Harvest Fund Management Co. Ltd lifted its position in shares of Take-Two Interactive Software, Inc. (NASDAQ:TTWO - Free Report) by 107.1% in the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 24,985 shares of the company's stock after buying an additional 12,918 shares during the period. Harvest Fund Management Co. Ltd's holdings in Take-Two Interactive Software were worth $5,178,000 as of its most recent SEC filing.

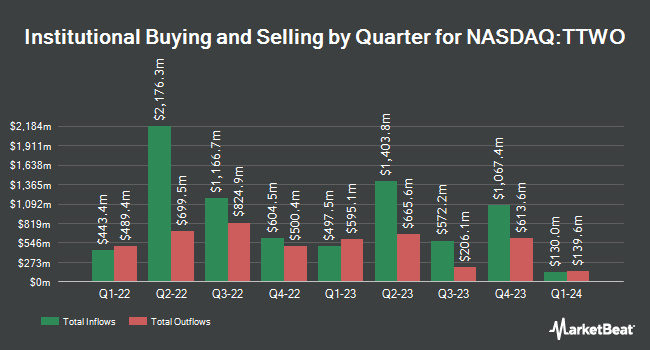

A number of other institutional investors and hedge funds have also made changes to their positions in TTWO. Park Square Financial Group LLC acquired a new stake in Take-Two Interactive Software in the 4th quarter valued at $28,000. North Capital Inc. bought a new position in shares of Take-Two Interactive Software during the first quarter worth about $35,000. Graybill Wealth Management LTD. acquired a new stake in Take-Two Interactive Software during the first quarter worth about $37,000. Cullen Frost Bankers Inc. raised its stake in Take-Two Interactive Software by 46.0% during the first quarter. Cullen Frost Bankers Inc. now owns 181 shares of the company's stock worth $38,000 after acquiring an additional 57 shares during the period. Finally, Itau Unibanco Holding S.A. raised its stake in Take-Two Interactive Software by 41.4% during the fourth quarter. Itau Unibanco Holding S.A. now owns 246 shares of the company's stock worth $45,000 after acquiring an additional 72 shares during the period. 95.46% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

TTWO has been the topic of several analyst reports. Morgan Stanley raised their price target on shares of Take-Two Interactive Software from $210.00 to $265.00 and gave the company an "overweight" rating in a research note on Monday, May 19th. Benchmark raised their price objective on shares of Take-Two Interactive Software from $225.00 to $250.00 and gave the stock a "buy" rating in a research note on Friday, May 16th. Robert W. Baird lifted their target price on shares of Take-Two Interactive Software from $210.00 to $230.00 and gave the company an "outperform" rating in a research note on Friday, May 16th. Wells Fargo & Company began coverage on shares of Take-Two Interactive Software in a research note on Monday. They set an "overweight" rating and a $265.00 target price for the company. Finally, BMO Capital Markets restated an "outperform" rating and set a $236.00 price target (down previously from $240.00) on shares of Take-Two Interactive Software in a report on Monday, May 5th. One investment analyst has rated the stock with a sell rating, one has issued a hold rating, nineteen have assigned a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat, Take-Two Interactive Software currently has an average rating of "Moderate Buy" and an average target price of $234.05.

View Our Latest Analysis on Take-Two Interactive Software

Insider Activity

In other news, Director Ellen F. Siminoff sold 414 shares of the company's stock in a transaction that occurred on Tuesday, July 15th. The shares were sold at an average price of $237.80, for a total value of $98,449.20. Following the completion of the transaction, the director owned 3,290 shares in the company, valued at $782,362. This represents a 11.18% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Daniel P. Emerson sold 27,056 shares of the company's stock in a transaction that occurred on Monday, June 2nd. The shares were sold at an average price of $225.22, for a total transaction of $6,093,552.32. Following the completion of the transaction, the insider owned 152,271 shares of the company's stock, valued at $34,294,474.62. This trade represents a 15.09% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 460,792 shares of company stock worth $104,014,443 over the last three months. Company insiders own 1.45% of the company's stock.

Take-Two Interactive Software Trading Down 0.1%

NASDAQ:TTWO traded down $0.17 during trading hours on Wednesday, hitting $223.81. The stock had a trading volume of 1,511,072 shares, compared to its average volume of 1,632,811. Take-Two Interactive Software, Inc. has a one year low of $135.24 and a one year high of $245.07. The company has a debt-to-equity ratio of 1.18, a quick ratio of 0.78 and a current ratio of 0.78. The company has a market cap of $41.29 billion, a price-to-earnings ratio of -8.81, a P/E/G ratio of 5.75 and a beta of 1.03. The business's 50 day moving average is $233.85 and its 200-day moving average is $217.10.

Take-Two Interactive Software Profile

(

Free Report)

Take-Two Interactive Software, Inc develops, publishes, and markets interactive entertainment solutions for consumers worldwide. It develops and publishes action/adventure products under the Grand Theft Auto, LA Noire, Max Payne, Midnight Club, and Red Dead Redemption names, as well as other franchises.

Featured Articles

Before you consider Take-Two Interactive Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Take-Two Interactive Software wasn't on the list.

While Take-Two Interactive Software currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.