance

Shares of NASDAQ:HTHT traded up $1.02 during midday trading on Wednesday, reaching $31.50. 3,556,872 shares of the company traded hands, compared to its average volume of 1,983,830. The company has a quick ratio of 0.88, a current ratio of 0.88 and a debt-to-equity ratio of 0.69. H World Group Limited Sponsored ADR has a 12 month low of $27.36 and a 12 month high of $42.98. The firm has a market capitalization of $9.67 billion, a price-to-earnings ratio of 21.87, a price-to-earnings-growth ratio of 1.17 and a beta of 0.47. The firm's fifty day moving average price is $33.69 and its two-hundred day moving average price is $34.69.

Analyst Upgrades and Downgrades

Separately, JPMorgan Chase & Co. cut their price objective on H World Group from $43.00 to $42.00 and set an "overweight" rating on the stock in a research report on Wednesday, May 21st. Two equities research analysts have rated the stock with a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $40.80.

Read Our Latest Research Report on HTHT

H World Group Profile

(

Free Report)

H World Group Limited develops leased and owned, manachised, and franchised hotels in the People's Republic of China. The company operates hotels under its own brands, such as HanTing Hotel, Ni Hao Hotel, Hi Inn, Elan Hotel, Zleep Hotels, Ibis Hotel, JI Hotel, Orange Hotel, Starway Hotel, Ibis Styles Hotel, CitiGO Hotel, Crystal Orange Hotel, IntercityHotel, Manxin Hotel, Mercure Hotel, Madison Hotel, Novotel Hotel, Joya Hotel, Blossom House, Steigenberger Hotels & Resorts, MAXX by Steigenberger, Jaz in the City, Grand Mercure, Steigenberger Icon, and Song Hotels.

Featured Stories

Before you consider H World Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H World Group wasn't on the list.

While H World Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.