Hsbc Holdings PLC trimmed its stake in shares of MP Materials Corp. (NYSE:MP - Free Report) by 25.9% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 463,314 shares of the company's stock after selling 162,061 shares during the period. Hsbc Holdings PLC owned 0.28% of MP Materials worth $11,053,000 at the end of the most recent quarter.

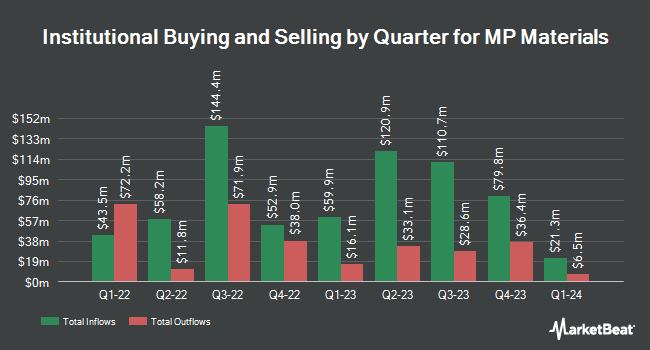

Several other hedge funds and other institutional investors have also added to or reduced their stakes in MP. Price T Rowe Associates Inc. MD lifted its holdings in MP Materials by 44.3% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 6,537,511 shares of the company's stock valued at $101,986,000 after purchasing an additional 2,005,505 shares in the last quarter. BNP Paribas Financial Markets purchased a new position in MP Materials during the fourth quarter valued at $14,886,000. Vanguard Group Inc. lifted its holdings in MP Materials by 7.4% during the first quarter. Vanguard Group Inc. now owns 13,662,567 shares of the company's stock valued at $333,503,000 after purchasing an additional 942,105 shares in the last quarter. Invesco Ltd. lifted its holdings in MP Materials by 25.3% during the first quarter. Invesco Ltd. now owns 2,655,102 shares of the company's stock valued at $64,811,000 after purchasing an additional 536,522 shares in the last quarter. Finally, Two Sigma Advisers LP purchased a new position in MP Materials during the fourth quarter valued at $5,524,000. 52.55% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of brokerages have recently commented on MP. Jefferies Financial Group upgraded shares of MP Materials from a "hold" rating to a "buy" rating and set a $80.00 target price for the company in a research report on Friday, August 1st. Cfra Research upgraded shares of MP Materials to a "moderate buy" rating in a research report on Monday, August 11th. Wall Street Zen upgraded shares of MP Materials from a "sell" rating to a "hold" rating in a research report on Saturday, July 26th. Morgan Stanley set a $65.00 target price on shares of MP Materials and gave the company an "equal weight" rating in a research report on Thursday, July 31st. Finally, JPMorgan Chase & Co. raised their price objective on shares of MP Materials from $18.00 to $64.00 and gave the stock a "neutral" rating in a research report on Monday, July 21st. Five equities research analysts have rated the stock with a Buy rating and four have issued a Hold rating to the company's stock. According to data from MarketBeat, MP Materials presently has an average rating of "Moderate Buy" and a consensus price target of $60.63.

View Our Latest Stock Report on MP

MP Materials Trading Up 2.0%

Shares of MP traded up $1.37 during trading on Wednesday, reaching $71.20. 5,611,811 shares of the company traded hands, compared to its average volume of 9,321,982. MP Materials Corp. has a twelve month low of $12.31 and a twelve month high of $82.50. The stock has a market cap of $12.61 billion, a PE ratio of -112.90 and a beta of 2.30. The stock has a 50-day simple moving average of $54.87 and a 200-day simple moving average of $34.89. The company has a quick ratio of 3.12, a current ratio of 3.60 and a debt-to-equity ratio of 0.83.

MP Materials (NYSE:MP - Get Free Report) last announced its quarterly earnings results on Thursday, August 7th. The company reported ($0.13) earnings per share for the quarter, beating analysts' consensus estimates of ($0.16) by $0.03. MP Materials had a negative net margin of 41.87% and a negative return on equity of 9.34%. The business had revenue of $57.39 million during the quarter, compared to analysts' expectations of $44.84 million. During the same period last year, the business earned ($0.17) earnings per share. The business's revenue for the quarter was up 83.6% on a year-over-year basis. On average, analysts anticipate that MP Materials Corp. will post -0.19 earnings per share for the current year.

MP Materials Company Profile

(

Free Report)

MP Materials Corp., together with its subsidiaries, produces rare earth materials. The company owns and operates the Mountain Pass Rare Earth mine and processing facility in North America. It holds the mineral rights to the Mountain Pass mine and surrounding areas, as well as intellectual property rights related to the processing and development of rare earth minerals.

Featured Articles

Before you consider MP Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MP Materials wasn't on the list.

While MP Materials currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.