Hussman Strategic Advisors Inc. increased its position in EchoStar Corporation (NASDAQ:SATS - Free Report) by 20.0% in the 1st quarter, according to its most recent 13F filing with the SEC. The firm owned 126,000 shares of the communications equipment provider's stock after buying an additional 21,000 shares during the period. EchoStar comprises approximately 0.8% of Hussman Strategic Advisors Inc.'s holdings, making the stock its 21st largest position. Hussman Strategic Advisors Inc.'s holdings in EchoStar were worth $3,223,000 at the end of the most recent quarter.

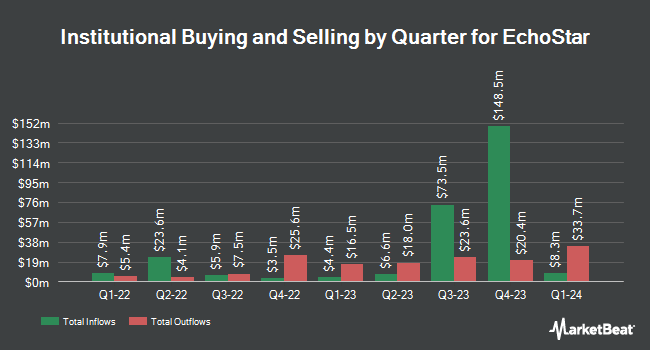

Other hedge funds also recently bought and sold shares of the company. Farther Finance Advisors LLC increased its holdings in EchoStar by 8,125.0% in the 1st quarter. Farther Finance Advisors LLC now owns 987 shares of the communications equipment provider's stock valued at $25,000 after acquiring an additional 975 shares during the last quarter. Fifth Third Bancorp lifted its position in EchoStar by 44.5% during the first quarter. Fifth Third Bancorp now owns 1,841 shares of the communications equipment provider's stock valued at $47,000 after purchasing an additional 567 shares during the last quarter. State of Wyoming bought a new position in EchoStar during the fourth quarter valued at $47,000. GAMMA Investing LLC lifted its position in EchoStar by 39.6% during the first quarter. GAMMA Investing LLC now owns 3,441 shares of the communications equipment provider's stock valued at $88,000 after purchasing an additional 976 shares during the last quarter. Finally, Quarry LP lifted its position in EchoStar by 8,906.7% during the fourth quarter. Quarry LP now owns 4,053 shares of the communications equipment provider's stock valued at $93,000 after purchasing an additional 4,008 shares during the last quarter. Institutional investors own 33.62% of the company's stock.

Analysts Set New Price Targets

Separately, Citigroup increased their price objective on shares of EchoStar from $27.00 to $28.50 and gave the company a "neutral" rating in a research report on Monday, June 23rd. Two analysts have rated the stock with a sell rating, four have issued a hold rating and one has assigned a buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Hold" and an average price target of $24.70.

Get Our Latest Stock Analysis on EchoStar

EchoStar Trading Down 0.2%

SATS stock traded down $0.05 during mid-day trading on Monday, reaching $28.56. 301,417 shares of the stock traded hands, compared to its average volume of 2,344,677. The company has a debt-to-equity ratio of 1.26, a quick ratio of 1.19 and a current ratio of 1.26. EchoStar Corporation has a one year low of $14.79 and a one year high of $33.04. The stock has a market capitalization of $8.21 billion, a PE ratio of -38.18 and a beta of 0.90. The business has a 50-day moving average price of $23.80 and a two-hundred day moving average price of $25.07.

EchoStar (NASDAQ:SATS - Get Free Report) last released its earnings results on Friday, May 9th. The communications equipment provider reported ($0.71) earnings per share for the quarter, topping the consensus estimate of ($0.90) by $0.19. The business had revenue of $3.87 billion during the quarter, compared to the consensus estimate of $3.87 billion. EchoStar had a negative return on equity of 1.08% and a negative net margin of 1.37%. The business's revenue for the quarter was down 3.6% compared to the same quarter last year. During the same period last year, the company earned ($0.40) earnings per share. Equities research analysts expect that EchoStar Corporation will post -1.99 EPS for the current year.

EchoStar Company Profile

(

Free Report)

EchoStar Corporation, together with its subsidiaries, provides networking technologies and services worldwide. The company operates in four segments: Pay-TV, Retail Wireless, 5G Network Deployment, Broadband and Satellite Services. The Pay-TV segment offers a direct broadcast and fixed satellite services; designs, develops, and distributes receiver system; and provides digital broadcast operations, including satellite uplinking/downlinking, transmission and, other services to third-party pay-TV providers; and multichannel, live-linear and on-demand streaming over-the-top internet-based domestic, international, Latino, and Freestream video programming services under the DISH and SLING brand names.

Read More

Before you consider EchoStar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EchoStar wasn't on the list.

While EchoStar currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.