HighPoint Advisor Group LLC grew its holdings in shares of Amazon.com, Inc. (NASDAQ:AMZN - Free Report) by 1.0% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 327,418 shares of the e-commerce giant's stock after purchasing an additional 3,133 shares during the quarter. Amazon.com makes up 3.6% of HighPoint Advisor Group LLC's investment portfolio, making the stock its 4th largest holding. HighPoint Advisor Group LLC's holdings in Amazon.com were worth $61,355,000 as of its most recent SEC filing.

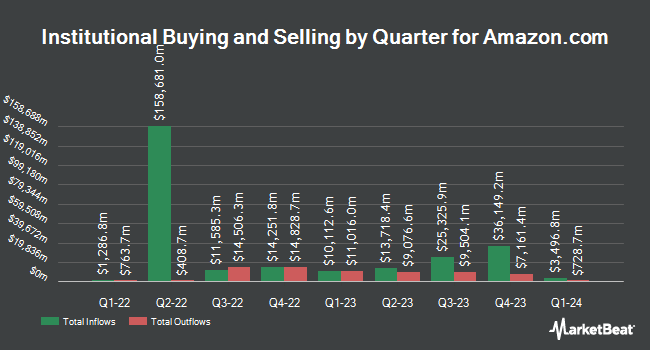

Several other large investors have also recently made changes to their positions in AMZN. Norges Bank purchased a new stake in shares of Amazon.com during the 4th quarter valued at $27,266,582,000. GAMMA Investing LLC increased its position in shares of Amazon.com by 21,420.5% during the 1st quarter. GAMMA Investing LLC now owns 30,245,061 shares of the e-commerce giant's stock valued at $5,754,425,000 after purchasing an additional 30,104,520 shares during the last quarter. Capital World Investors increased its position in shares of Amazon.com by 36.8% during the 4th quarter. Capital World Investors now owns 65,709,496 shares of the e-commerce giant's stock valued at $14,416,078,000 after purchasing an additional 17,681,004 shares during the last quarter. Vanguard Group Inc. grew its stake in shares of Amazon.com by 2.2% during the 4th quarter. Vanguard Group Inc. now owns 823,360,597 shares of the e-commerce giant's stock worth $180,637,081,000 after acquiring an additional 17,635,391 shares during the period. Finally, Capital International Investors grew its stake in shares of Amazon.com by 26.5% during the 4th quarter. Capital International Investors now owns 57,268,523 shares of the e-commerce giant's stock worth $12,564,961,000 after acquiring an additional 12,000,745 shares during the period. 72.20% of the stock is owned by hedge funds and other institutional investors.

Amazon.com Price Performance

Shares of AMZN traded up $6.6690 during trading hours on Friday, reaching $228.6190. 23,563,066 shares of the company's stock traded hands, compared to its average volume of 44,459,570. The stock has a market cap of $2.44 trillion, a PE ratio of 34.82, a price-to-earnings-growth ratio of 1.51 and a beta of 1.31. The company has a current ratio of 1.02, a quick ratio of 0.81 and a debt-to-equity ratio of 0.15. The firm's 50 day simple moving average is $222.30 and its 200-day simple moving average is $208.35. Amazon.com, Inc. has a 12 month low of $161.38 and a 12 month high of $242.52.

Amazon.com (NASDAQ:AMZN - Get Free Report) last released its earnings results on Thursday, July 31st. The e-commerce giant reported $1.68 earnings per share for the quarter, topping analysts' consensus estimates of $1.31 by $0.37. The company had revenue of $167.70 billion during the quarter, compared to the consensus estimate of $161.80 billion. Amazon.com had a return on equity of 23.84% and a net margin of 10.54%.Amazon.com's quarterly revenue was up 13.3% compared to the same quarter last year. During the same quarter in the previous year, the company posted $1.26 EPS. Amazon.com has set its Q3 2025 guidance at EPS. Equities analysts expect that Amazon.com, Inc. will post 6.31 EPS for the current year.

Analyst Upgrades and Downgrades

AMZN has been the subject of several research reports. Monness Crespi & Hardt increased their price target on Amazon.com from $265.00 to $275.00 and gave the stock a "buy" rating in a research note on Friday, August 1st. Canaccord Genuity Group reiterated a "buy" rating and set a $280.00 price target on shares of Amazon.com in a research note on Friday, August 1st. Morgan Stanley reiterated an "overweight" rating and set a $300.00 price target on shares of Amazon.com in a research note on Thursday, August 14th. Scotiabank increased their price target on Amazon.com from $250.00 to $275.00 and gave the stock a "sector outperform" rating in a research note on Tuesday, July 22nd. Finally, Piper Sandler raised their target price on Amazon.com from $250.00 to $255.00 and gave the stock an "overweight" rating in a research note on Friday, August 1st. Two investment analysts have rated the stock with a Strong Buy rating, forty-six have assigned a Buy rating and two have given a Hold rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Buy" and an average price target of $262.87.

Read Our Latest Analysis on AMZN

Insider Buying and Selling

In related news, CEO Douglas J. Herrington sold 4,784 shares of the business's stock in a transaction that occurred on Friday, August 15th. The stock was sold at an average price of $232.32, for a total value of $1,111,418.88. Following the completion of the sale, the chief executive officer owned 510,255 shares in the company, valued at $118,542,441.60. The trade was a 0.93% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, insider Jeffrey P. Bezos sold 2,643,142 shares of the business's stock in a transaction that occurred on Thursday, July 24th. The stock was sold at an average price of $230.43, for a total value of $609,059,211.06. Following the completion of the sale, the insider owned 883,779,901 shares of the company's stock, valued at $203,649,402,587.43. The trade was a 0.30% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 25,012,284 shares of company stock valued at $5,656,976,492 in the last 90 days. 9.70% of the stock is currently owned by corporate insiders.

Amazon.com Profile

(

Free Report)

Amazon.com, Inc engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS). It also manufactures and sells electronic devices, including Kindle, Fire tablets, Fire TVs, Echo, Ring, Blink, and eero; and develops and produces media content.

Further Reading

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report