HB Wealth Management LLC raised its position in shares of Transdigm Group Incorporated (NYSE:TDG - Free Report) by 666.5% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 5,603 shares of the aerospace company's stock after purchasing an additional 4,872 shares during the period. HB Wealth Management LLC's holdings in Transdigm Group were worth $7,751,000 as of its most recent filing with the Securities and Exchange Commission.

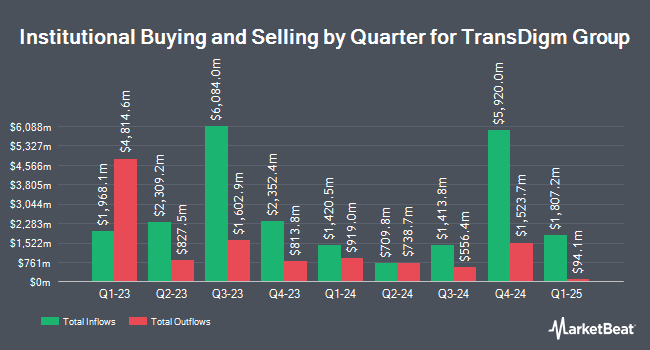

Several other institutional investors and hedge funds have also bought and sold shares of TDG. Mediolanum International Funds Ltd raised its position in shares of Transdigm Group by 0.9% in the first quarter. Mediolanum International Funds Ltd now owns 6,662 shares of the aerospace company's stock valued at $9,175,000 after purchasing an additional 59 shares during the period. Phoenix Financial Ltd. bought a new stake in shares of Transdigm Group in the first quarter valued at approximately $6,801,000. Prescott Group Capital Management L.L.C. bought a new stake in shares of Transdigm Group in the first quarter valued at approximately $289,000. AM Investment Strategies LLC bought a new stake in shares of Transdigm Group in the first quarter valued at approximately $730,000. Finally, Equitable Trust Co. raised its position in shares of Transdigm Group by 8.3% in the first quarter. Equitable Trust Co. now owns 5,887 shares of the aerospace company's stock valued at $8,143,000 after purchasing an additional 450 shares during the period. 95.78% of the stock is owned by institutional investors.

Insider Transactions at Transdigm Group

In other news, COO Joel Reiss sold 3,000 shares of the firm's stock in a transaction dated Tuesday, May 20th. The stock was sold at an average price of $1,434.35, for a total value of $4,303,050.00. Following the transaction, the chief operating officer owned 3,600 shares of the company's stock, valued at $5,163,660. This trade represents a 45.45% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CFO Sarah Wynne sold 3,200 shares of the company's stock in a transaction on Thursday, June 12th. The stock was sold at an average price of $1,452.15, for a total transaction of $4,646,880.00. Following the transaction, the chief financial officer owned 3,400 shares of the company's stock, valued at approximately $4,937,310. This represents a 48.48% decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 119,113 shares of company stock valued at $173,419,391. Company insiders own 4.09% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have recently issued reports on the stock. Northcoast Research raised shares of Transdigm Group from a "neutral" rating to a "buy" rating and set a $1,500.00 price target on the stock in a research report on Wednesday, April 9th. Truist Financial boosted their price target on shares of Transdigm Group from $1,553.00 to $1,730.00 and gave the company a "buy" rating in a research report on Friday, July 11th. Citigroup boosted their price objective on shares of Transdigm Group from $1,635.00 to $1,795.00 and gave the company a "buy" rating in a research note on Monday, July 14th. Susquehanna increased their target price on shares of Transdigm Group from $1,300.00 to $1,600.00 and gave the stock a "neutral" rating in a research note on Monday, July 14th. Finally, Stifel Nicolaus started coverage on shares of Transdigm Group in a research note on Tuesday, June 24th. They issued a "buy" rating and a $1,710.00 target price on the stock. Four analysts have rated the stock with a hold rating and twelve have issued a buy rating to the stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $1,606.47.

Check Out Our Latest Report on TDG

Transdigm Group Price Performance

Shares of TDG traded up $16.48 on Wednesday, reaching $1,623.17. The company's stock had a trading volume of 43,288 shares, compared to its average volume of 271,345. The stock has a market capitalization of $91.17 billion, a P/E ratio of 54.80, a PEG ratio of 3.25 and a beta of 1.04. The stock's 50 day simple moving average is $1,496.66 and its two-hundred day simple moving average is $1,400.72. Transdigm Group Incorporated has a 12-month low of $1,176.31 and a 12-month high of $1,622.85.

Transdigm Group (NYSE:TDG - Get Free Report) last posted its quarterly earnings data on Tuesday, May 6th. The aerospace company reported $9.11 EPS for the quarter, topping the consensus estimate of $8.83 by $0.28. Transdigm Group had a negative return on equity of 38.71% and a net margin of 21.09%. The firm had revenue of $2.15 billion for the quarter, compared to the consensus estimate of $2.17 billion. During the same quarter last year, the company earned $7.99 earnings per share. The business's revenue for the quarter was up 12.0% compared to the same quarter last year. Analysts expect that Transdigm Group Incorporated will post 35.13 earnings per share for the current year.

Transdigm Group Company Profile

(

Free Report)

TransDigm Group Incorporated designs, produces, and supplies aircraft components in the United States and internationally. The Power & Control segment offers mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric motors and generators, batteries and chargers, databus and power controls, sensor products, switches and relay panels, hoists, winches and lifting devices, and cargo loading and handling systems.

Featured Articles

Before you consider Transdigm Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transdigm Group wasn't on the list.

While Transdigm Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report