HB Wealth Management LLC grew its stake in Marriott International, Inc. (NASDAQ:MAR - Free Report) by 91.4% during the first quarter, according to its most recent 13F filing with the SEC. The firm owned 11,969 shares of the company's stock after acquiring an additional 5,717 shares during the period. HB Wealth Management LLC's holdings in Marriott International were worth $2,851,000 as of its most recent filing with the SEC.

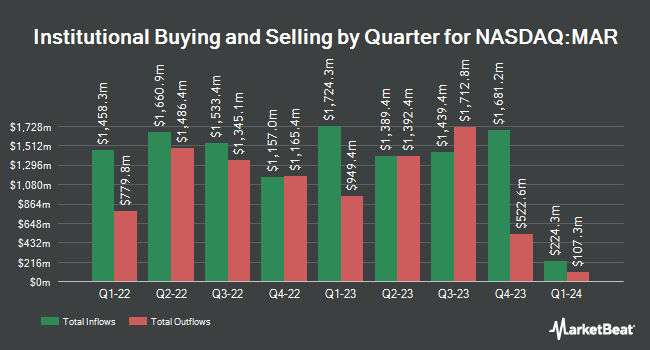

Several other hedge funds have also made changes to their positions in the business. Straightline Group LLC purchased a new stake in Marriott International during the fourth quarter worth approximately $495,000. Sequoia Financial Advisors LLC boosted its position in shares of Marriott International by 11.9% in the 1st quarter. Sequoia Financial Advisors LLC now owns 13,441 shares of the company's stock valued at $3,202,000 after purchasing an additional 1,432 shares during the period. Financial Gravity Asset Management Inc. acquired a new stake in shares of Marriott International in the 1st quarter valued at about $2,244,000. Alpha Cubed Investments LLC acquired a new stake in shares of Marriott International in the 1st quarter valued at about $974,000. Finally, Invesco Ltd. boosted its position in shares of Marriott International by 17.4% in the 4th quarter. Invesco Ltd. now owns 3,469,070 shares of the company's stock valued at $967,662,000 after purchasing an additional 512,963 shares during the period. Institutional investors and hedge funds own 70.70% of the company's stock.

Marriott International Stock Performance

NASDAQ MAR traded down $3.83 during trading hours on Wednesday, hitting $269.64. 662,688 shares of the company's stock were exchanged, compared to its average volume of 1,713,540. The business's 50 day moving average is $268.85 and its 200-day moving average is $262.32. The firm has a market capitalization of $73.85 billion, a P/E ratio of 30.77, a price-to-earnings-growth ratio of 2.64 and a beta of 1.41. Marriott International, Inc. has a 12-month low of $204.55 and a 12-month high of $307.52.

Marriott International (NASDAQ:MAR - Get Free Report) last posted its quarterly earnings data on Tuesday, May 6th. The company reported $2.32 earnings per share for the quarter, beating analysts' consensus estimates of $2.25 by $0.07. Marriott International had a net margin of 9.75% and a negative return on equity of 100.64%. The company had revenue of $6.26 billion during the quarter, compared to analysts' expectations of $6.19 billion. During the same period in the prior year, the company posted $2.13 EPS. The firm's revenue for the quarter was up 4.8% on a year-over-year basis. As a group, equities research analysts anticipate that Marriott International, Inc. will post 10.1 EPS for the current fiscal year.

Marriott International Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, June 30th. Investors of record on Friday, May 23rd were issued a $0.67 dividend. The ex-dividend date was Friday, May 23rd. This represents a $2.68 dividend on an annualized basis and a yield of 0.99%. This is an increase from Marriott International's previous quarterly dividend of $0.63. Marriott International's dividend payout ratio is currently 30.52%.

Insider Activity at Marriott International

In other Marriott International news, insider Rajeev Menon sold 2,500 shares of the firm's stock in a transaction on Tuesday, June 24th. The shares were sold at an average price of $268.28, for a total transaction of $670,700.00. Following the completion of the transaction, the insider directly owned 5,706 shares of the company's stock, valued at $1,530,805.68. This trade represents a 30.47% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Anthony Capuano sold 12,000 shares of the firm's stock in a transaction on Friday, May 30th. The stock was sold at an average price of $263.90, for a total transaction of $3,166,800.00. Following the transaction, the chief executive officer directly owned 124,067 shares of the company's stock, valued at approximately $32,741,281.30. This represents a 8.82% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 15,500 shares of company stock valued at $4,107,710. Insiders own 10.68% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts recently issued reports on MAR shares. Stifel Nicolaus lowered their price target on Marriott International from $295.00 to $240.00 and set a "hold" rating on the stock in a report on Wednesday, April 16th. Truist Financial cut their price target on shares of Marriott International from $300.00 to $273.00 and set a "hold" rating for the company in a report on Friday, May 30th. Robert W. Baird lifted their price objective on Marriott International from $265.00 to $285.00 and gave the company a "neutral" rating in a report on Wednesday, July 16th. BMO Capital Markets lifted their price objective on Marriott International from $250.00 to $265.00 and gave the company a "market perform" rating in a report on Wednesday, May 7th. Finally, Morgan Stanley lowered their price objective on Marriott International from $275.00 to $267.00 and set an "overweight" rating on the stock in a report on Tuesday, April 22nd. Thirteen analysts have rated the stock with a hold rating, seven have issued a buy rating and two have issued a strong buy rating to the stock. Based on data from MarketBeat.com, Marriott International has a consensus rating of "Moderate Buy" and a consensus price target of $276.90.

Check Out Our Latest Analysis on Marriott International

Marriott International Profile

(

Free Report)

Marriott International, Inc engages in operating, franchising, and licensing hotel, residential, timeshare, and other lodging properties worldwide. It operates its properties under the JW Marriott, The Ritz-Carlton, The Luxury Collection, W Hotels, St. Regis, EDITION, Bvlgari, Marriott Hotels, Sheraton, Westin, Autograph Collection, Renaissance Hotels, Le Méridien, Delta Hotels by Marriott, Tribute Portfolio, Gaylord Hotels, Design Hotels, Marriott Executive Apartments, Apartments by Marriott Bonvoy, Courtyard by Marriott, Fairfield by Marriott, Residence Inn by Marriott, SpringHill Suites by Marriott, Four Points by Sheraton, TownePlace Suites by Marriott, Aloft Hotels, AC Hotels by Marriott, Moxy Hotels, Element Hotels, Protea Hotels by Marriott, City Express by Marriott, and St.

Featured Articles

Before you consider Marriott International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marriott International wasn't on the list.

While Marriott International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report