State of New Jersey Common Pension Fund D lessened its holdings in shares of Humana Inc. (NYSE:HUM - Free Report) by 7.2% in the first quarter, according to its most recent filing with the SEC. The firm owned 40,992 shares of the insurance provider's stock after selling 3,166 shares during the quarter. State of New Jersey Common Pension Fund D's holdings in Humana were worth $10,846,000 as of its most recent SEC filing.

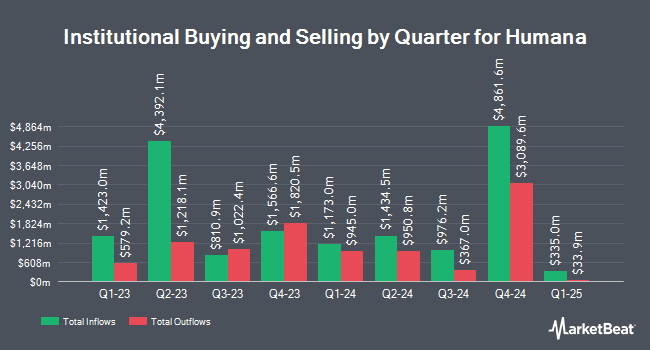

A number of other institutional investors also recently added to or reduced their stakes in the business. Cary Street Partners Investment Advisory LLC lifted its holdings in shares of Humana by 63.9% in the first quarter. Cary Street Partners Investment Advisory LLC now owns 118 shares of the insurance provider's stock valued at $31,000 after buying an additional 46 shares during the period. Applied Finance Capital Management LLC lifted its holdings in shares of Humana by 1.7% in the first quarter. Applied Finance Capital Management LLC now owns 2,943 shares of the insurance provider's stock valued at $779,000 after buying an additional 48 shares during the period. Achmea Investment Management B.V. lifted its holdings in shares of Humana by 0.5% in the first quarter. Achmea Investment Management B.V. now owns 10,379 shares of the insurance provider's stock valued at $2,746,000 after buying an additional 49 shares during the period. Beech Hill Advisors Inc. lifted its holdings in shares of Humana by 6.1% in the first quarter. Beech Hill Advisors Inc. now owns 865 shares of the insurance provider's stock valued at $229,000 after buying an additional 50 shares during the period. Finally, Townsquare Capital LLC lifted its holdings in shares of Humana by 2.8% in the first quarter. Townsquare Capital LLC now owns 2,255 shares of the insurance provider's stock valued at $597,000 after buying an additional 61 shares during the period. Institutional investors and hedge funds own 92.38% of the company's stock.

Humana Stock Performance

Shares of HUM stock opened at $286.73 on Friday. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.95 and a quick ratio of 1.95. Humana Inc. has a fifty-two week low of $206.87 and a fifty-two week high of $382.72. The stock's 50-day moving average is $242.70 and its two-hundred day moving average is $253.54. The firm has a market cap of $34.49 billion, a P/E ratio of 22.01, a PEG ratio of 1.68 and a beta of 0.44.

Humana (NYSE:HUM - Get Free Report) last issued its earnings results on Wednesday, July 30th. The insurance provider reported $6.27 earnings per share for the quarter, missing the consensus estimate of $6.32 by ($0.05). Humana had a return on equity of 13.67% and a net margin of 1.28%. The firm had revenue of $32.39 billion during the quarter, compared to analyst estimates of $31.85 billion. During the same period in the previous year, the company earned $6.96 earnings per share. The business's revenue for the quarter was up 9.6% on a year-over-year basis. Analysts predict that Humana Inc. will post 16.47 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

HUM has been the subject of several research analyst reports. Oppenheimer upped their price objective on Humana from $300.00 to $310.00 and gave the company an "outperform" rating in a report on Thursday, May 1st. Raymond James Financial upgraded Humana from a "market perform" rating to an "outperform" rating and set a $315.00 price objective for the company in a report on Thursday, May 1st. Truist Financial cut their target price on Humana from $280.00 to $260.00 and set a "hold" rating on the stock in a research report on Wednesday, July 16th. Morgan Stanley cut their target price on Humana from $290.00 to $277.00 and set an "equal weight" rating on the stock in a research report on Thursday, July 31st. Finally, Piper Sandler cut their target price on Humana from $288.00 to $272.00 and set a "neutral" rating on the stock in a research report on Thursday, July 31st. Seventeen analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $281.43.

Get Our Latest Stock Analysis on Humana

Humana Company Profile

(

Free Report)

Humana Inc, together with its subsidiaries, provides medical and specialty insurance products in the United States. It operates through two segments, Insurance and CenterWell. The company offers medical and supplemental benefit plans to individuals. It has a contract with Centers for Medicare and Medicaid Services to administer the Limited Income Newly Eligible Transition prescription drug plan program; and contracts with various states to provide Medicaid, dual eligible, and long-term support services benefits.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Humana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Humana wasn't on the list.

While Humana currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.