Oak Thistle LLC boosted its stake in HCA Healthcare, Inc. (NYSE:HCA - Free Report) by 36.6% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 9,615 shares of the company's stock after buying an additional 2,575 shares during the period. HCA Healthcare accounts for approximately 0.7% of Oak Thistle LLC's portfolio, making the stock its 23rd largest position. Oak Thistle LLC's holdings in HCA Healthcare were worth $3,322,000 at the end of the most recent reporting period.

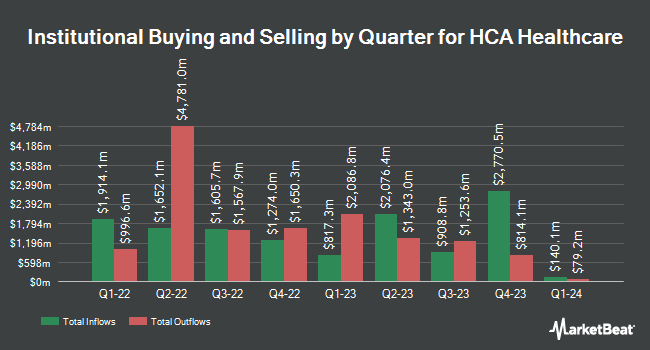

Several other institutional investors and hedge funds have also bought and sold shares of the stock. Atwood & Palmer Inc. bought a new position in shares of HCA Healthcare during the first quarter valued at approximately $28,000. Bartlett & CO. Wealth Management LLC increased its stake in shares of HCA Healthcare by 888.9% during the first quarter. Bartlett & CO. Wealth Management LLC now owns 89 shares of the company's stock valued at $31,000 after purchasing an additional 80 shares in the last quarter. ORG Partners LLC increased its stake in shares of HCA Healthcare by 344.0% during the first quarter. ORG Partners LLC now owns 111 shares of the company's stock valued at $38,000 after purchasing an additional 86 shares in the last quarter. Migdal Insurance & Financial Holdings Ltd. increased its stake in shares of HCA Healthcare by 75.8% during the first quarter. Migdal Insurance & Financial Holdings Ltd. now owns 116 shares of the company's stock valued at $40,000 after purchasing an additional 50 shares in the last quarter. Finally, Legacy Investment Solutions LLC increased its position in shares of HCA Healthcare by 99.0% during the fourth quarter. Legacy Investment Solutions LLC now owns 191 shares of the company's stock valued at $62,000 after acquiring an additional 95 shares in the last quarter. 62.73% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at HCA Healthcare

In other news, COO Jon M. Foster sold 15,698 shares of the business's stock in a transaction dated Tuesday, May 13th. The shares were sold at an average price of $369.32, for a total value of $5,797,585.36. Following the sale, the chief operating officer directly owned 12,646 shares in the company, valued at $4,670,420.72. The trade was a 55.38% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Corporate insiders own 1.30% of the company's stock.

HCA Healthcare Price Performance

Shares of HCA traded down $7.22 during trading hours on Friday, reaching $334.26. 3,175,863 shares of the stock traded hands, compared to its average volume of 1,334,458. The company has a current ratio of 1.19, a quick ratio of 1.06 and a debt-to-equity ratio of 69.07. HCA Healthcare, Inc. has a 52-week low of $289.98 and a 52-week high of $417.14. The company's 50-day moving average price is $373.81 and its two-hundred day moving average price is $345.68. The company has a market cap of $80.41 billion, a P/E ratio of 14.86, a price-to-earnings-growth ratio of 1.19 and a beta of 1.47.

HCA Healthcare (NYSE:HCA - Get Free Report) last released its earnings results on Friday, July 25th. The company reported $6.84 earnings per share for the quarter, beating analysts' consensus estimates of $6.20 by $0.64. HCA Healthcare had a net margin of 8.07% and a return on equity of 1,063.91%. The company had revenue of $18.61 billion for the quarter, compared to analysts' expectations of $18.49 billion. During the same quarter in the previous year, the company earned $5.50 EPS. HCA Healthcare's revenue for the quarter was up 6.4% on a year-over-year basis. On average, analysts anticipate that HCA Healthcare, Inc. will post 24.98 earnings per share for the current year.

HCA Healthcare Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Tuesday, September 16th will be issued a $0.72 dividend. This represents a $2.88 dividend on an annualized basis and a yield of 0.86%. HCA Healthcare's dividend payout ratio is currently 12.81%.

Wall Street Analysts Forecast Growth

Several equities research analysts recently weighed in on HCA shares. Bank of America downgraded shares of HCA Healthcare from a "buy" rating to a "neutral" rating and set a $394.00 price target for the company. in a research report on Wednesday, July 16th. Wells Fargo & Company raised shares of HCA Healthcare from an "underweight" rating to an "equal weight" rating and raised their price target for the company from $320.00 to $385.00 in a research report on Thursday, May 29th. Royal Bank Of Canada restated an "outperform" rating and issued a $404.00 target price (up previously from $376.00) on shares of HCA Healthcare in a report on Monday, June 23rd. Guggenheim initiated coverage on shares of HCA Healthcare in a report on Wednesday, April 9th. They issued a "neutral" rating on the stock. Finally, Stephens upgraded shares of HCA Healthcare to a "strong-buy" rating in a report on Monday, June 2nd. Eight analysts have rated the stock with a hold rating, nine have given a buy rating and two have issued a strong buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $399.46.

Get Our Latest Analysis on HCA

HCA Healthcare Profile

(

Free Report)

HCA Healthcare, Inc, through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States. It operates general and acute care hospitals that offers medical and surgical services, including inpatient care, intensive care, cardiac care, diagnostic, and emergency services; and outpatient services, such as outpatient surgery, laboratory, radiology, respiratory therapy, cardiology, and physical therapy.

Featured Articles

Before you consider HCA Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HCA Healthcare wasn't on the list.

While HCA Healthcare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.