Hotchkis & Wiley Capital Management LLC increased its stake in APA Corporation (NASDAQ:APA - Free Report) by 2.9% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 36,439,749 shares of the company's stock after acquiring an additional 1,029,961 shares during the period. APA makes up approximately 2.6% of Hotchkis & Wiley Capital Management LLC's investment portfolio, making the stock its 7th biggest position. Hotchkis & Wiley Capital Management LLC owned approximately 10.08% of APA worth $765,964,000 at the end of the most recent reporting period.

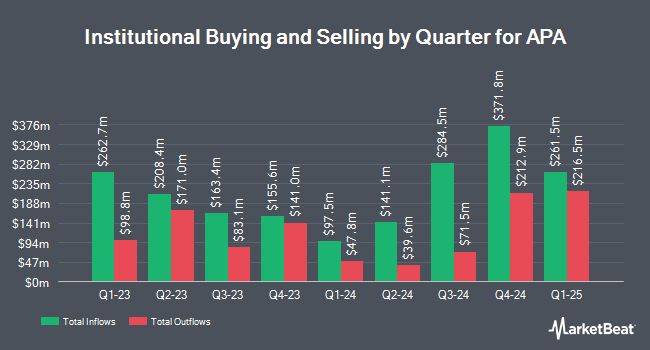

Several other institutional investors and hedge funds have also made changes to their positions in APA. Dimensional Fund Advisors LP boosted its holdings in shares of APA by 46.8% in the first quarter. Dimensional Fund Advisors LP now owns 9,080,787 shares of the company's stock valued at $190,876,000 after acquiring an additional 2,894,543 shares in the last quarter. Freestone Grove Partners LP bought a new position in shares of APA in the fourth quarter valued at approximately $30,767,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its holdings in shares of APA by 29.1% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 5,297,871 shares of the company's stock valued at $122,328,000 after acquiring an additional 1,195,212 shares in the last quarter. Nuveen LLC bought a new position in shares of APA in the first quarter valued at approximately $22,533,000. Finally, Charles Schwab Investment Management Inc. boosted its holdings in shares of APA by 8.1% in the first quarter. Charles Schwab Investment Management Inc. now owns 13,932,980 shares of the company's stock valued at $292,871,000 after acquiring an additional 1,046,893 shares in the last quarter. 83.01% of the stock is currently owned by institutional investors.

APA Trading Up 2.1%

APA stock traded up $0.47 during midday trading on Wednesday, reaching $22.59. The stock had a trading volume of 5,232,427 shares, compared to its average volume of 7,967,687. The firm's fifty day simple moving average is $19.56 and its two-hundred day simple moving average is $18.92. APA Corporation has a twelve month low of $13.58 and a twelve month high of $29.47. The company has a debt-to-equity ratio of 0.62, a current ratio of 0.80 and a quick ratio of 0.80. The firm has a market cap of $8.08 billion, a price-to-earnings ratio of 7.56, a PEG ratio of 6.58 and a beta of 1.23.

APA (NASDAQ:APA - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The company reported $0.87 EPS for the quarter, topping analysts' consensus estimates of $0.45 by $0.42. APA had a net margin of 10.53% and a return on equity of 20.98%. The firm had revenue of $2.18 billion during the quarter, compared to analyst estimates of $2.03 billion. During the same quarter last year, the business posted $1.17 EPS. The company's revenue was down 14.4% on a year-over-year basis. Equities analysts anticipate that APA Corporation will post 4.03 EPS for the current fiscal year.

Analysts Set New Price Targets

APA has been the subject of several recent analyst reports. Roth Capital cut shares of APA from a "buy" rating to a "neutral" rating and set a $22.00 price objective for the company. in a report on Wednesday, August 13th. Scotiabank restated a "sector perform" rating and set a $22.00 target price (up from $14.00) on shares of APA in a report on Friday, July 11th. Argus upgraded shares of APA to a "hold" rating in a report on Friday, May 16th. Royal Bank Of Canada reduced their target price on shares of APA from $24.00 to $22.00 and set a "sector perform" rating for the company in a report on Monday, July 14th. Finally, Morgan Stanley raised their target price on shares of APA from $22.00 to $23.00 and gave the stock an "underweight" rating in a report on Monday, August 18th. Three research analysts have rated the stock with a Buy rating, fourteen have assigned a Hold rating and three have assigned a Sell rating to the stock. According to MarketBeat, APA has an average rating of "Hold" and a consensus price target of $23.72.

Check Out Our Latest Research Report on APA

About APA

(

Free Report)

APA Corporation, an independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids. It has oil and gas operations in the United States, Egypt, and North Sea. The company also has exploration and appraisal activities in Suriname, as well as holds interests in projects located in Uruguay and internationally.

Further Reading

Before you consider APA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and APA wasn't on the list.

While APA currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.