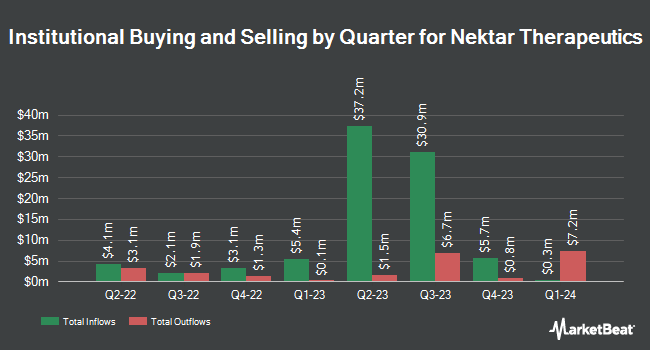

Ieq Capital LLC increased its position in Nektar Therapeutics (NASDAQ:NKTR - Free Report) by 2,435.4% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 557,222 shares of the biopharmaceutical company's stock after purchasing an additional 535,244 shares during the period. Ieq Capital LLC owned approximately 0.30% of Nektar Therapeutics worth $379,000 at the end of the most recent reporting period.

Other hedge funds also recently bought and sold shares of the company. US Asset Management LLC bought a new position in Nektar Therapeutics in the 4th quarter worth about $31,000. Algert Global LLC bought a new position in Nektar Therapeutics in the 1st quarter worth about $33,000. US Bancorp DE boosted its stake in Nektar Therapeutics by 257.8% in the 1st quarter. US Bancorp DE now owns 50,085 shares of the biopharmaceutical company's stock worth $34,000 after purchasing an additional 36,085 shares in the last quarter. Wealth Enhancement Advisory Services LLC bought a new position in Nektar Therapeutics in the 1st quarter worth about $41,000. Finally, ProShare Advisors LLC boosted its stake in Nektar Therapeutics by 49.0% in the 4th quarter. ProShare Advisors LLC now owns 50,277 shares of the biopharmaceutical company's stock worth $47,000 after purchasing an additional 16,543 shares in the last quarter. Institutional investors own 75.88% of the company's stock.

Nektar Therapeutics Trading Down 0.8%

Nektar Therapeutics stock traded down $0.39 during midday trading on Wednesday, hitting $48.18. The stock had a trading volume of 1,653,916 shares, compared to its average volume of 950,617. The firm's fifty day moving average is $27.08 and its two-hundred day moving average is $17.02. The company has a market capitalization of $916.38 million, a PE ratio of -5.48 and a beta of 1.06. Nektar Therapeutics has a 52-week low of $6.45 and a 52-week high of $49.01.

Nektar Therapeutics (NASDAQ:NKTR - Get Free Report) last released its earnings results on Thursday, August 7th. The biopharmaceutical company reported ($2.95) earnings per share (EPS) for the quarter, topping the consensus estimate of ($3.13) by $0.18. The company had revenue of $11.18 million during the quarter, compared to analyst estimates of $9.42 million. Nektar Therapeutics had a negative net margin of 163.17% and a negative return on equity of 631.43%. As a group, equities research analysts predict that Nektar Therapeutics will post -0.72 earnings per share for the current fiscal year.

Insider Activity at Nektar Therapeutics

In other Nektar Therapeutics news, CEO Howard W. Robin sold 6,666 shares of the stock in a transaction that occurred on Friday, September 5th. The shares were sold at an average price of $38.53, for a total transaction of $256,840.98. Following the completion of the sale, the chief executive officer directly owned 56,008 shares of the company's stock, valued at $2,157,988.24. This trade represents a 10.64% decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, insider Jonathan Zalevsky sold 1,721 shares of the stock in a transaction that occurred on Thursday, September 4th. The shares were sold at an average price of $33.52, for a total transaction of $57,687.92. Following the sale, the insider directly owned 17,462 shares of the company's stock, valued at approximately $585,326.24. This trade represents a 8.97% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 18,512 shares of company stock valued at $627,540 over the last three months. 5.25% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

NKTR has been the topic of a number of analyst reports. BTIG Research upped their price target on shares of Nektar Therapeutics from $60.00 to $100.00 and gave the stock a "buy" rating in a research note on Tuesday, June 24th. Wall Street Zen cut shares of Nektar Therapeutics from a "hold" rating to a "sell" rating in a research note on Wednesday, May 14th. HC Wainwright upped their target price on shares of Nektar Therapeutics to $120.00 and gave the company a "buy" rating in a research note on Tuesday, June 24th. Finally, B. Riley upped their target price on shares of Nektar Therapeutics from $60.00 to $85.00 and gave the company a "buy" rating in a research note on Tuesday, July 8th. Six equities research analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $88.33.

View Our Latest Research Report on Nektar Therapeutics

Nektar Therapeutics Company Profile

(

Free Report)

Nektar Therapeutics, a biopharmaceutical company, focuses on discovering and developing medicines in the field of immunotherapy in the United States and internationally. The company is developing rezpegaldesleukin, a cytokine Treg stimulant that is in phase 2 clinical trial for the treatment of systemic lupus erythematosus and ulcerative colitis, as well as phase 2b clinical trial to treat atopic dermatitis and psoriasis; and NKTR-255, an IL-15 receptor agonist, which is in phase 1 clinical trial to boost the immune system's natural ability to fight cancer.

See Also

Before you consider Nektar Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nektar Therapeutics wasn't on the list.

While Nektar Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.